Question: ABC start a partnership and operate it for one year. A and B each contribute $50,000 to start the partnership while C contributes assets having

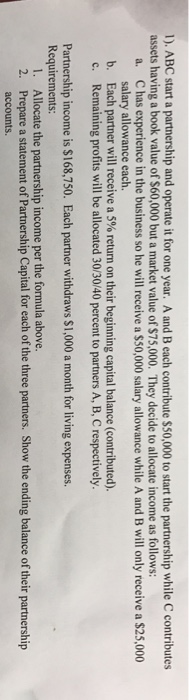

ABC start a partnership and operate it for one year. A and B each contribute $50,000 to start the partnership while C contributes assets having a book value of $60,000 but a market value of $75,000. They decide to allocate income as follows: C has experience in the business so he will receive a $50,000 salary allowance while A and B will only receive a $25,000 salary allowance each. Each partner will receive a 5% return on their beginning capital balance (contributed). Remaining profits will be allocated 30/30/40 percent to partners A, B, C respectively. Partnership income is $168, 750. Each partner withdraws $1,000 a month for living expenses. Allocate the partnership income per the formula above. Prepare a statement of Partnership Capital for each of the three partners. Show the ending balance of their partnership accounts

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts