Question: accidentally uploaded excercises 2 a) After completing Exercise One, calculate the account balance for the Inventory taccount. What is the correct debit balance total for

accidentally uploaded excercises 2

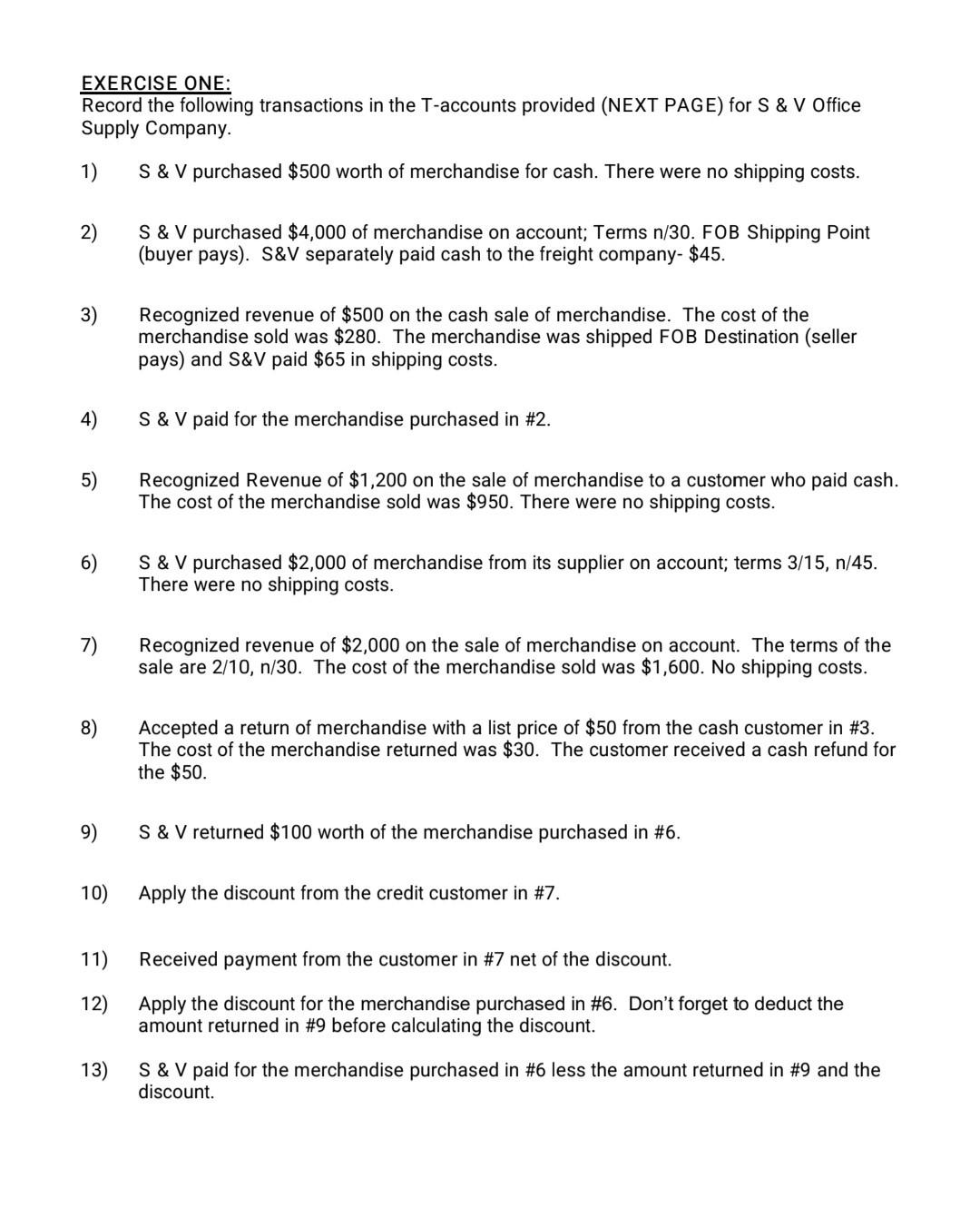

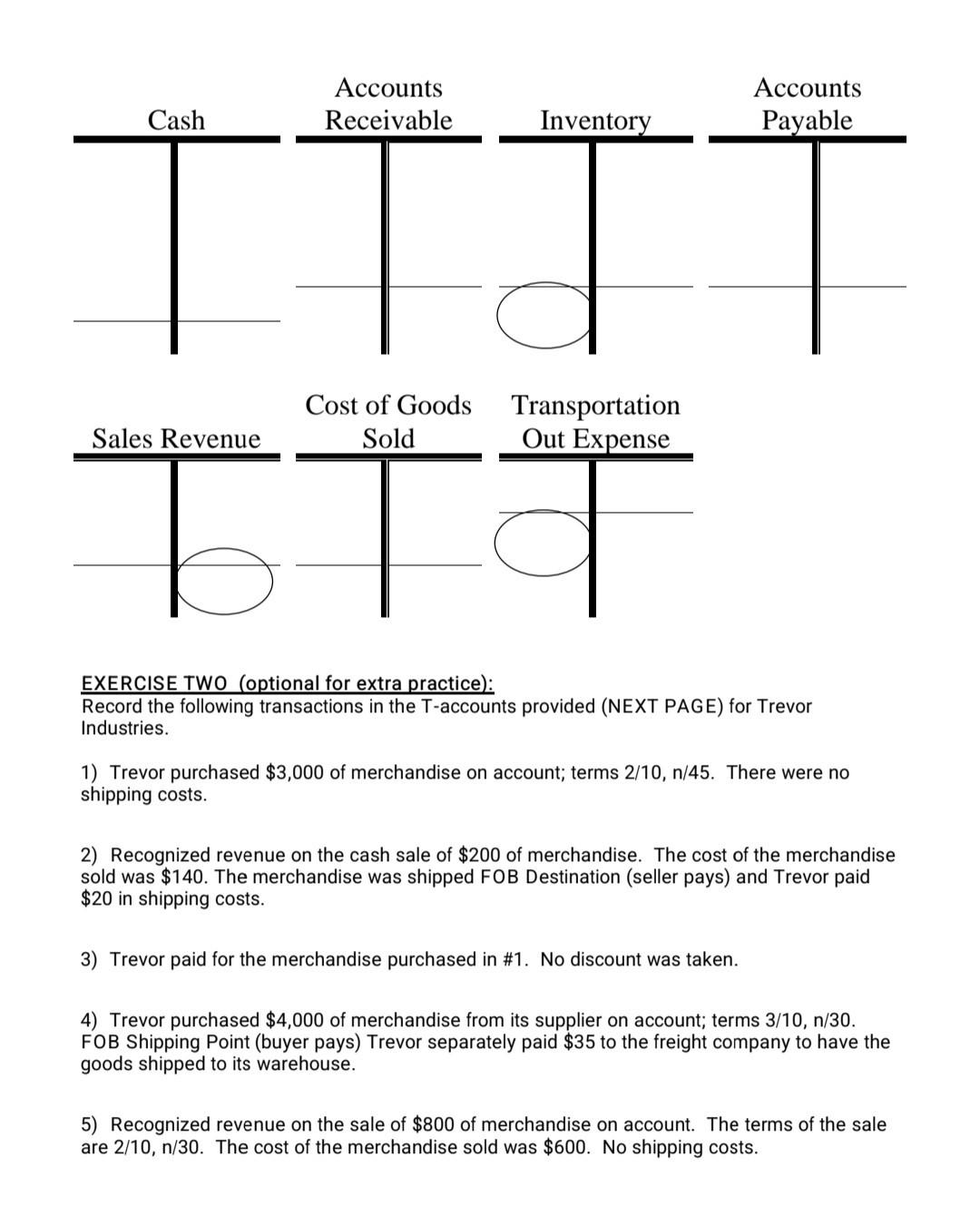

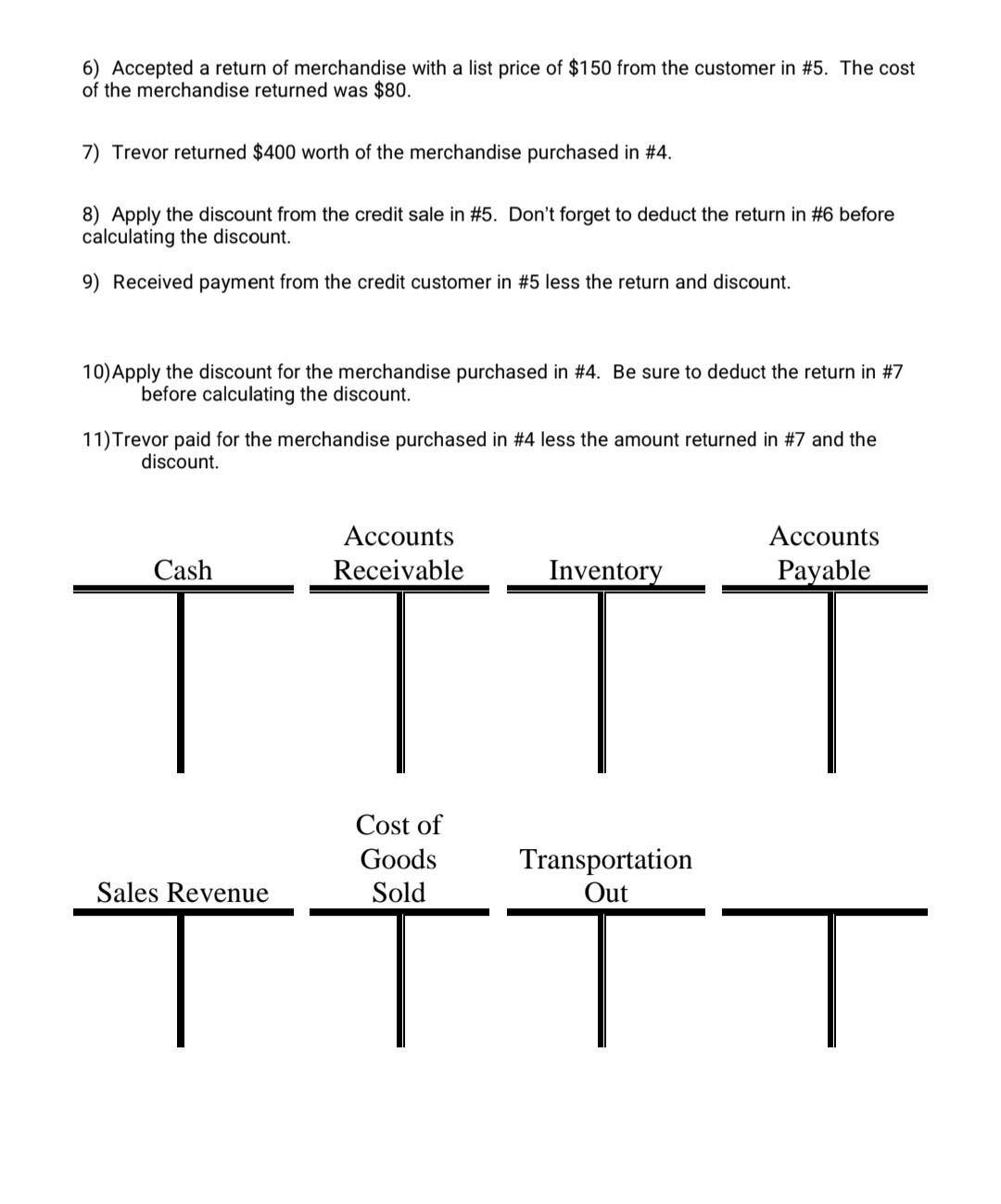

a) After completing Exercise One, calculate the account balance for the Inventory taccount. What is the correct debit balance total for this account? See circle on the printed exercise. (8 points for correct answer. No partial credit). b) After completing Exercise One, calculate the account balance for the Sales Revenue taccount. What is the correct credit balance total for this account? See circle on the printed exercise. (8 points for correct answer. No partial credit). c) After completing Exercise One, calculate the account balance for the Transportation Out Expense t-account. What is the correct debit balance total for this account? See circle on the printed exercise. (4 points for correct answer. No partial credit). EXERCISE ONE: Record the following transactions in the T-accounts provided (NEXT PAGE) for S \& V Office Supply Company. 1) S&V purchased $500 worth of merchandise for cash. There were no shipping costs. 2) S \& V purchased $4,000 of merchandise on account; Terms n/30. FOB Shipping Point (buyer pays). S\&V separately paid cash to the freight company- $45. 3) Recognized revenue of $500 on the cash sale of merchandise. The cost of the merchandise sold was $280. The merchandise was shipped FOB Destination (seller pays) and S&V paid $65 in shipping costs. 4) S&V paid for the merchandise purchased in #2. 5) Recognized Revenue of $1,200 on the sale of merchandise to a customer who paid cash. The cost of the merchandise sold was $950. There were no shipping costs. 6) S&V purchased $2,000 of merchandise from its supplier on account; terms 3/15,n/45. There were no shipping costs. 7) Recognized revenue of $2,000 on the sale of merchandise on account. The terms of the sale are 2/10,n/30. The cost of the merchandise sold was $1,600. No shipping costs. 8) Accepted a return of merchandise with a list price of $50 from the cash customer in #3. The cost of the merchandise returned was $30. The customer received a cash refund for the $50. 9) S&V returned $100 worth of the merchandise purchased in #6. 10) Apply the discount from the credit customer in #7. 11) Received payment from the customer in #7 net of the discount. 12) Apply the discount for the merchandise purchased in #6. Don't forget to deduct the amount returned in #9 before calculating the discount. 13) S& paid for the merchandise purchased in #6 less the amount returned in #9 and the discount. EXERCISE TWO (optional for extra practice): Record the following transactions in the T-accounts provided (NEXT PAGE) for Trevor Industries. 1) Trevor purchased $3,000 of merchandise on account; terms 2/10,n/45. There were no shipping costs. 2) Recognized revenue on the cash sale of $200 of merchandise. The cost of the merchandise sold was $140. The merchandise was shipped FOB Destination (seller pays) and Trevor paid $20 in shipping costs. 3) Trevor paid for the merchandise purchased in #1. No discount was taken. 4) Trevor purchased $4,000 of merchandise from its supplier on account; terms 3/10,n/30. FOB Shipping Point (buyer pays) Trevor separately paid $35 to the freight company to have the goods shipped to its warehouse. 5) Recognized revenue on the sale of $800 of merchandise on account. The terms of the sale are 2/10,n/30. The cost of the merchandise sold was $600. No shipping costs. 6) Accepted a return of merchandise with a list price of $150 from the customer in #5. The cost of the merchandise returned was $80. 7) Trevor returned $400 worth of the merchandise purchased in #4. 8) Apply the discount from the credit sale in #5. Don't forget to deduct the return in #6 before calculating the discount. 9) Received payment from the credit customer in #5 less the return and discount. 10) Apply the discount for the merchandise purchased in #4. Be sure to deduct the return in #7 before calculating the discount. 11)Trevor paid for the merchandise purchased in #4 less the amount returned in #7 and the discount

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts