Question: Accounting: Bonds Prepare a bond table by using the present value and present value of annuity table, not excel. Bond#1: Given: The Max Corporation issued

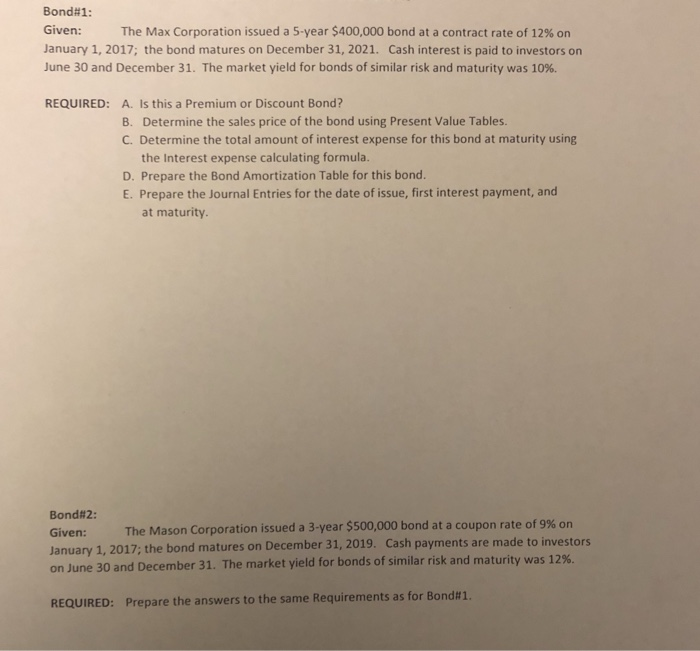

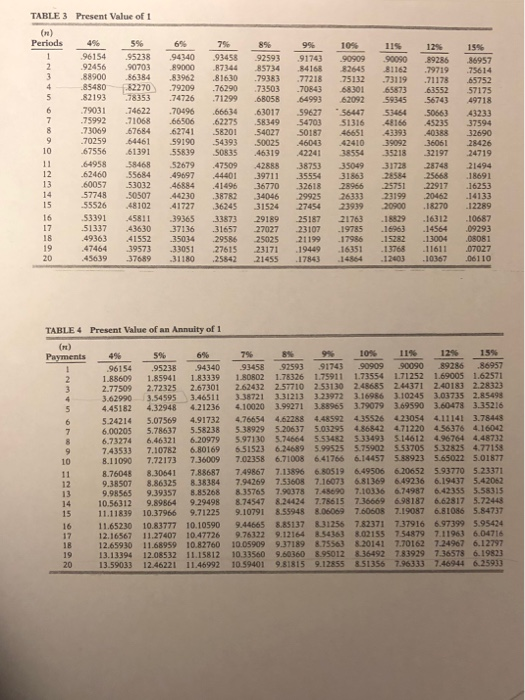

Bond#1: Given: The Max Corporation issued a 5-year $400,000 bond at a contract rate of 12% on January 1, 2017; the bond matures on December 31, 2021. Cash interest is paid to investors on June 30 and December 31 . The market yield for bonds of similar risk and maturity was 10%. A. Is this a Premium or Discount Bond? B. Determine the sales price of the bond using Present Value Tables. C. Determine the total amount of interest expense for this bond at maturity using REQUIRED: the Interest expense calculating formula D. Prepare the Bond Amortization Table for this bond E. Prepare the Journal Entries for the date of issue, first interest payment, and at maturity. Bond#2: Given: January 1, 2017; the bond matures on December 31, 2019. Cash payments are made to investors on June 30 and December 31, The market yield for bonds of similar risk and maturity was 12%. The Mason Corporation issued a 3-year $500,000 bond at a coupon rate of 9% on REQUIRED: Prepare the answers to the same Requirements as for Bond# 1. TABLE 3 Present Value of 1 Periods 4% 5% 6% 7% 8% 9% 10% 11% 12% 96154 95238 94340 93458 92593 9174390909 90090 89286 86957 .92456 .90703 .89000 .87344 .85734 .84168 82645 1162 .719, 75614 88900 86384 83962 81630 79383 77218 75132 73119 71178 65752 .85480-i82270) .79209 .76290 .73503 .70843 .68301 65873 .63552 57175 82193 78353 74726 71299 68058 64993 62092 59345 56743 49718 79031 74622 7049666634 63017 59627 5644753464 5066343233 75992 .71068 .66506 .62275 .58349 54703 51316 .48166 .45235 37594 .73069 .67684 .62741 .58201 .54027 S0187 .46651-43393 A0388 32690 .70259 .64461-59190 .54393 .50025-46043 42410 39092 36061 28426 .67556 .61391 .55839 .50835 .46319 .42241 38554 .35218 .32197 .24719 6495858468 52679 47509 4288838753 35049 31728 2874 21494 62460 55684 4969744401 39711 35554 31863 28584 25668 18691 .60057 .53032 .46884 .41496 .36770 .32618 .20966 .25751 .22917 .16253 57748 .50507 .44230 .38782 .34046 .29925 26333 199-20462-14133 15 55526 48102 41727 36245 31524 27454 23939 20900 18270 12289 5339145811 39365 33873 29189 25187 21763 188291631210687 .51337 .43630-37136 .31657 27027-23107-19785 .16963 .14564 .09293 .49363 41552 .35034 .29586 .25025 .21199 .17986 .15282 .13004 .08081 .47464 .39573 .33051 ,27615 .23171 .19449 .16351 .13768 .11611 .07027 .45639 .37689 .31180 ,25842 .21455 .17843 .14864 .12403 .10367 .06110 13 14 TABLE4 Present Value of an Annuity of 1 12% 15% 96154 9523894340 93458 92593 91743 90909 90090 89286 .86957 1.88609 1.85941 1.83339 1.80802 1.78326 1.75911 1.73554 1.71252 1.69005 1.62571 2.77509 2.72325 2.67301 2.62432 2.57710 253130 2.48685 244371 2.40183 2.28323 3.62990 3.54595 3.46511 338721 3.31213 3.23972 3.16986 3.10245 3.03735 2.85498 4.45182 4.32948 4.21236 4.10020 3.99271 3.88965 3.79079 3.69590 3.60478 3.35216 524214 5.07569 4.91732 4.76654 4.62288 4.48592 435526 423054 4.11141 3.78448 6.00205 5.78637 5.58238 5.38929 520637 5.03295 4.86842 471220 456376 4.16042 6.73274 6.46321 6.20979 5.97130 5.74664 553482 5.33493 514612 4.96764 4.48732 7.43533 7.10782 6.80169 651523 624689 5.99525 5.75902 5.53705 5.32825 4.77158 8.11090 7.72173 7.36009 7.02358 6.71008 641766 6.14457 5.88923 5.65022 5.01877 8.76048 8.30641 7.88687 7.49867 7.13896 6.80519 649506 6.20652 5.93770 5.23371 9.38507 8.86325 8.38384 7.94269 7.53608 7.16073 6.81369 649236 6.19437 5.42062 9.98565 9.39357 8.852688.357657.90378 7.48690 7.10336 674987 642355 558315 14 10.56312 9.89864 9.29498 8.74547 8.24424 7.78615 7.36669 698187 6.62817 5.72448 15 11.11839 10.37966 9.71225 9.10791 8.55948 8.06069 7.60608 7.19087 6.81086 5.84737 16 11.65230 10.83777 10.10590 9.44665 8.85137 831256 7.82371 737916 697399 5.95424 17 12.16567 11.27407 10.47726 976322 912164 8.54363 8.02155 7.54879 7.11963 6.04716 18 12.65930 11.68959 10.82760 1005909 937189 75563 20141 7.70162 71067 6.1277 19 13.1 3394 12.08532 11.15812 10.33560 960360 895012 6492 733929 736575 61952S 13.59033 12.46221 1146992 10.59401 981815 9.12855 851356 7.96333 7.46944 6.25933

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts