Question: ACC 4 2 1 ( Submit soft pdf version to the ASSIGNMENT folder ) Received an inheritance of $ 2 0 0 , 0 0

ACCSubmit soft pdf version to the ASSIGNMENT folder Received an inheritance of $ from his uncle, Jerry. Joseph used $ to

purchase Gabriel, Inc. stock on May and invested $ in Gold, Inc. stock on

May

Received Orange, Inc. stock worth $ as a gift from his aunt, Jane, on June

Her adjusted basis for the stock was $ No gift taxes were paid on the transfer. Jane

had purchased the stock on April Joseph sold the stock on July for

$

On July Joseph sold onehalf of the Gabriel, Inc. stock for $

Joseph was notified on July that Yellow, Inc. stock he purchased from a colleague

on September for $ had become worthless. While he perceived that the

investment was risky, he did not anticipate that the corporation would declare

bankruptcy.

On August Joseph received a parcel of land in Phoenix worth $ in

exchange for a parcel of land he owned in Tucson. Because the Tucson parcel was worth

$ he also received $ cash. Joseph's adjusted basis for the Tucson parcel

was $ He originally purchased it on September

On November Joseph sold the condominium in which he had been living for the

past years Smallhouse Lane, Tuscon, AZ and moved into a rented

townhouse. The sales price was $ selling expenses were $ and

repairmaintenance expenses for not previously properly maintaining the property

were $ Joseph purchased the condominium for $

Joseph's potential itemized deductions, exclusive of the aforementioned information, are

as follows:

During the year, Joseph makes estimated Federal income tax payments of $

payments of $ were made on April June Sept. and

Dec.

THIS RETURN IS FOR TAX LAWS IN EFFECT FOR WILL APPLY

Compute Joseph's lowest net tax payable or refund due for making any available

elections to reduce the tax. The tax forms required for your computations are Forms

& Schedules and Schedules A B C D and SE You

should include Form and the Transmittal Letter to Joseph. Complete the

Federal tax return using Intuit ProConnect Tax Software. Submit the filing

copy of the return in pdf format in DL courses using the link under the assignments tab.

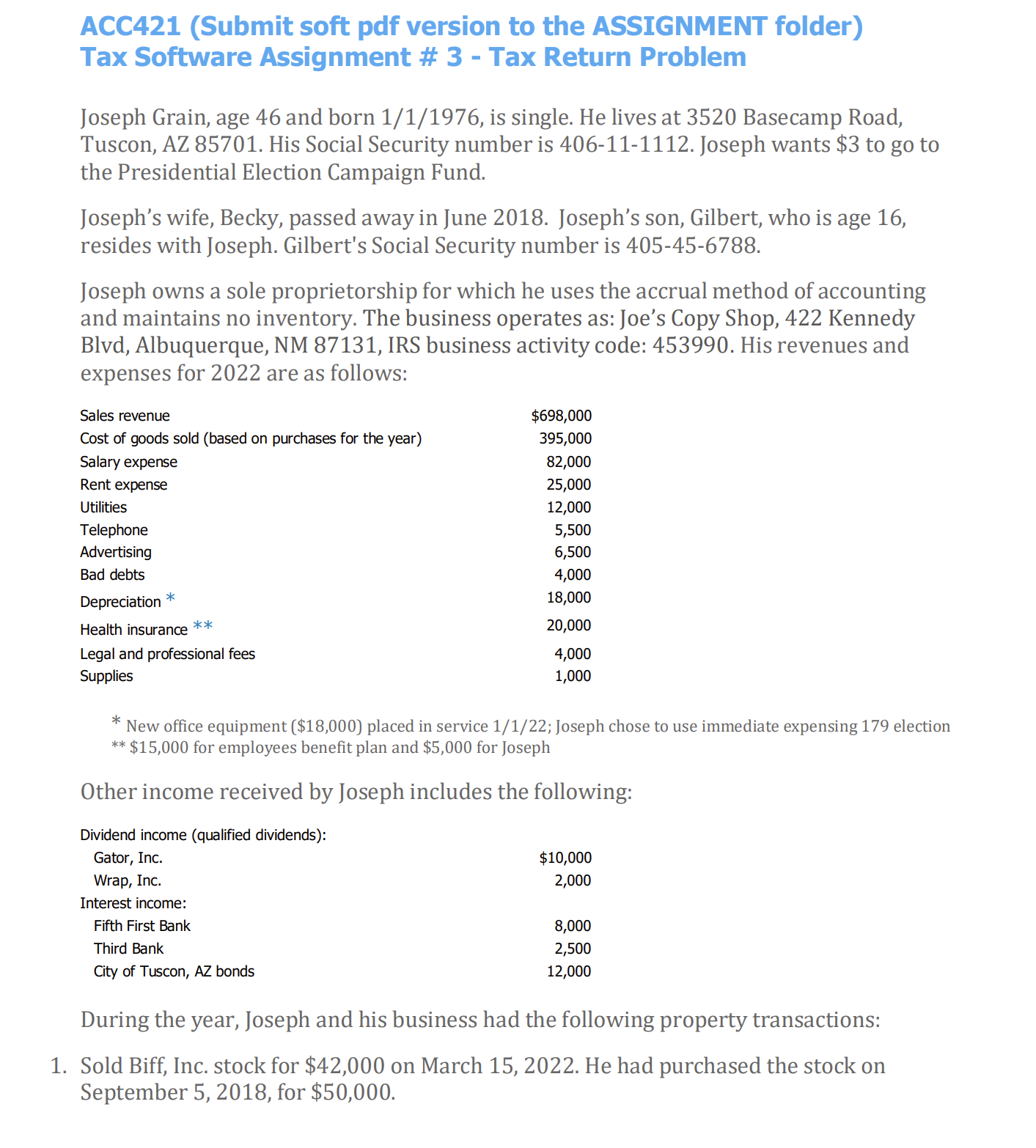

Tax Software Assignment # Tax Return Problem

Joseph Grain, age and born is single. He lives at Basecamp Road,

Tuscon, AZ His Social Security number is Joseph wants $ to go to

the Presidential Election Campaign Fund.

Joseph's wife, Becky, passed away in June Joseph's son, Gilbert, who is age

resides with Joseph. Gilbert's Social Security number is

Joseph owns a sole proprietorship for which he uses the accrual method of accounting

and maintains no inventory. The business operates as: Joe's Copy Shop, Kennedy

Blvd Albuquerque, NM IRS business activity code: His revenues and

expenses for are as follows:

New office equipment $ placed in service ; Joseph chose to use immediate expensing election

$ for employees benefit plan and $ for Joseph

Other income received by Joseph includes the following:

During the year, Joseph and his business had the following property transactions:

Sold Biff, Inc. stock for $ on March He had purchased the stock on

September for $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock