Question: Abe Factor opened a new accounting practice called X-Factor Accounting and completed these activities during March 2020: March 1 Invested $50,000 in cash and office

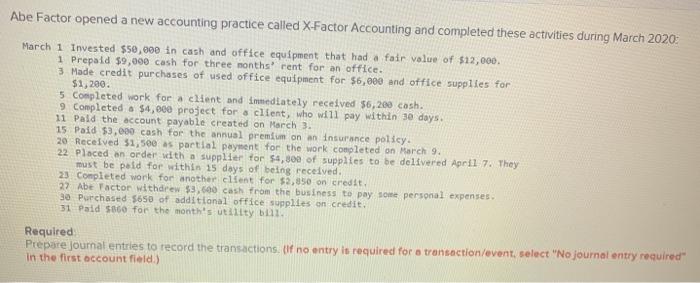

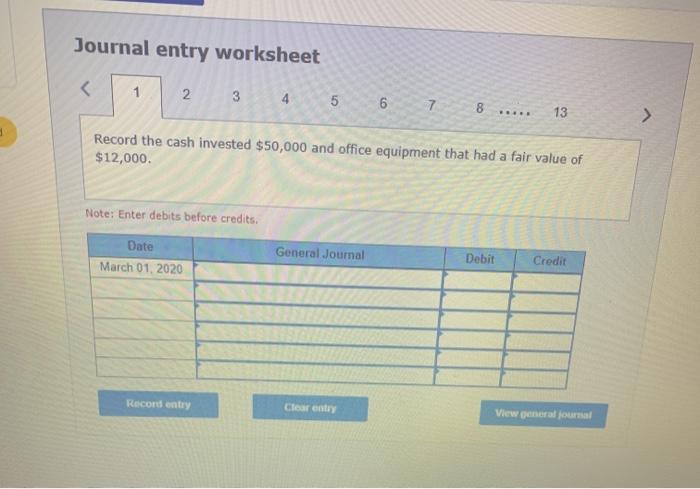

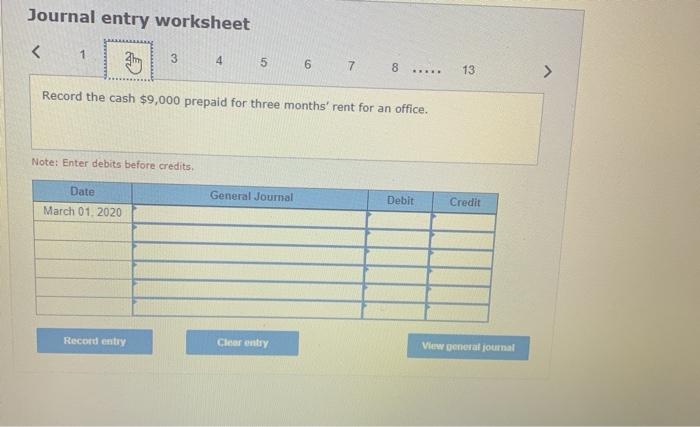

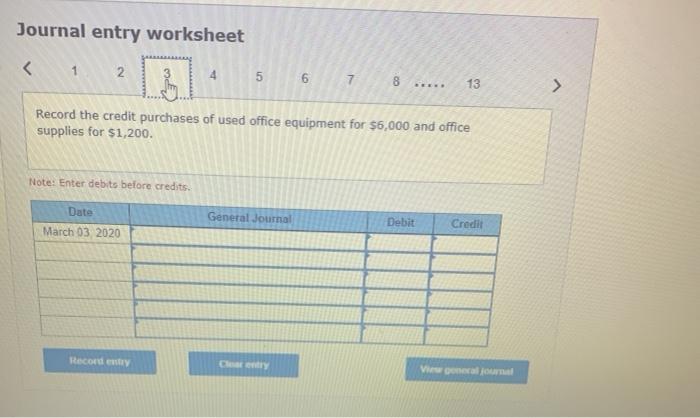

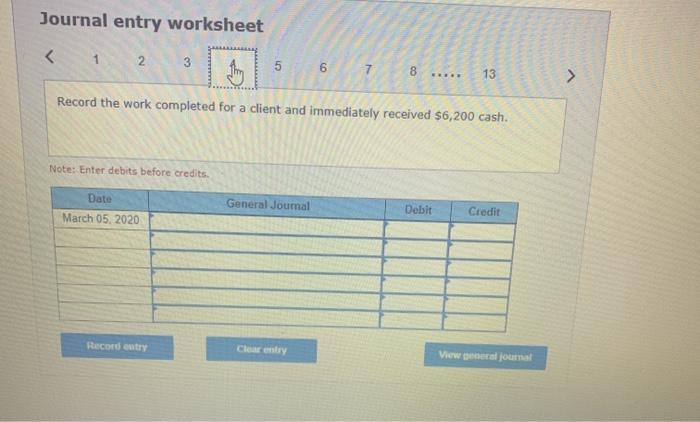

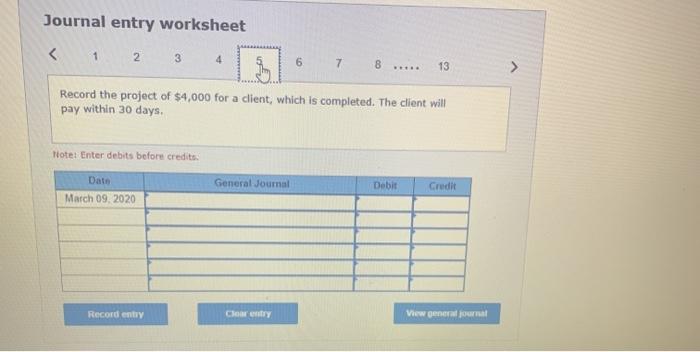

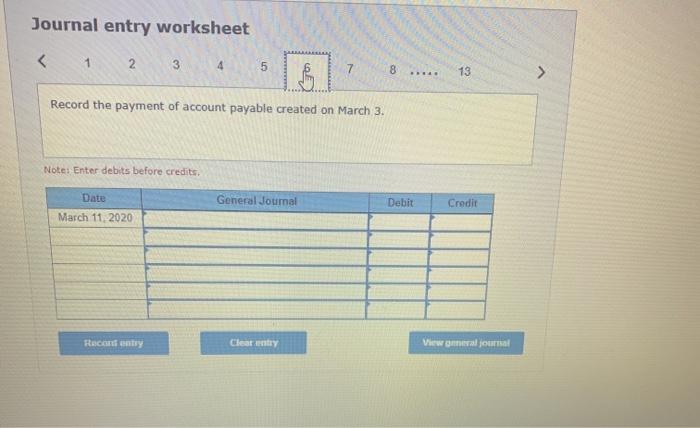

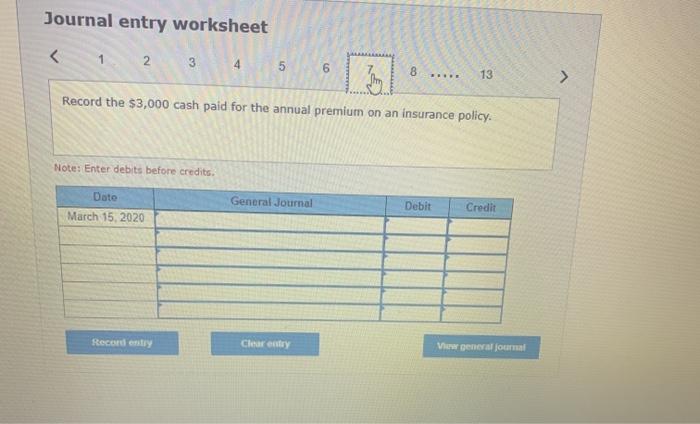

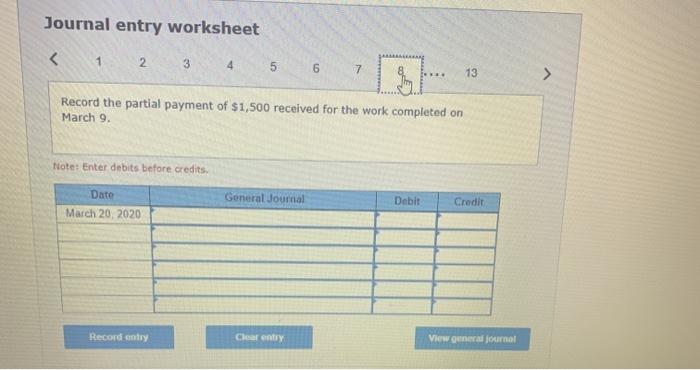

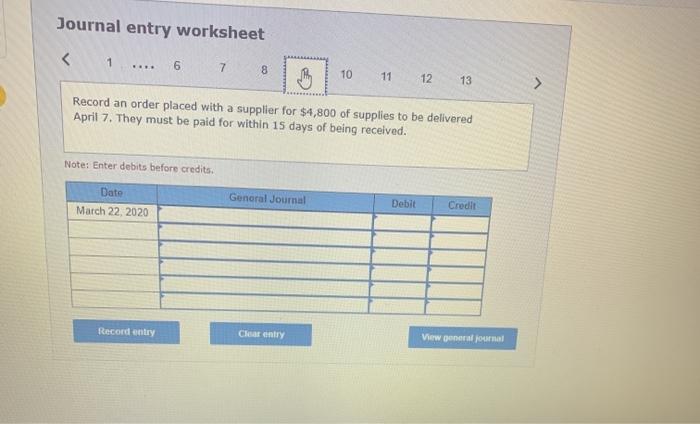

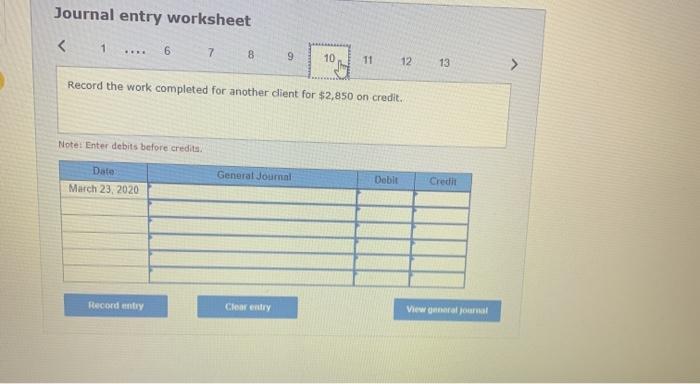

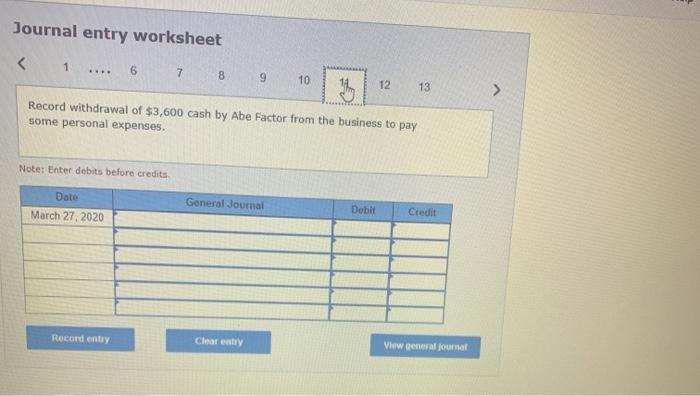

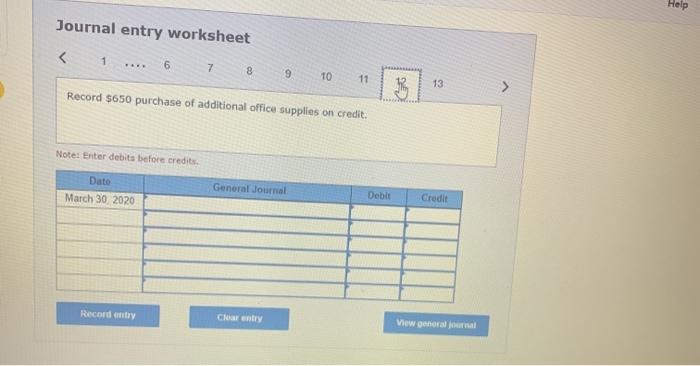

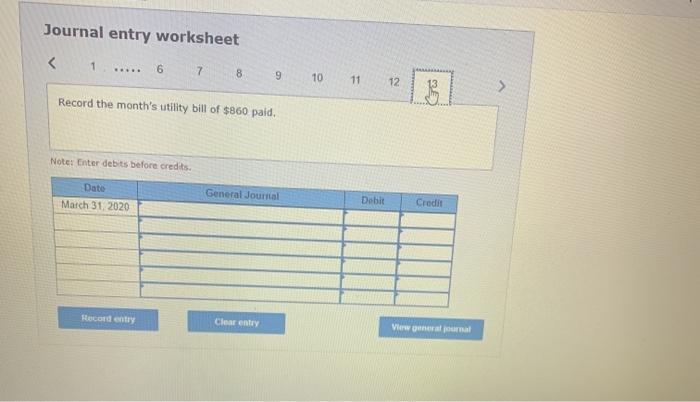

Abe Factor opened a new accounting practice called X-Factor Accounting and completed these activities during March 2020: March 1 Invested $50,000 in cash and office equipment that had a fair value of $12,000. 1 Prepaid $9,000 cash for three months' rent for an office. 3 Made credit purchases of used office equipment for $6,000 and office supplies for $1,200. 5 Completed work for a client and immediately received 56,200 cash. 9 Completed a $4,000 project for a client, who will pay within 30 days. 11 Pald the account payable created on March 3. 15 Paid $3,000 cash for the annual premium on an insurance policy. 20 Received $1,500 as partial payment for the work completed on March 9. 22 placed an order dth a supplier for $4,800 of supplies to be delivered April 7. They must be paid for within 15 days of being received 23 Completed work for another client for $2,850 on credit. 27 Abe Factor withdrew $3,600 cash from the business to pay some personal expenses. 30 Purchased $650 of additional office supplies on credit, 31 Paid 5860 for the month's utility bill Required Prepare Journal entries to record the transactions. Of no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet Record the cash $9,000 prepaid for three months' rent for an office. Note: Enter debits before credits Date General Journal Debit Credit March 01, 2020 Record entry Clear entry View general journal Journal entry worksheet Record the work completed for a client and immediately received $6,200 cash. Note: Enter debits before credits Date General Journal Dobit March 05, 2020 Credit Record entry Clearly View general journal Journal entry worksheet Record the work completed for another dient for $2,850 on credit. Note: Enter debits before credits Date March 23, 2020 General Journal Debit Credit Record entry Clear enly View oneral Journal Journal entry worksheet Record $650 purchase of additional office supplies on credit: Go Note: Enter debits before credits Date March 30, 2020 General Journal Debit Credit Record entry Charent View general Journal Journal entry worksheet 1 .. 6 7 8 9 10 11 12 > Record the month's utility bill of $860 paid, Note: Enter debts before credits Date March 31, 2020 General Journal Debit Credit Record entry Clear entry View all

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts