Question: according to CAPM: number 46 Homework Assignment: Return and Risk 2 45. A typical investor is assumed to be: A. a fair gambler. B. a

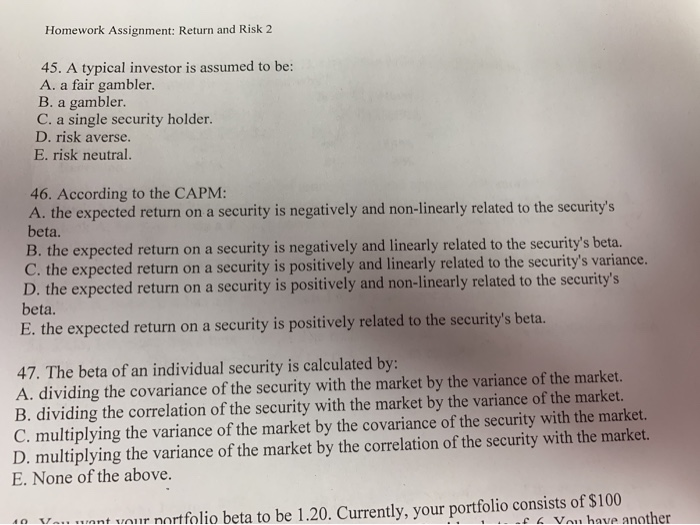

Homework Assignment: Return and Risk 2 45. A typical investor is assumed to be: A. a fair gambler. B. a gambler. C. a single security holder. D. risk averse. E. risk neutral. 46. According to the CAPM: A. the expected return on a security is negatively and non-linearly related to the security's beta. B. the expected return on a security is negatively and linearly related to the security's beta. C. the expected return on a security is positively and linearly related to the security's variance. D. the expected return on a security is positively and non-linearly related to the security's beta. E. the expected return on a security is positively related to the security's beta, 47. The beta of an individual security is calculated by: A. dividing the covariance of the security with the market by the variance of the market. B. dividing the correlation of the security with the market by the variance of the market. C. multiplying the variance of the market by the covariance of the security with the market. D. multiplying the variance of the market by the correlation of the security with the market. E. None of the above. 40 Va.. want your nortfolio beta to be 1.20. Currently, your portfolio consists of $100 1. 6 Van have another

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts