Access the attached Future Value Excel file and fill in the blank cells corresponding to monthly payment, number of years to invest, and a specific rate of return.

Part 1

How much you will save each month to invest? Choose an amount between $100 and $600 to use as your monthly contribution.

How many years are you going to invest? Choose a number of years between 20 and 35.

Choose an interest rate between 4.00% and 10.00%. The interest will be compound monthly for this example (so 12 times a year).

What is the future value of your account? Excel will calculate this for you.

Part 2

Keeping all other factors the same, decrease the number of years you invest (choose between 5 and 15 years). What is the future value of your account under this scenario?

Part 3

Compare your future value amounts in Part 1 and Part 2. Were you surprised at the difference?

My answer

I have to say I was very shocked more like surprised at the difference in my future value amount In scenario one and two. I believe the earlier I get a head start the more money I would have saved up during each month invest in $300. The more number of years I used increase the amount of money invested throughout the years. I believe having a long term goal in compound interest helps me invest in a long way. 22 years is not that long for me to invest in because I work now and invest in my 401k and it is the same amount and long term accomplishment as the interest rate is 5% by the time I retire I will be set. Therefore I have chosen scenario one for the most important part since Im still young and just starting. I hope during this course of class my fellow classmates will help me understand the knowledge and better interest rate to budget through.

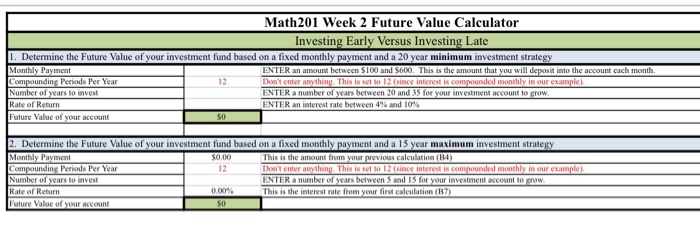

Math201 Week 2 Future Value Calculator

Investing Early Versus Investing Late

1. Determine the Future Value of your investment fund based on a fixed monthly payment and a 20 year minimum investment strategy

Monthly Payment

$300

ENTER an amount between $100 and $600. This is the amount that you will deposit into the account each month.

Compounding Periods Per Year

12

Don't enter anything. This is set to 12 (since interest is compounded monthly in our example).

Number of years to invest

22

ENTER a number of years between 20 and 35 for your investment account to grow.

Rate of Return

5%

ENTER an interest rate between 4% and 10%

Future Value of your account

$132,250

2. Determine the Future Value of your investment fund based on a fixed monthly payment and a 15 year maximum investment strategy

Monthly Payment

$300

This is the amount from your previous calculation (B4)

Compounding Periods Per Year

12

Don't enter anything. This is set to 12 (since interest is compounded monthly in our example).

Number of years to invest

7

ENTER a number of years between 5 and 15 for your investment account to grow.

Rate of Return

5%

This is the interest rate from your first calculation (B7)

Future Value of your account

$30,099

Math201 Week 2 Future Value Calculator Investing Early Versus Investing Late Determine the Future Value of your investment fund based on a fixed monthly payment and a 20 year minimum investment strategy 12 ompounding Periods Per Year umber of years to invest ENTERa number of years between 20 and 35 for your investment account to grow ENTER an interest rate between 4% and 10% Rate of Return ture Valuc of your account Determine the Future Value of your investment fund based on a fixed mont ment and a 15 year maximum investment strategy 0,00 unding Periods Per Year 12 Doet enou anything Thm set so 12 csmee meres. compounded onthly tn our example) ENTER a number of years between 5 and 15 for your investment account to grow This is the interest rate fom Rate of Return your fiest calculation Math201 Week 2 Future Value Calculator Investing Early Versus Investing Late Determine the Future Value of your investment fund based on a fixed monthly payment and a 20 year minimum investment strategy 12 ompounding Periods Per Year umber of years to invest ENTERa number of years between 20 and 35 for your investment account to grow ENTER an interest rate between 4% and 10% Rate of Return ture Valuc of your account Determine the Future Value of your investment fund based on a fixed mont ment and a 15 year maximum investment strategy 0,00 unding Periods Per Year 12 Doet enou anything Thm set so 12 csmee meres. compounded onthly tn our example) ENTER a number of years between 5 and 15 for your investment account to grow This is the interest rate fom Rate of Return your fiest calculation