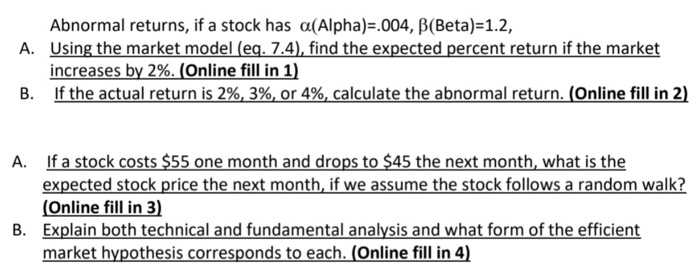

Question: Abnormal returns, if a stock has (Alpha):004, (Beta)-12, A. Using the market model (ea. 7.4) find the expected percent return if the market increases by

Abnormal returns, if a stock has (Alpha):004, (Beta)-12, A. Using the market model (ea. 7.4) find the expected percent return if the market increases by 2%- (Online fill in 1) If the actual return is 2%, 3%, or 4%, calculate the abnormal return. (Online fill in 2) B. If a stock costs $55 one month and drops to $45 the next month, what is the expected stock price the next month if we assume the stock follows a random walk? A. (Online fill in 3) Explain both technical and fundamental analysis and what form of the efficient market hypothesis corresponds to each. (Online fill in 4) B

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts