Question: B) Discuss the practical limitations of the Replacement Analysis you have undertaken in Part A. Venta Co has decided to accept an investment project and

B) Discuss the practical limitations of the Replacement Analysis you have undertaken in Part A. Venta Co has decided to accept an investment project and is now considering financing it with a lease. The asset used for the investment project could be leased over four years at a rental of £36,000 pa, payable in advance for each year. Tax is payable at 30%, one year in arrears. The post-tax cost of borrowing 10%.

C) Calculate the Net Present Value of the lease.

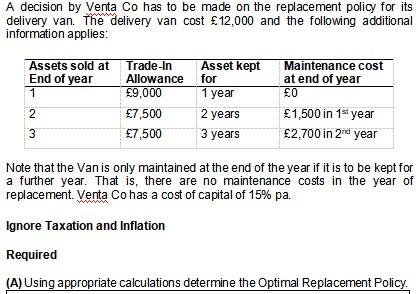

A decision by Venta Co has to be made on the replacement policy for its delivery van. The delivery van cost 12,000 and the following additional information applies: Asset kept for Trade-In Maintenance cost at end of year 0 Assets sold at End of year Allowance 1 9,000 1 year 2 7,500 2 years 1,500 in 1 year 7,500 3 years 2,700 in 2nd year Note that the Van is only maintained at the end of the year if it is to be kept for a further year. That is, there are no maintenance costs in the year of replacement. Venta Co has a cost of capital of 15% pa. Ignore Taxation and Inflation Required (A) Using appropriate calculations determine the Optimal Replacement Policy.

Step by Step Solution

3.33 Rating (159 Votes )

There are 3 Steps involved in it

A The correct method is to use EAC Equivalent annual cost for all three options and select the one w... View full answer

Get step-by-step solutions from verified subject matter experts