Question: able Window Help 3 Layout References 19 Ace 101 Chapter 11 Mailings Review View Tell me 1 ' 21 A AalbCcDoe Normal No Spa A

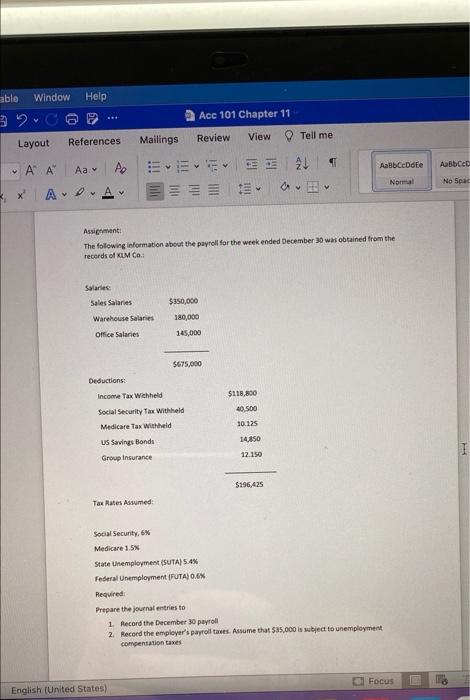

able Window Help 3" Layout References 19 Ace 101 Chapter 11 Mailings Review View Tell me 1 ' 21 A AalbCcDoe Normal No Spa A P. Av === Assini The following information about the payroll for the week ended December 30 was obtained from the records of KLM CO. Salaries Sales Salaries $350,000 Warehouse Salaries 180,000 Office Salaries 145,000 $675,000 Deductions: Income Tax Withheld $118,800 40.500 10.125 Social Security Tax Withheld Medicare Tax Withheld US Savings Bonds Group Insurance 14850 I 12.150 $196,425 Tax Rates Assumed Social Security, 6x Medicare 1.5% State Unemployment (SUTA) 5.4% Federal Unemployment (FUTA). Required Prepare the journal entries to 1. Record the December 30 payroll 2. Record the employer's payroll aus. Assume that $85,000 is subject to unemployment compensation taxes Focus 10 English (United States)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts