Question: Your, assignment t is to prepare a ATCF replacement analysis study. Defender The actual machine was installed 2 years ago at a cost of

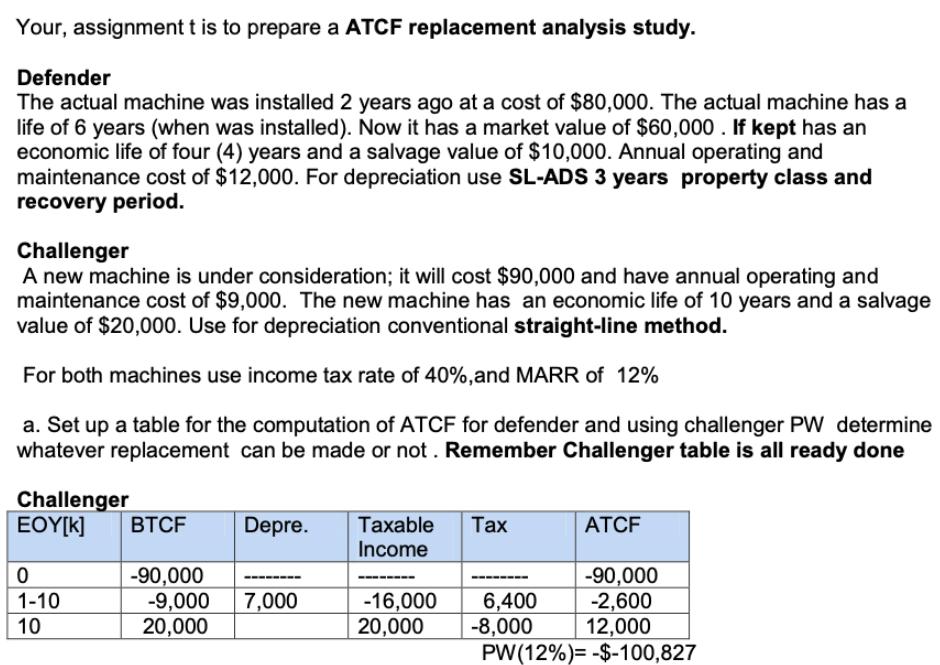

Your, assignment t is to prepare a ATCF replacement analysis study. Defender The actual machine was installed 2 years ago at a cost of $80,000. The actual machine has a life of 6 years (when was installed). Now it has a market value of $60,000 . If kept has an economic life of four (4) years and a salvage value of $10,000. Annual operating and maintenance cost of $12,000. For depreciation use SL-ADS 3 years property class and recovery period. Challenger A new machine is under consideration; it will cost $90,000 and have annual operating and maintenance cost of $9,000. The new machine has an economic life of 10 years and a salvage value of $20,000. Use for depreciation conventional straight-line method. For both machines use income tax rate of 40%,and MARR of 12% a. Set up a table for the computation of ATCF for defender and using challenger PW determine whatever replacement can be made or not . Remember Challenger table is all ready done Challenger BTCF Depre. Taxable x ATCF Income -90,000 -9,000 20,000 -90,000 -2,600 12,000 PW(12%)= -$-100,827 -- ----- -16,000 20,000 6,400 -8,000 1-10 7,000 10

Step by Step Solution

3.42 Rating (155 Votes )

There are 3 Steps involved in it

Answer Defender EOYk BTCFin Depreciation Taxable incomeTIBTCFDep... View full answer

Get step-by-step solutions from verified subject matter experts