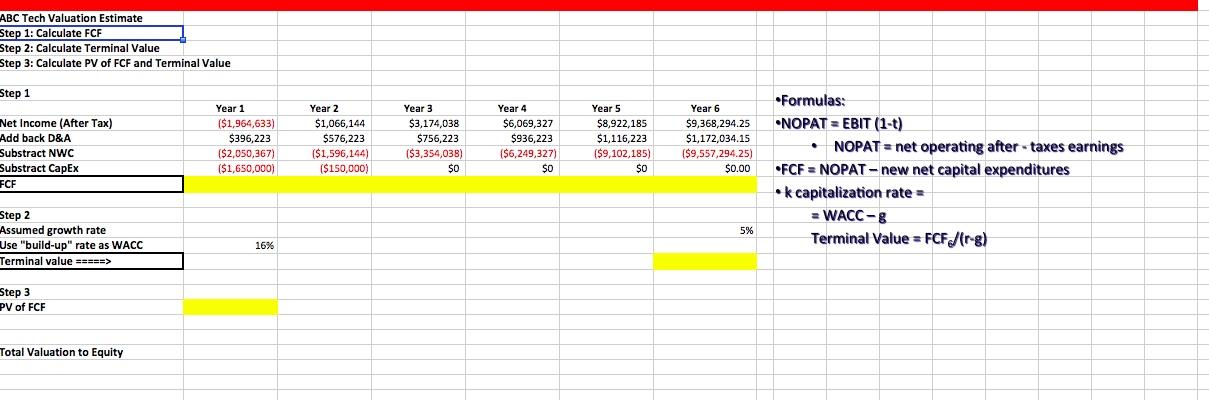

Question: ABC Tech Valuation Estimate Step 1: Calculate FCF Step 2: Calculate Terminal Value Step 3: Calculate PV of FCF and Terminal Value Step 1

ABC Tech Valuation Estimate Step 1: Calculate FCF Step 2: Calculate Terminal Value Step 3: Calculate PV of FCF and Terminal Value Step 1 Net Income (After Tax) Add back D&A Year 1 Substract NWC Substract CapEx FCF Step 2 Assumed growth rate Use "build-up" rate as WACC Terminal value =====> Step 3 PV of FCF Total Valuation to Equity Year 4 Year 5 $6,069,327 $936,223 ($3,354,038) ($6,249,327) $8,922,185 $1,116,223 ($9,102,185) Year 6 $9,368,294.25 $1,172,034.15 $0 $0 $0 ($9,557,294.25) $0.00 ($1,964,633) $396,223 ($2,050,367) ($1,650,000) Year 2 $1,066,144 $576,223 ($1,596,144) ($150,000) Year 3 $3,174,038 $756,223 16% 5% *Formulas: *NOPAT = EBIT (1-t) NOPAT = net operating after-taxes earnings *FCF = NOPAT- new net capital expenditures k capitalization rate = = WACC-g Terminal Value= FCF/(r-g)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts