Question: According to the data provided in the screenshots below, answer the following question: QUESTION: Given the calculation in the previous questions(provided below), what can be

According to the data provided in the screenshots below, answer the following question:

QUESTION: Given the calculation in the previous questions(provided below), what can be concluded about the Australian subsidiary? Explain your answer. [2 marks]

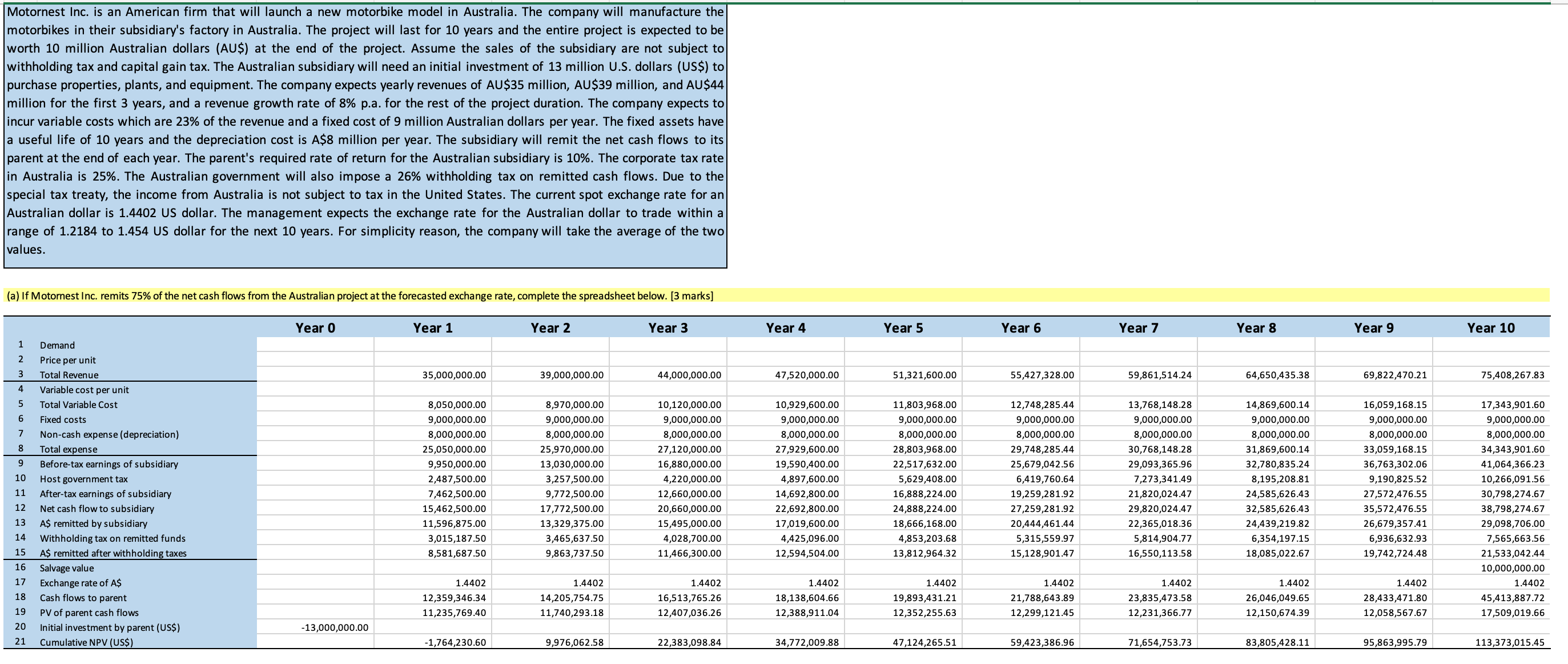

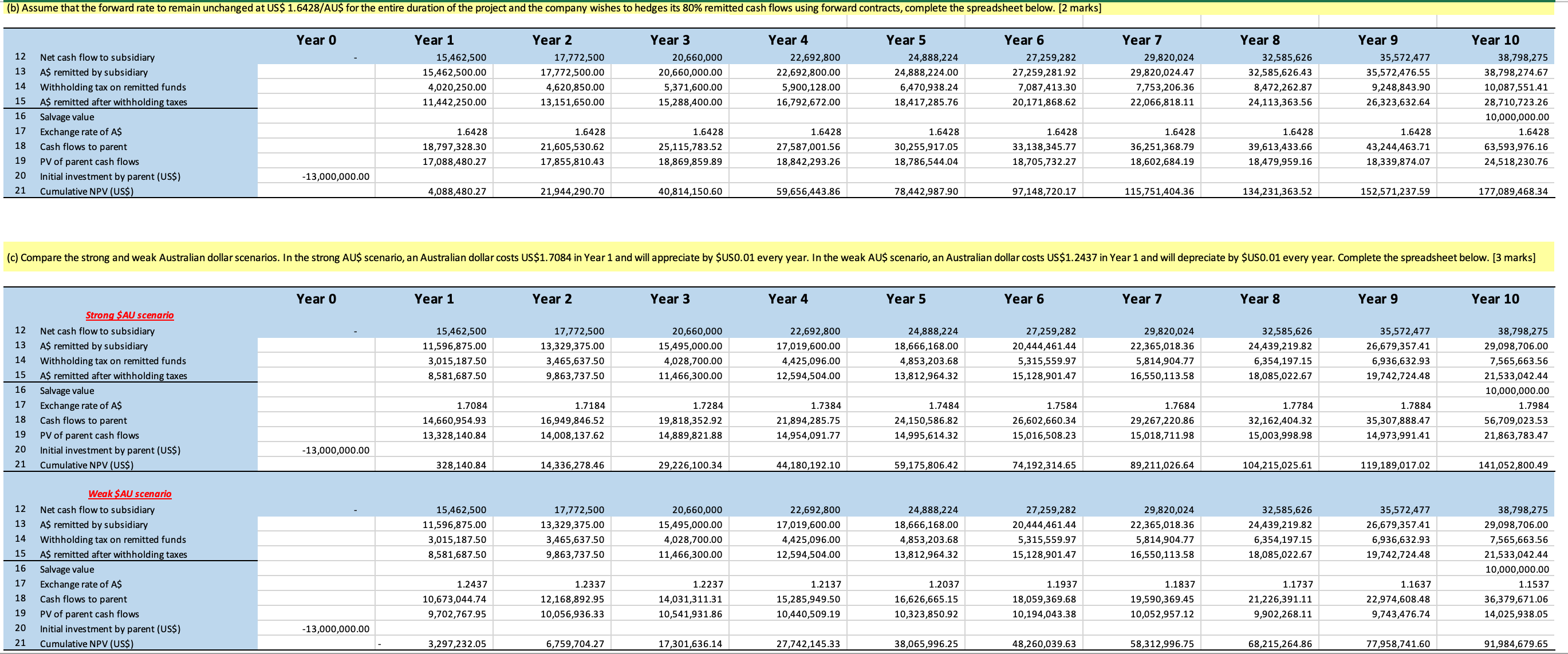

Motornest Inc. is an American firm that will launch a new motorbike model in Australia. The company will manufacture the motorbikes in their subsidiary's factory in Australia. The project will last for 10 years and the entire project is expected to be worth 10 million Australian dollars (AUS) at the end of the project. Assume the sales of the subsidiary are not subject to withholding tax and capital gain tax. The Australian subsidiary will need an initial investment of 13 million U.S. dollars (US$) to purchase properties, plants, and equipment. The company expects yearly revenues of AU$35 million, AU$39 million, and AU$44 million for the first 3 years, and a revenue growth rate of 8% p.a. for the rest of the project duration. The company expects to incur variable costs which are 23% of the revenue and a fixed cost of 9 million Australian dollars per year. The fixed assets have a useful life of 10 years and the depreciation cost is A$8 million per year. The subsidiary will remit the net cash flows to its parent at the end of each year. The parent's required rate of return for the Australian subsidiary is 10%. The corporate tax rate in Australia is 25%. The Australian government will also impose a 26% withholding tax on remitted cash flows. Due to the special tax treaty, the income from Australia is not subject to tax in the United States. The current spot exchange rate for an Australian dollar is 1.4402 US dollar. The management expects the exchange rate for the Australian dollar to trade within a range of 1.2184 to 1.454 US dollar for the next 10 years. For simplicity reason, the company will take the average of the two values. (a) If Motornest Inc. remits 75% of the net cash flows from the Australian project at the forecasted exchange rate, complete the spreadsheet below. [3 marks] Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Year 8 Year 9 Year 10 Demand N Price per unit Total Revenue 35,000,000.00 39,000,000.00 44,000,000.00 47,520,000.00 51,321,600.00 55,427,328.00 59,861,514.24 64,650,435.38 69,822,470.21 75,408,267.83 n P Variable cost per unit Total Variable Cost 8,050,000.00 8,970,000.00 10,120,000.00 10,929,600.00 11,803,968.00 12,748,285.44 13,768,148.28 14,869,600.14 16,059,168.15 17,343,901.60 Fixed costs 9,000,000.00 9,000,000.00 9,000,000.00 9,000,000.00 9,000,000.00 9,000,000.00 9,000,000.00 9,000,000.00 9,000,000.00 9,000,000.00 Non-cash expense (depreciation) 8,000,000.00 8,000,000.00 8,000,000.00 8,000,000.00 8,000,000.00 8,000,000.00 8,000,000.00 8,000,000.00 8,000,000.00 8,000,000.00 Total expense 25,050,000.00 25,970,000.00 27,120,000.00 27,929,600.00 28,803,968.00 29,748,285.44 30,768,148.28 31,869,600.14 33,059,168.15 34,343,901.60 Before-tax earnings of subsidiary 9,950,000.00 13,030,000.00 16,880,000.00 19,590,400.00 22,517,632.00 25,679,042.56 29,093,365.96 32,780,835.2 36,763,302.06 41,064,366.23 10 Host government tax 2,487,500.00 3,257,500.00 4,220,000.00 4,897,600.00 5,629,408.00 6,419,760.64 7,273,341.49 8,195,208.81 9,190,825.52 10,266,091.56 11 After-tax earnings of subsidiary 7,462,500.00 9,772,500.00 12,660,000.00 14,692,800.00 16,888,224.00 19,259,281.92 21,820,024.47 24,585,626.43 27,572,476.55 30,798,274.67 12 Net cash flow to subsidiary 15,462,500.00 17,772,500.00 20,660,000.00 22,692,800.00 24,888,224.00 27,259,281.92 29,820,024.47 32,585,626.43 35,572,476.55 38,798,274.67 13 A$ remitted by subsidiary 11,596,875.00 13,329,375.00 15,495,000.00 17,019,600.00 18,666,168.00 20,444,461.44 22,365,018.36 24,439,219.82 26,679,357.41 29,098,706.00 14 Withholding tax on remitted funds 3,015,187.50 3,465,637.50 4,028,700.00 4,425,096.00 4,853,203.68 5,315,559.97 5,814,904.77 6,354,197.15 6,936,632.93 7,565,663.56 15 AS remitted after withholding taxes 8,581,687.50 9,863,737.50 11,466,300.00 12,594,504.00 13,812,964.32 15,128,901.47 16,550,113.58 18,085,022.67 19,742,724.48 21,533,042.44 16 Salvage value 10,000,000.00 17 Exchange rate of A$ 1.4402 1.4402 1.4402 1.4402 1.4402 1.4402 1.4402 1.4402 1.4402 1.4402 18 Cash flows to parent 12,359,346.34 14,205,754.75 16,513,765.26 18,138,604.66 19,893,431.21 21,788,643.89 23,835,473.58 26,046,049.65 28,433,471.80 45,413,887.72 19 PV of parent cash flows 11,235,769.40 11,740,293.18 12,407,036.26 12,388,911.04 12,352,255.63 12,299,121.45 12,231,366.77 12,150,674.39 12,058,567.67 17,509,019.66 20 Initial investment by parent (US$) -13,000,000.00 21 Cumulative NPV (US$) -1,764,230.60 9,976,062.58 22,383,098.84 34,772,009.88 47,124,265.51 59,423,386.96 71,654,753.73 83,805,428.11 95,863,995.79 113,373,015.45(b) Assume that the forward rate to remain unchanged at US$ 1.6428/AUS for the entire duration of the project and the company wishes to hedges its 80% remitted cash flows using forward contracts, complete the spreadsheet below. [2 marks] Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Year 8 Year 9 Year 10 12 Net cash flow to subsidiary 15,462,500 17,772,500 20,660,000 22,692,800 24,888,224 27,259,282 29,820,024 32,585,626 35,572,477 38,798,275 13 A$ remitted by subsidiary 15,462,500.00 17,772,500.00 20,660,000.00 22,692,800.00 24,888,224.00 27,259,281.92 29,820,024.47 32,585,626.43 35,572,476.55 38,798,274.67 14 Withholding tax on remitted funds 4,020,250.00 4,620,850.00 5,371,600.00 5,900,128.00 6,470,938.24 7,087,413.30 7,753,206.36 8,472,262.87 9,248,843.90 10,087,551.41 15 A$ remitted after withholding taxes 11,442,250.00 13,151,650.00 15,288,400.00 16,792,672.00 18,417,285.76 20,171,868.62 22,066,818.11 24,113,363.56 26,323,632.64 28,710,723.26 16 Salvage value 10,000,000.0 17 Exchange rate of A$ 1.6428 1.6428 1.6428 1.6428 1.6428 1.6428 1.6428 1.6428 1.6428 1.6428 18 Cash flows to parent 18,797,328. 21,605,530.62 25,115,783.52 27,587,001.56 30,255,917.05 33,138,34 36,251,368.79 39,613,433.66 43,244,463.71 63,593,976.16 19 PV of parent cash flows 17,088,480.27 17,855,810.43 18,869,859.89 18,842,293.26 18,786,544.04 18,705,732.27 18,602,684.19 18,479,959.16 18,339,874.07 24,518,230.76 20 Initial investment by parent (US$) -13,000,000.00 21 Cumulative NPV (US$ 4,088,480.27 21,944,290.70 40,814,150.60 59,656,443.86 78,442,987.90 97,148,720.17 115,751,404.36 134,231,363.52 152,571,237.59 177,089,468.34 (c) Compare the strong and weak Australian dollar scenarios. In the strong AU$ scenario, an Australian dollar costs US$1.7084 in Year 1 and will appreciate by $US0.01 every year. In the weak AU$ scenario, an Australian dollar costs US$1.2437 in Year 1 and will depreciate by $US0.01 every year. Complete the spreadsheet below. [3 marks] Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Year 8 Year 9 Year 10 Strong SAU scenario 12 Net cash flow to subsidiary 15,462,500 17,772,500 20,660,000 22,692,800 24,888,224 27,259,282 29,820,024 32,585,626 35,572,477 38,798,275 13 A$ remitted by subsidiary 11,596,875.00 13,329,375.00 15,495,000.00 17,019,600.00 18,666,168.00 20,444,461.44 22,365,018.36 219.82 26,679,357.41 29,098,706.00 14 Withholding tax on remitted funds 3,015,187.50 3,465,637.50 4,028,700.00 4,425,096.00 4,853,203.68 5,315,559.97 5,814,904.77 6,354,197.15 6,936,632.93 7,565,663.56 15 A$ remitted after withholding taxes 8,581,687.50 9,863,737.50 11,466,300.00 12,594,504.00 13,812,964.32 15,128,901.47 16,550,113.58 18,085,022.67 19,742,724.48 21,533,042.44 16 Salvage value 10,000,000.00 17 Exchange rate of A$ 1.7084 1.7184 1.7284 1.7384 1.7484 1.7584 1.7684 1.7784 1.7884 1.7984 18 Cash flows to parent 14,660,954.93 16,949,846.52 19,818,352.92 21,894,285.75 24,150,586.82 26,602,660.34 29,267,220.86 32,162,404.32 35,307,888.47 56,709,023.53 19 PV of parent cash flows 13,328,140.84 14,008,137.62 14,889,821.88 14,954,091.77 14,995,614.32 15,016,508.23 15,018,711.98 15,003,998.98 14,973,991.41 21,863,783.47 20 Initial investment by parent (US$) -13,000,000.00 21 Cumulative NPV (US$) 328,140.84 14,336,278.46 29,226,100.34 44,180,192.10 59,175,806.42 74,192,314.65 89,211,026.64 104,215,025.61 119,189,017.02 141,052,800.49 Weak SAU scenario 12 Net cash flow to subsidiary 15,462,500 17,772,500 20,660,000 22,692,800 24,888,224 27,259,282 29,820,024 32,585,626 35,572,477 38,798,275 13 A$ remitted by subsidiary 11,596,875.00 13,329,375.00 15,495,000.00 17,019,600.00 18,666,168.00 20,444,461.44 22,365,018.36 24,439,219.82 26,679,357.41 29,098,706.00 14 Withholding tax on remitted funds 3,015,187.50 3,465,637.50 4,028,700.00 4,425,096.00 4,853,203.68 5,315,559.97 5,814,904.77 6,354,197.15 6,936,632.93 7,565,663.56 15 A$ remitted after withholding taxes 8,581,687.50 9,863,737.50 11,466,300.00 12,594,504.00 13,812,964.32 15,128,901.47 16,550,113.58 18,085,022.67 19,742,724.48 21,533,042.44 16 Salvage value 10,000,000.00 17 Exchange rate of A$ 1.2437 1.2337 1.2237 1.2137 1.2037 1.1937 1.1837 1.1737 1.1637 1.1537 18 Cash flows to parent 10,673,044.74 12,168,892.95 14,031,311.31 15,285,949.50 16,626,665.15 18,059,369.68 19,590,369.45 21,226,391.11 22,974,608.48 36,379,671.06 19 PV of parent cash flows 9,702,767.95 10,056,936.33 10,541,931.86 10,440,509.19 10,323,850.92 10,194,043.38 10,052,957.12 9,902,268.11 9,743,476.74 14,025,938.05 20 Initial investment by parent (US$) -13,000,000.00 21 Cumulative NPV (US$) 3,297,232.05 5,759,704.27 17,301,636.14 27,742,145.33 38,065,996.25 48,260,039.63 58,312,996.75 68,215,264.86 77,958,741.60 91,984,679.65