Question: Please prepare the correct journal entry for the attached information. n. For tax purpose, the company changes (1) depreciation method for buiding ($100,000,000) from double-declining

Please prepare the correct journal entry for the attached information.

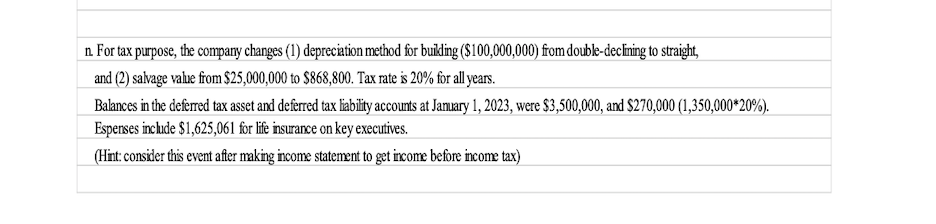

n. For tax purpose, the company changes (1) depreciation method for buiding ($100,000,000) from double-declining to straight, and (2) salvage value from $25,000,000 to $868,800. Tax rate is 20% for all years. Balances in the deferred tax asset and deferred tax liability accounts at January 1,2023 , were $3,500,000, and $270,000(1,350,00020%). Espenses include $1,625,061 for life insurance on key executives. (Hint: consider this event after making income statement to get income before income tax)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts