Question: AC D Question 18 5 pts An analyst is calculating the expected return for a stock. She observes the rate for U.S. Treasury securities is

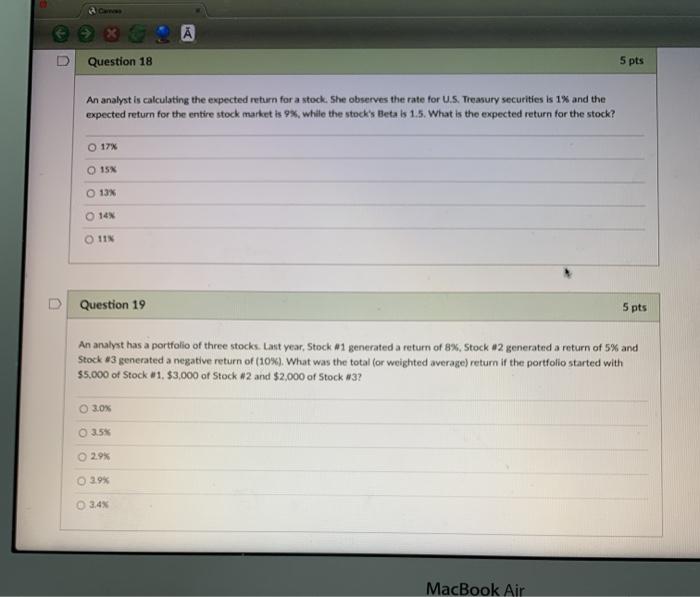

AC D Question 18 5 pts An analyst is calculating the expected return for a stock. She observes the rate for U.S. Treasury securities is 1% and the expected return for the entire stock market is 9%, while the stock's Beta is 1.5. What is the expected return for the stock? 17% 15% O 13% O 14 O 11 D Question 19 5 pts An analyst has a portfolio of three stocks. Last year, Stock 1 generated a return of 8%, Stock #2 generated a return of 5% and Stock 3 generated a negative return of (10%). What was the total (or weighted average) return of the portfolio started with $5.000 of Stock #1, $3,000 of Stock #2 and $2,000 of Stock #3? O 30% 35% 2.9% 29% 3.4% MacBook Air

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts