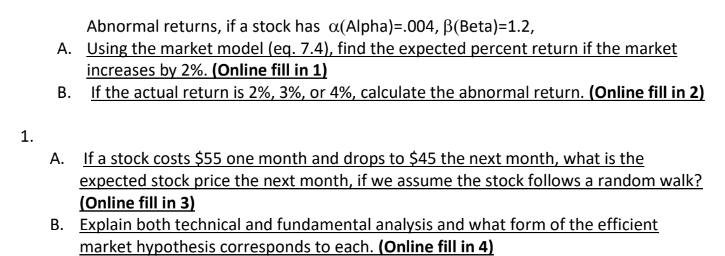

Question: Abnormal returns, if a stock has (Alpha):004, (Beta)-12, A. Using the market model (eq. 7.4), find the expected percent return if the market increases by

Abnormal returns, if a stock has (Alpha):004, (Beta)-12, A. Using the market model (eq. 7.4), find the expected percent return if the market increases by 2%. (Online fill in 1) If the actual return is 2%, 3%, or 4%, calculate the abnormal return. (Online fill in 2) B. 1. If a stock costs $55 one month and drops to $45 the next month, what is the expected stock price the next month, if we assume the stock follows a random walk? (Online fill in 3) Explain both technical and fundamental analysis and what form of the efficient market hypothesis corresponds to each. (Online fill in 4) A. B. Abnormal returns, if a stock has (Alpha):004, (Beta)-12, A. Using the market model (eq. 7.4), find the expected percent return if the market increases by 2%. (Online fill in 1) If the actual return is 2%, 3%, or 4%, calculate the abnormal return. (Online fill in 2) B. 1. If a stock costs $55 one month and drops to $45 the next month, what is the expected stock price the next month, if we assume the stock follows a random walk? (Online fill in 3) Explain both technical and fundamental analysis and what form of the efficient market hypothesis corresponds to each. (Online fill in 4) A. B

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts