Question: Above is an example from my professsor. I do not understand how he gets the synergy gain as well as some other numbers and the

Above is an example from my professsor. I do not understand how he gets the synergy gain as well as some other numbers and the overall concept. IF someone could help explain this and work it out, it would be much apprecaited. Thanks a lot!!

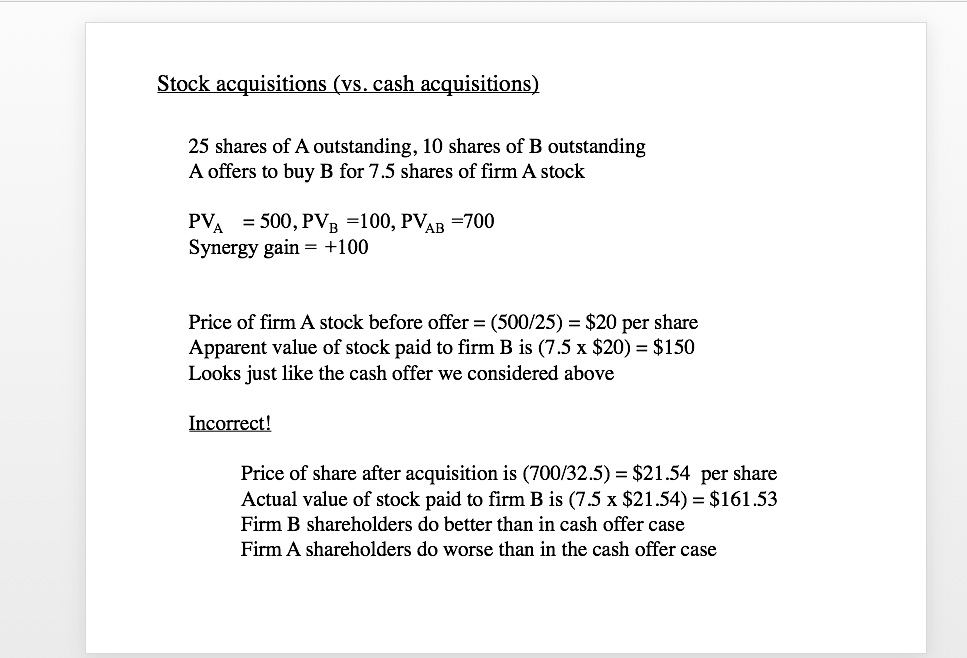

Stock acquisitions (vs. cash acquisitions) 25 shares of A outstanding, 10 shares of B outstanding A offers to buy B for 7.5 shares of firm A stock PVA500, PVB -100, PVAB-700 Synergy gain-+100 Price of firm A stock before offer- (500/25) $20 per share Apparent value of stock paid to firm B is (7.5 x $20) = $150 Looks just like the cash offer we considered above Incorrect! Price of share after acquisition is (700/32.5)-$21.54 per share Actual value of stock paid to firm B is (7.5 x $21.54)-$161.53 Firm B shareholders do better than in cash offer case Firm A shareholders do worse than in the cash offer case

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts