Question: ACC-360 QuickBooks Assignment 2 (QB2) Be sure to complete the steps required in the ACC-360 QuickBooks Student Registration Instructions document. Note that there is an

ACC-360 QuickBooks Assignment 2 (QB2)

Be sure to complete the steps required in the ACC-360 QuickBooks Student Registration Instructions document. Note that there is an additional requirement (enable projects) for this class that has not been used in any other class before.

PURPOSE:

The purpose of this assignment is to have students become familiar with an accounting software package that accommodates budgeting. Students will set up accounts, enter an annual budget, and produce budget related output reports in QuickBooks.

STEP ONE:

Set up accounts.

Go to QuickBooks and login to your company. Choose the Accounting menu from the left-hand side of the screen and select Chart of Accounts. Click New (green button on the upper right side of the screen).

Enter the Account Type, Detail Type, and Name for each of the following six accounts. Enter Save and New to enter another account, Save and Close when you have entered all accounts.

| Name | Account Type | Detail Type |

| Equipment Revenues | Income | Sales of Product Income |

| Maintenance Contract Revenues | Income | Service/Fee Income |

| Marketing Expenses | Expenses | Advertising/Promotional |

| Distribution Expenses | Expenses | Shipping, Freight & Delivery |

| Customer Maintenance Costs | Expenses | Other Business Expenses |

| Administrative Costs | Expenses | Office/General Administrative Expenses |

These accounts should now be shown on your Chart of Accounts. Please note that Cost of Goods Sold should already be on your Chart of Accounts.

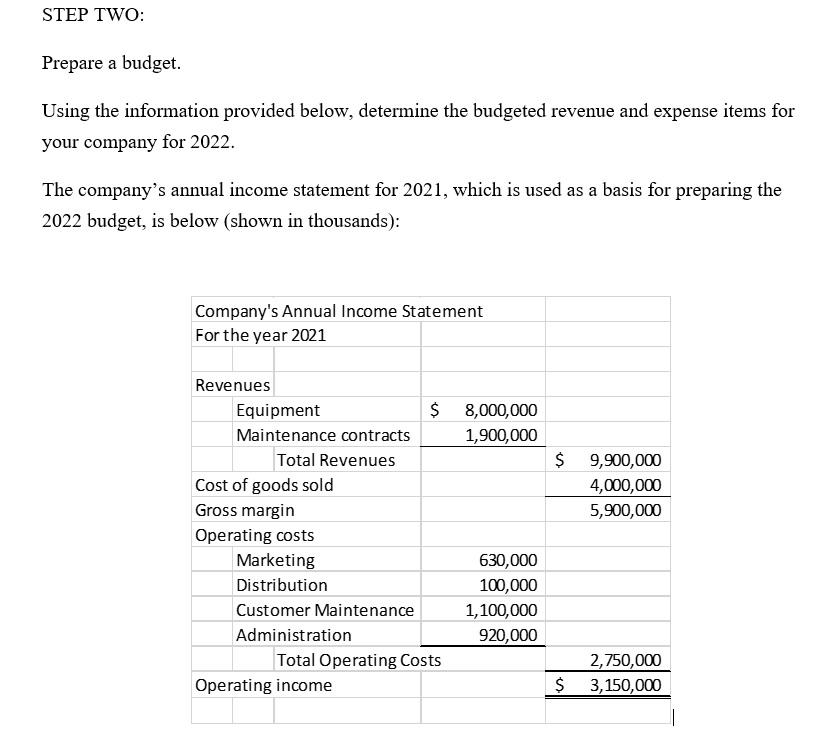

STEP TWO:

Prepare a budget.

Using the information provided below, determine the budgeted revenue and expense items for your company for 2022.

The companys annual income statement for 2021, which is used as a basis for preparing the 2022 budget, is below (shown in thousands):

Please see picture

Additional information to be used in preparing the budget for 2022 are as follows:

1. Selling prices of equipment are expected to increase by 10% as the economic recovery begins. The selling price of each maintenance contract is expected to remain unchanged from 2021.

2. Equipment sales in units are expected to increase by 6%, with a corresponding 6% growth in units of maintenance contracts.

3. Cost of each unit sold is expected to increase by 5% to pay for the necessary technology and quality improvements.

4. Marketing costs are expected to increase by $290,000, but administration costs are expected to remain at 2021 levels.

5. Distribution costs vary in proportion to the number of units of equipment sold.

6. Two maintenance technicians are to be hired at a total cost of $160,000, which covers wages and related travel costs. The objective is to improve customer service and shorten response time.

7. There is no beginning or ending inventory of equipment.

STEP THREE:

Go to QuickBooks and login to your company. Create the budget by clicking on the settings cog at the upper right-hand side of the screen and selecting Budgeting under the Tools list. Click Add Budget and create the budget as a yearly (annual) budget (FY2022). QBs will automatically divide the budget items by 12 to evenly spread over the months in the year. Name the budget ACC360 QB2.

Click the Next button to enter the budgeted amounts that you calculated in Step Two. After entering all amounts, click Save. You will now see a list of budgets that includes the one you just created. From the drop-down menu in the Action column select Run Budget Overview report. Save your Budget Overview Report for 2022 into a pdf file named LastnameFirstinitial.ACC360.QB2.

STEP FOUR:

Submit your pdf file in the digital classroom.

Congratulations! You have completed your assignment.

Data included herein is adapted from problem 6-38 of your textbook.

STEP TWO: Prepare a budget. Using the information provided below, determine the budgeted revenue and expense items for your company for 2022. The company's annual income statement for 2021, which is used as a basis for preparing the 2022 budget, is below (shown in thousands): Company's Annual Income Statement For the year 2021 8,000,000 1,900,000 $ 9,900,000 4,000,000 5,900,000 Revenues Equipment $ Maintenance contracts Total Revenues Cost of goods sold Gross margin Operating costs Marketing Distribution Customer Maintenance Administration Total Operating Costs Operating income 630,000 100,000 1,100,000 920,000 2,750,000 3,150,000 $ STEP TWO: Prepare a budget. Using the information provided below, determine the budgeted revenue and expense items for your company for 2022. The company's annual income statement for 2021, which is used as a basis for preparing the 2022 budget, is below (shown in thousands): Company's Annual Income Statement For the year 2021 8,000,000 1,900,000 $ 9,900,000 4,000,000 5,900,000 Revenues Equipment $ Maintenance contracts Total Revenues Cost of goods sold Gross margin Operating costs Marketing Distribution Customer Maintenance Administration Total Operating Costs Operating income 630,000 100,000 1,100,000 920,000 2,750,000 3,150,000 $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts