Bottle-Up Inc., was organized on January 7, 2008, and made its S election on January 24, 2008.

Question:

Bottle-Up Inc., was organized on January 7, 2008, and made its S election on January 24, 2008. The necessary consents to the election were filed in a timely manner. Its address is 1234 Hill Street, City, ST 33333. Bottle-Up uses the calendar year as tax year, the accrual method of accounting, and the first-in, first-out (FIFO) inventory method. Bottle-Up manufactures ornamental glass bottles. It made no changes to its inventory costing methods this year. It uses the specific identification method for bad debt for book and tax purposes. Herman Hiebert is the tax matters person. Financial statements for the current year are below. Ignore the U.S. (domestic) production activities deduction. Prepare a 2017 S Corporation tax return for Bottle-Up

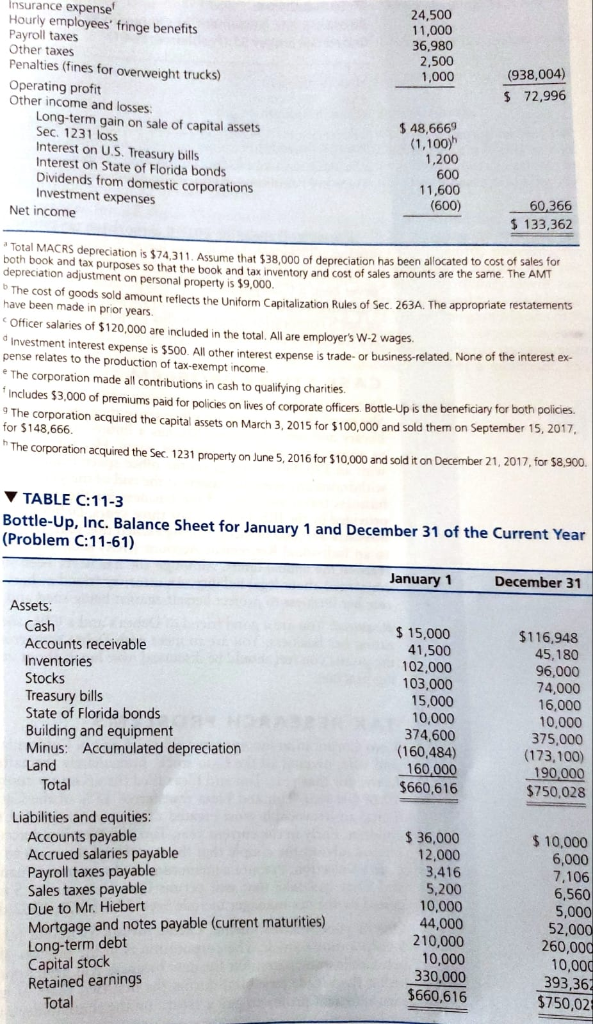

December 31 :

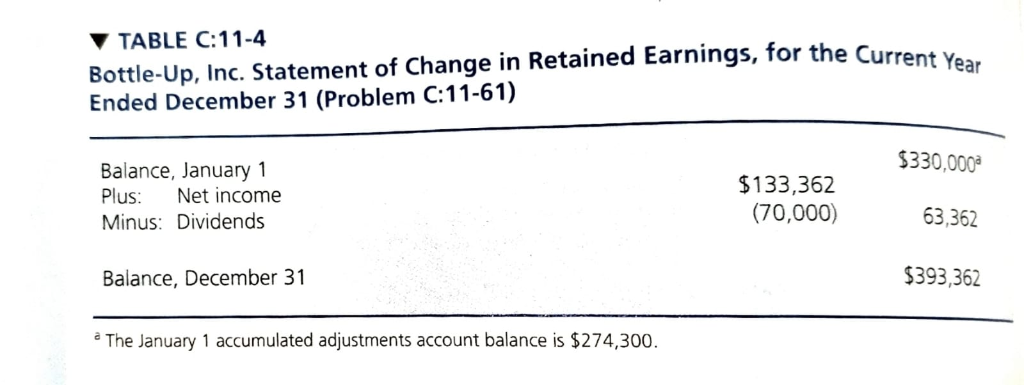

Retained Earnings 393,362

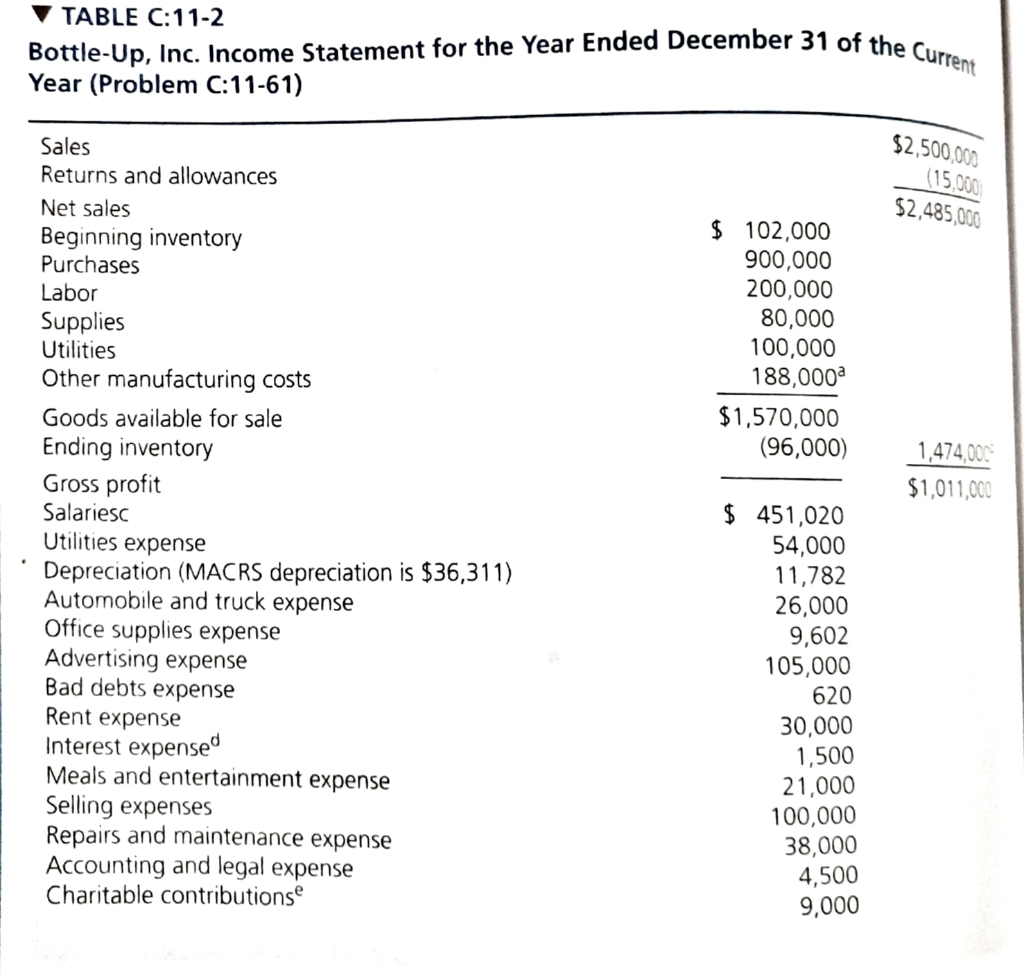

TABLE C:11-2 Bottle-Up, Inc. Income Statement for the Year Ended December 31 of the Current Year (Problem C:11-61) Sales Returns and allowances Net sales Beginning inventory Purchases Labor Supplies Utilities Other manufacturing costs Goods available for sale Ending inventory Gross profit Salariesc Utilities expense Depreciation (MACRS depreciation is $36,311) Automobile and truck expense Office supplies expense Advertising expense Bad debts expense Rent expense Interest expensed Meals and entertainment expense Selling expenses Repairs and maintenance expense Accounting and legal expense Charitable contributions $ 102,000 900,000 200,000 80,000 100,000 188,000 $1,570,000 (96,000) $ 451,020 54,000 11,782 26,000 9,602 105,000 620 30,000 1,500 21,000 100,000 38,000 4,500 9,000 $2,500,000 (15,000) $2,485,000 1,474,000 $1,011,000 Insurance expense Hourly employees' fringe benefits Payroll taxes Other taxes Penalties (fines for overweight trucks) Operating profit Other income and losses: Long-term gain on sale of capital assets Sec. 1231 loss Interest on U.S. Treasury bills Interest on State of Florida bonds Dividends from domestic corporations Investment expenses Net income Total MACRS depreciation is $74,311. Assume that $38,000 of depreciation has been allocated to cost of sales for both book and tax purposes so that the book and tax inventory and cost of sales amounts are the same. The AMT depreciation adjustment on personal property is $9,000. Assets: Cash Accounts receivable Inventories The cost of goods sold amount reflects the Uniform Capitalization Rules of Sec. 263A. The appropriate restatements have been made in prior years. Stocks Treasury bills State of Florida bonds Building and equipment Minus: Accumulated depreciation Land 24,500 11,000 36,980 2,500 1,000 Officer salaries of $120,000 are included in the total. All are employer's W-2 wages. Investment interest expense is $500. All other interest expense is trade-or business-related. None of the interest ex- pense relates to the production of tax-exempt income. Total $ 48,6669 (1,100) 1,200 600 The corporation made all contributions in cash to qualifying charities. Includes $3,000 of premiums paid for policies on lives of corporate officers. Bottle-Up is the beneficiary for both policies. 9 The corporation acquired the capital assets on March 3, 2015 for $100,000 and sold them on September 15, 2017, for $148,666. The corporation acquired the Sec. 1231 property on June 5, 2016 for $10,000 and sold it on December 21, 2017, for $8.9 Liabilities and equities: Accounts payable Accrued salaries payable 11,600 (600) TABLE C:11-3 Bottle-Up, Inc. Balance Sheet for January 1 and December 31 of the Current Year (Problem C:11-61) Payroll taxes payable Sales taxes payable Due to Mr. Hiebert Mortgage and notes payable (current maturities) Long-term debt Capital stock Retained earnings Total. (938,004) $ 72,996 60,366 $ 133,362 January 1 $15,000 41,500 102,000 103,000 15,000 10,000 374,600 (160,484) 160,000 $660,616 $36,000 12,000 3,416 5,200 10,000 44,000 210,000 10,000 330,000 $660,616 = December 31 $116,948 45,180 96,000 74,000 16,000 10,000 375,000 (173,100) 190,000 $750,028 $10,000 6,000 7,106 6,560 5,000 52,000 260,000 10,000 393,362 $750,02 TABLE C:11-4 Bottle-Up, Inc. Statement of Change in Retained Earnings, for the Current Year Ended December 31 (Problem C:11-61) Balance, January 1 Plus: Net income Minus: Dividends Balance, December 31 a The January 1 accumulated adjustments account balance is $274,300. $133,362 (70,000) $330,000 63,362 $393,362 TABLE C:11-2 Bottle-Up, Inc. Income Statement for the Year Ended December 31 of the Current Year (Problem C:11-61) Sales Returns and allowances Net sales Beginning inventory Purchases Labor Supplies Utilities Other manufacturing costs Goods available for sale Ending inventory Gross profit Salariesc Utilities expense Depreciation (MACRS depreciation is $36,311) Automobile and truck expense Office supplies expense Advertising expense Bad debts expense Rent expense Interest expensed Meals and entertainment expense Selling expenses Repairs and maintenance expense Accounting and legal expense Charitable contributions $ 102,000 900,000 200,000 80,000 100,000 188,000 $1,570,000 (96,000) $ 451,020 54,000 11,782 26,000 9,602 105,000 620 30,000 1,500 21,000 100,000 38,000 4,500 9,000 $2,500,000 (15,000) $2,485,000 1,474,000 $1,011,000 Insurance expense Hourly employees' fringe benefits Payroll taxes Other taxes Penalties (fines for overweight trucks) Operating profit Other income and losses: Long-term gain on sale of capital assets Sec. 1231 loss Interest on U.S. Treasury bills Interest on State of Florida bonds Dividends from domestic corporations Investment expenses Net income Total MACRS depreciation is $74,311. Assume that $38,000 of depreciation has been allocated to cost of sales for both book and tax purposes so that the book and tax inventory and cost of sales amounts are the same. The AMT depreciation adjustment on personal property is $9,000. Assets: Cash Accounts receivable Inventories The cost of goods sold amount reflects the Uniform Capitalization Rules of Sec. 263A. The appropriate restatements have been made in prior years. Stocks Treasury bills State of Florida bonds Building and equipment Minus: Accumulated depreciation Land 24,500 11,000 36,980 2,500 1,000 Officer salaries of $120,000 are included in the total. All are employer's W-2 wages. Investment interest expense is $500. All other interest expense is trade-or business-related. None of the interest ex- pense relates to the production of tax-exempt income. Total $ 48,6669 (1,100) 1,200 600 The corporation made all contributions in cash to qualifying charities. Includes $3,000 of premiums paid for policies on lives of corporate officers. Bottle-Up is the beneficiary for both policies. 9 The corporation acquired the capital assets on March 3, 2015 for $100,000 and sold them on September 15, 2017, for $148,666. The corporation acquired the Sec. 1231 property on June 5, 2016 for $10,000 and sold it on December 21, 2017, for $8.9 Liabilities and equities: Accounts payable Accrued salaries payable 11,600 (600) TABLE C:11-3 Bottle-Up, Inc. Balance Sheet for January 1 and December 31 of the Current Year (Problem C:11-61) Payroll taxes payable Sales taxes payable Due to Mr. Hiebert Mortgage and notes payable (current maturities) Long-term debt Capital stock Retained earnings Total. (938,004) $ 72,996 60,366 $ 133,362 January 1 $15,000 41,500 102,000 103,000 15,000 10,000 374,600 (160,484) 160,000 $660,616 $36,000 12,000 3,416 5,200 10,000 44,000 210,000 10,000 330,000 $660,616 = December 31 $116,948 45,180 96,000 74,000 16,000 10,000 375,000 (173,100) 190,000 $750,028 $10,000 6,000 7,106 6,560 5,000 52,000 260,000 10,000 393,362 $750,02 TABLE C:11-4 Bottle-Up, Inc. Statement of Change in Retained Earnings, for the Current Year Ended December 31 (Problem C:11-61) Balance, January 1 Plus: Net income Minus: Dividends Balance, December 31 a The January 1 accumulated adjustments account balance is $274,300. $133,362 (70,000) $330,000 63,362 $393,362

Expert Answer:

Financial Accounting Tools for business decision making

ISBN: 978-0470534779

6th Edition

Authors: Paul D. Kimmel, Jerry J. Weygandt, Donald E. Kieso

Students also viewed these accounting questions

-

22. Suppose K is the delivery price and ST is the spot price of the asset at maturity of the contract, in general, the payoff from a long position in a forward contract on one unit of an asset is ()....

-

A corporation was organized on January 1. At that time, 10,000 shares of common were sold and issued at $10.00 per share cash. $20,000 of the proceeds was used to purchase equipment. The corporation...

-

The Fly Right Travel Agency was organized on January 1, 2010, by Joe Kirkpatrick. Joe is a good manager but a poor accountant. From the trial balance prepared by a parttime bookkeeper, Joe prepared...

-

A psychologist shows a list of eight activities to a subject in an experiment. How many ways can the subject pick a first, second, and third activity? a. Identify the total number of objects n and...

-

Refer to the Statistics in Context section of Chapter 7 concerning monthly changes in the Canadian to U.S. exchange rate. A computer calculation gives = -.0021 and s = .0234 for the n = 41 monthly...

-

After issuing bonds in Chapter 15 , Kerr Consulting Corporation has some excess cash on hand. Alex Kerr, the Corporation's major shareholder, intends to invest some of the cash for different time...

-

What are some potential disadvantages of using a packaged application to help automate the employee goal-setting process?

-

The Cincinnati Zoo and Botanical Gardens had a record attendance of 1.87 million visitors in 2017 (Cincinnati Business Courier website). Nonprofit organizations such as zoos and museums are becoming...

-

Starbucks (SBUX) Income Statement for 2018 contained the following financial data: Revenue Cost of Revenue Operating Expenses Interest Expense $22,387,000 $ 9,038,000 $ 9,452,000 $ 93,000 Using the...

-

Glen Pool Club, Inc., has an installment loan outstanding with a current balance of $150.000. The company makes monthly installments of $1,543, which include interest computed at an annual rate of 6...

-

Which of the following is NOT a diversifiable risk? OA. The risk that the CEO is killed in a plane crash OB. The risk of a key employee being hired away by a competitor OC. The risk of a product...

-

CORONAVIRUS ETHICS: PANDEMIC SEVERITY AND JUDGMENTS OF MARKETING ETHICS Yvetta Simonyan, University of Bath N. Craig Smith, INSEAD Contact Information: For further information, please contact Yvetta...

-

A skydiver with mass m experiences a constant downward gravitational force F, mg where g is the magnitude of the acceleration due to gravity. They also experience an upward drag force proportional to...

-

A circular space station spins about its axis to simulate gravity in the living quarters located along its periphery. What is the direction of acceleration of a person standing at the periphery?

-

Explain how the equilibrium wage rate is determined for a perfectly competitive industry and how a firm in that industry determines its profit maximizing employment level?

-

If h(x)=7+6f(x), where f(3) h'(3) = = = 7 and f'(3) 3, find h'(3).

-

For the function given below, find a formula for the Riemann sum obtained by dividing the interval [a,b] into n equal subintervals and using the right-hand endpoint for each ck. Then take a limit of...

-

What steps must a business take to implement a program of social responsibility?

-

The following financial information is for Cheaney Company. Additional information:1. Inventory at the beginning of 2011 was $115,000.2. Receivables (net) at the beginning of 2011 were $86,000.3....

-

Laser Recording Systems, founded in 1981, produces disks for use in the home market. The following is an excerpt from Laser Recording Systems financial statements (all dollars in thousands). LASER...

-

The following information was taken from the 2009 financial statements of pharmaceutical giant Merck and Co. All dollar amounts are in millions. Retained earnings, January 1, 2009 ... $43,698.8...

-

Assume the same facts as in Problem I:9-53, except that Becky and Ken are not related and that under the terms of the loan Ken agrees to repay Becky the \($5,000\) plus interest (at a reasonable...

-

During 2022, Becky loans her brother Ken \($5,000,\) which he intends to use to establish a small business. Because Ken has no other assets and needs cash to establish the business, the agreement...

-

During 2023, Pam incurred the following casualty losses: All of the items were destroyed in the same casualty, which resulted from a federally declared disaster. Before considering the casualty...

Study smarter with the SolutionInn App