Question: accounting 10 HW Help Save & Exit Submit Check my work 1 Fleetwood Company recently had a computer malfunction and lost a portion of its

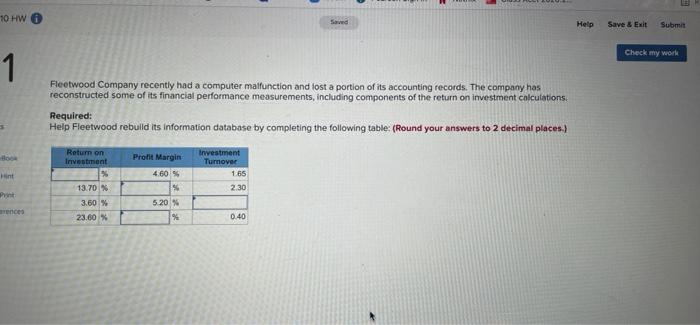

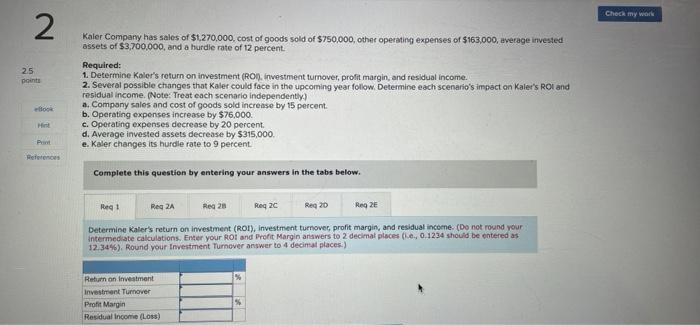

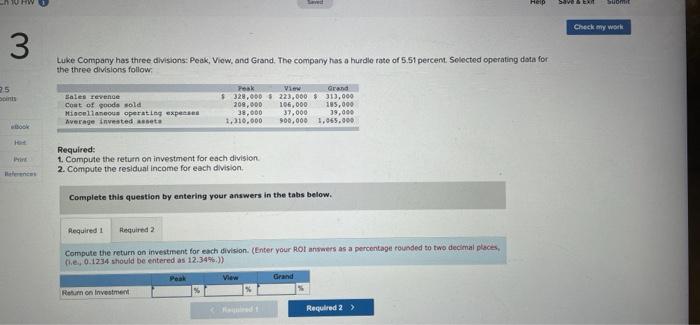

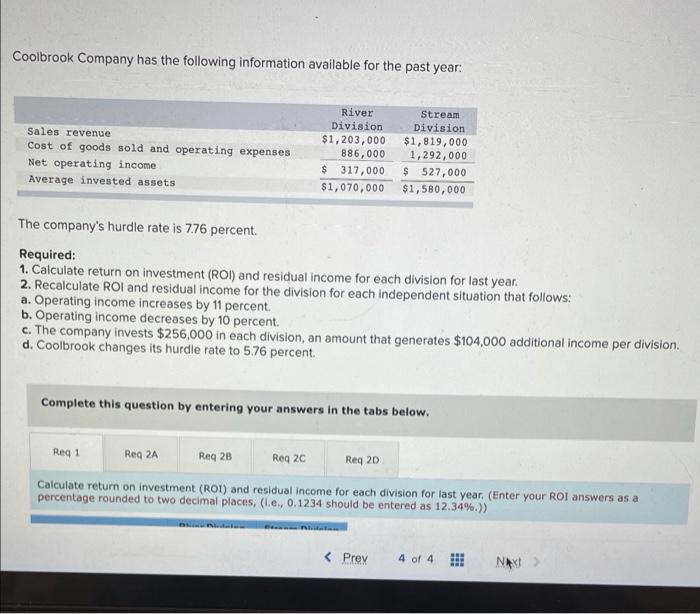

10 HW Help Save & Exit Submit Check my work 1 Fleetwood Company recently had a computer malfunction and lost a portion of its accounting records. The company has reconstructed some of its financial performance measurements, including components of the return on investment calculations Required: Help Fleetwood rebuild its information database by completing the following table: (Round your answers to 2 decimal places.) Return on Investment Profit Margin 4.60 5 % 5.20 % Investment Turnover 1.65 2.30 13.70% 3.60 % 23.60 % rences % 0.40 Check my word 2 25 points Kaler Company has sales of $1.270,000, cost of goods sold of $750,000, other operating expenses of $163,000, average invested assets of $3,700,000, and a hurdle rate of 12 percent. Required: 1. Determine Kaler's return on investment (RO). Investment turnover, profit margin, and residual income. 2. Several possible changes that Kaler could face in the upcoming year follow. Determine each scenario's impact on Kaler's ROI and residual income. (Note: Treat each scenario independently) a. Company sales and cost of goods sold increase by 15 percent. b. Operating expenses increase by $76,000 c. Operating expenses decrease by 20 percent d. Average invested assets decrease by $315,000. e. Kaler changes its hurdle rate to 9 percent. - Het Pent ferences Complete this question by entering your answers in the tabs below. Regt Reg 2A Reg 28 Reg 20 Reg 20 Reg 2E Determine Kaler's return on investment (ROI), Investment turnover, profit margin, and residual income. (Do not round your intermediate calculations. Enter your ROI and Pront Margin answers to 2 decimal places (.e., 0.1234 should be entered as 12.34%). Round your Investment Turnover answer to 4 decimal places) Return on investment Investment Turnover Profit Margin Residual income (Loss) Help Save B EN Suomi Check my work 3 25 Luke Company has three divisions: Peak, View, and Grand. The company has a hurdle rate of 5.51 percent. Selected operating data for the three divisions follow Peak View Grand Sales revenge $328,000 $ 223,000 313,000 Coat of goods sold 200,000 106,000 15,000 Misollaneous operating expense 38,000 37,000 39,000 Average invested assets 1.310.000 900,000 5,065.000 book Required: 1. Compute the return on investment for each division 2. Compute the residual income for each division Complete this question by entering your answers in the tabs below. Required 1 Required 2 Compute the return on investment for each division (Enter your ROI answers as a percentage rounded to two decimal places, ne, 0.1234 should be entered as 12.34%)) Peak View Grand Return on investment Required 2 > Coolbrook Company has the following information available for the past year: Sales revenue Cost of goods sold and operating expenses Net operating income Average invested assets River Division $1,203,000 886,000 $ 317,000 $1,070,000 Stream Division $1,819,000 1,292,000 $ 527,000 $1,500,000 The company's hurdle rate is 776 percent. Required: 1. Calculate return on investment (ROI) and residual income for each division for last year. 2. Recalculate ROI and residual income for the division for each independent situation that follows: a. Operating income increases by 11 percent. b. Operating income decreases by 10 percent. c. The company invests $256,000 in each division, an amount that generates $104,000 additional income per division. d. Coolbrook changes its hurdle rate to 5.76 percent. Complete this question by entering your answers in the tabs below. Reg 1 Req 2A Reg 28 Reg 2c Reg 2D Calculate return on investment (ROI) and residual income for each division for last year. (Enter your ROI answers as a percentage rounded to two decimal places, (le, 0.1234 should be entered as 12.34%.)) .

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts