Question: Bohemian Company has 500,000 shares of no par common stock with a stated value of $8 per share issued and outstanding as of January

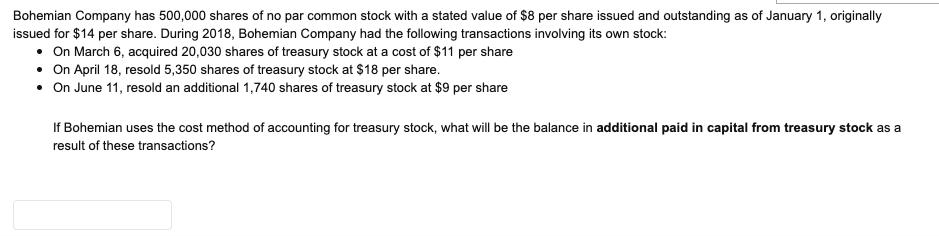

Bohemian Company has 500,000 shares of no par common stock with a stated value of $8 per share issued and outstanding as of January 1, originally issued for $14 per share. During 2018, Bohemian Company had the following transactions involving its own stock: On March 6, acquired 20,030 shares of treasury stock at a cost of $11 per share On April 18, resold 5,350 shares of treasury stock at $18 per share. On June 11, resold an additional 1,740 shares of treasury stock at $9 per share If Bohemian uses the cost method of accounting for treasury stock, what will be the balance in additional paid in capital from treasury stock as a result of these transactions?

Step by Step Solution

3.27 Rating (150 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts