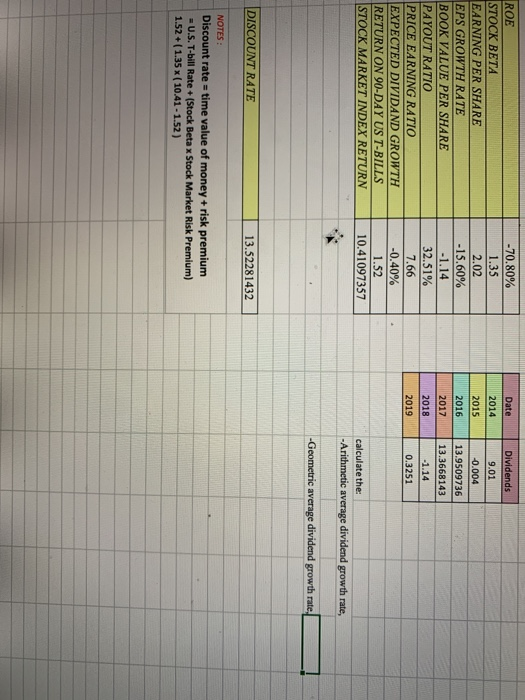

Question: according to the data find 1- arithmetic average dividend growth rate. 2- Geometric average dividend growth rate show your calculation ROE STOCK BETA EARNING PER

ROE STOCK BETA EARNING PER SHARE EPS GROWTH RATE BOOK VALUE PER SHARE PAYOUT RATIO PRICE EARNING RATIO EXPECTED DIVIDAND GROWTH RETURN ON 90-DAY US T-BILLS STOCK MARKET INDEX RETURN -70.80% 1.35 2.02 -15.60% -1.14 32.51% 7.66 -0.40% 1.52 10.41097357 Date 2014 2015 2016. 2017 2018 Dividends 9.01 -0.004 13.9509736 13.3668143 -1.14 0.3251 2019 calculate the: -Arithmetic average dividend growth rate, -Geometric average dividend growth rate, DISCOUNT RATE 13.52281432 NOTES: Discount rate=time value of money + risk premium U.S. T-bill Rate+ (Stock Beta x Stock Market Risk Premium) 1.52+(1.35 x (10.41 -1.52) ROE STOCK BETA EARNING PER SHARE EPS GROWTH RATE BOOK VALUE PER SHARE PAYOUT RATIO PRICE EARNING RATIO EXPECTED DIVIDAND GROWTH RETURN ON 90-DAY US T-BILLS STOCK MARKET INDEX RETURN -70.80% 1.35 2.02 -15.60% -1.14 32.51% 7.66 -0.40% 1.52 10.41097357 Date 2014 2015 2016. 2017 2018 Dividends 9.01 -0.004 13.9509736 13.3668143 -1.14 0.3251 2019 calculate the: -Arithmetic average dividend growth rate, -Geometric average dividend growth rate, DISCOUNT RATE 13.52281432 NOTES: Discount rate=time value of money + risk premium U.S. T-bill Rate+ (Stock Beta x Stock Market Risk Premium) 1.52+(1.35 x (10.41 -1.52)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts