Question: ABC is contemplating exchanging a machine used in its operations for a similar machine, ABC will exchange machines with either XYZ inc. or DEF Company.

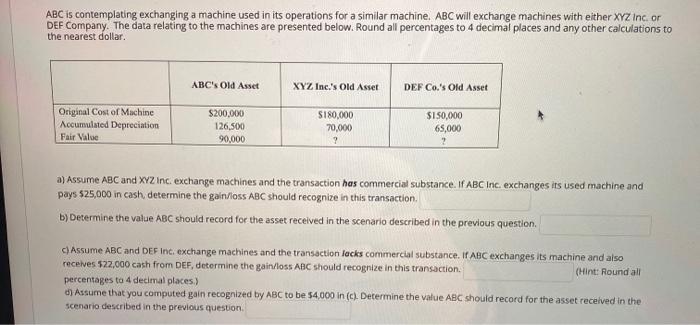

ABC is contemplating exchanging a machine used in its operations for a similar machine, ABC will exchange machines with either XYZ inc. or DEF Company. The data relating to the machines are presented below. Round all percentages to 4 decimal places and any other calculations to the nearest dollar. ABC's Old Asset XYZ Inc.'s Old Asset DEF Co.'s Old Asset Original Cost of Machine Accumulated Depreciation Fair Value $200,000 126,500 90,000 $180,000 70.000 $150,000 65,000 2 a) Assume ABC and XYZ Inc exchange machines and the transaction has commercial substance. If ABC Inc. exchanges its used machine and pays $25,000 in cash, determine the gain/ios ABC should recognize in this transaction, b) Determine the value ABC should record for the asset received in the scenario described in the previous question. c) Assume ABC and DEF Inc exchange machines and the transaction lacks commercial substance. If ABC exchanges its machine and also receives 522,000 cash from DEF, determine the gain/loss ABC should recognize in this transaction. (Hint: Round all percentages to 4 decimal places.) d) Assume that you computed gain recognized by ABC to be 54.000 in (C). Determine the value ABC should record for the asset received in the scenario described in the previous

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts