Question: Be sure your initial post is at least 100 words. Then reply to at least 3 classmates posts over 3 different days. Access the attached

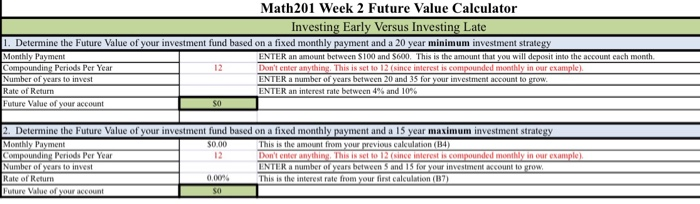

Math201 Week 2 Future Value Calculator Investing Early Versus Investing Late Determine the Future Value of your investment fund based on a fixed n ent and a 20 year minimum investment strategy between $100 and $600, This is the amount that you will deposit into the account each n 12 Don't entor anylhing This is et to 12 csince interest is compounded moeily in our example ENTER a number of years between 20 and 35 for your investment account to unding Periods Per Year umber of years to invest Rate of Return Future Value of our account ETER an interest rate between 4% and 10% $0.00 Compounding Periods Per Year umber of years to invest Rate of Return s between S and 15 for your investment account to grovw ENTER a number of This is the interest rate from your first calculation (B7 0 00%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts