Question: URGENT!! ..... I NEED HELP AS SOON AS POSSIBLE. THIS HOMEWORK IS GRADED AND IT`S DUE VERY VERY SOON. PLEASE SAVE MY LIFE. THANK YOU

URGENT!! ..... I NEED HELP AS SOON AS POSSIBLE. THIS HOMEWORK IS GRADED AND IT`S DUE VERY VERY SOON. PLEASE SAVE MY LIFE. THANK YOU IN ADVANCE i REALLY APPRECIATE YOUR HELP.

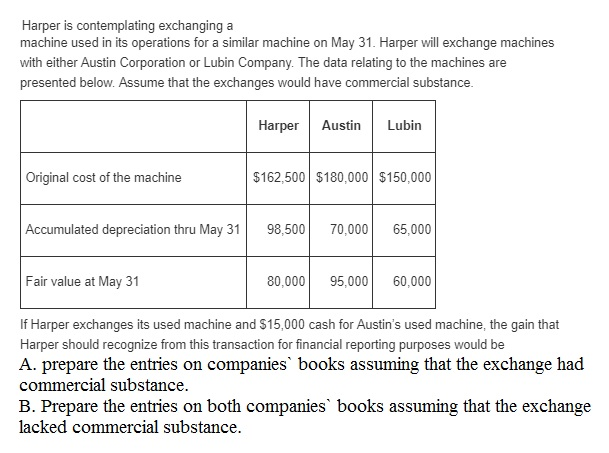

Harper is contemplating exchanging a machine used in its operations for a similar machine on May 31. Harper will exchange machines with either Austin Corporation or Lubin Company. The data relating to the machines are presented below. Assume that the exchanges would have commercial substance. Harpe Austin Lubin Original cost of the machine $162,500 $180,000 $150,000 Accumulated depreciation thru May 31 98,500 70,000 65,000 Fair value at May 31 80,000 95.000 60,000 If Harper exchanges its used machine and $15,000 cash for Austin's used machine, the gain that Harper should recognize from this transaction for financial reporting purposes would be commercial substance. B. Prepare the entries on both companies' books assuming that the exchange lacked commercial substance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts