Question: Consider a 1-step binomial model, where there are two possible time evolution H,T and a stock with current price So = 100 and time-1

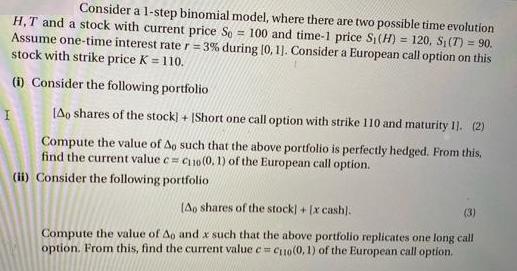

Consider a 1-step binomial model, where there are two possible time evolution H,T and a stock with current price So = 100 and time-1 price S,(H) = 120, SI(T) = 90. Assume one-time interest rate r = 3% during [0, 1]. Consider a European call option on this stock with strike price K = 110. !! (i) Consider the following portfolio (Ao shares of the stock] + IShort one call option with strike 110 and maturity 11. (2) Compute the value of Ao such that the above portfolio is perfectly hedged. From this, find the current value c= cu0 (0. 1) of the European call option. (ii) Consider the following portfolio (Ao shares of the stock] + [x cash). (3) Compute the value of Ao and x such that the above portfolio replicates one long call option. From this, find the current value c C10(0, 1) of the European call option.

Step by Step Solution

3.47 Rating (154 Votes )

There are 3 Steps involved in it

i The Portfolio consisting of long position in 0 shares and short position in 1one call option is pe... View full answer

Get step-by-step solutions from verified subject matter experts