Question: ACCOUNTING 1---CHAPTER 5 PROBLEMS 1. Boston Computer Sales uses the perpetual inventory system and had the following transactions occur during December: Dec. 1 Sold merchandise

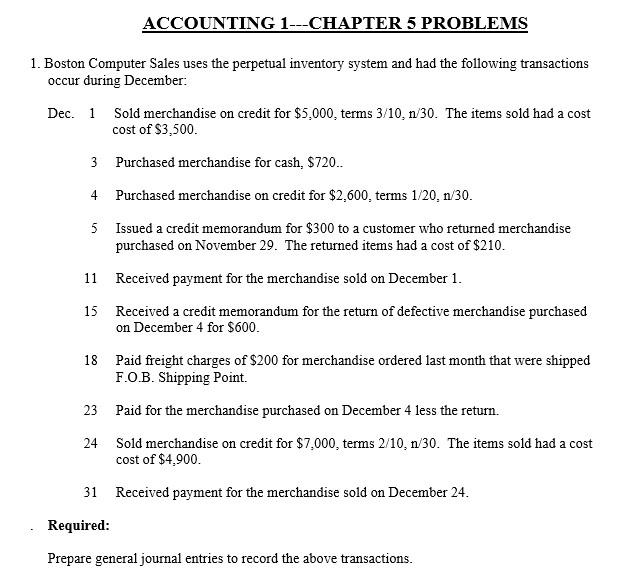

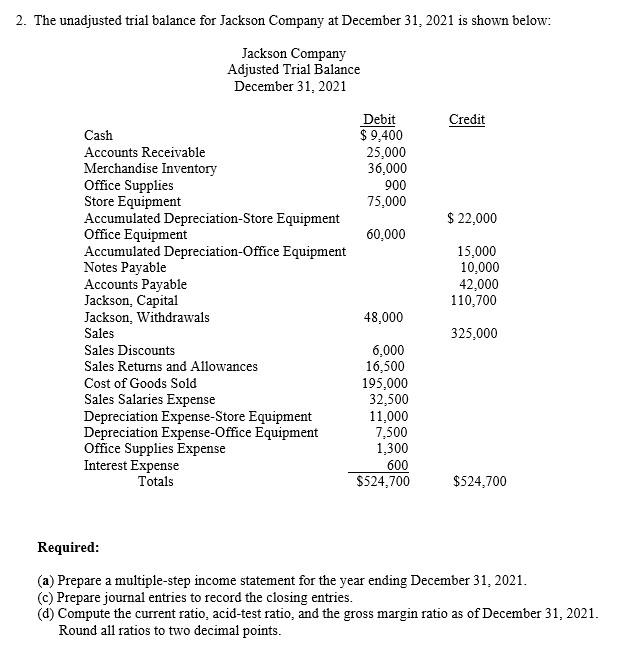

ACCOUNTING 1---CHAPTER 5 PROBLEMS 1. Boston Computer Sales uses the perpetual inventory system and had the following transactions occur during December: Dec. 1 Sold merchandise on credit for $5,000, terms 3/10, n/30. The items sold had a cost cost of $3,500. 3 Purchased merchandise for cash, $720.. 4 Purchased merchandise on credit for $2,600. terms 1/20. n/30. 5 Issued a credit memorandum for $300 to a customer who returned merchandise purchased on November 29. The returned items had a cost of $210. 11 Received payment for the merchandise sold on December 1. 15 Received a credit memorandum for the return of defective merchandise purchased on December 4 for $600. 18 Paid freight charges of $200 for merchandise ordered last month that were shipped F.O.B. Shipping Point. 23 Paid for the merchandise purchased on December 4 less the return. 24 Sold merchandise on credit for $7.000, terms 2/10,n/30. The items sold had a cost cost of $4.900. 31 Received payment for the merchandise sold on December 24. Required: Prepare general journal entries to record the above transactions. 2. The unadjusted trial balance for Jackson Company at December 31, 2021 is shown below: Jackson Company Adjusted Trial Balance December 31, 2021 Credit Debit $9.400 25,000 36,000 900 75,000 $ 22,000 60,000 Cash Accounts Receivable Merchandise Inventory Office Supplies Store Equipment Accumulated Depreciation Store Equipment Office Equipment Accumulated Depreciation Office Equipment Notes Payable Accounts Payable Jackson, Capital Jackson, Withdrawals Sales Sales Discounts Sales Returns and Allowances Cost of Goods Sold Sales Salaries Expense Depreciation Expense-Store Equipment Depreciation Expense-Office Equipment Office Supplies Expense Interest Expense Totals 15,000 10,000 42,000 110,700 48,000 325,000 6,000 16,500 195,000 32,500 11,000 7,500 1,300 600 $524,700 $524,700 Required: (a) Prepare a multiple-step income statement for the year ending December 31, 2021. () Prepare journal entries to record the closing entries. (d) Compute the current ratio, acid-test ratio, and the gross margin ratio as of December 31, 2021. Round all ratios to two decimal points

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts