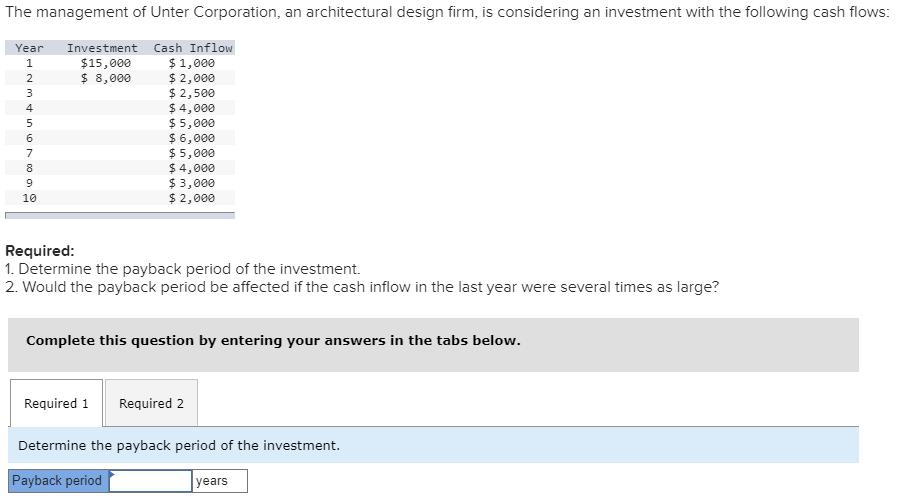

Question: The management of Unter Corporation, an architectural design firm, is considering an investment with the following cash flows: Year Investment Cash Inflow $1,000 $

The management of Unter Corporation, an architectural design firm, is considering an investment with the following cash flows: Year Investment Cash Inflow $1,000 $ 2,000 $ 2,500 $ 4,000 $ 5,000 $6,000 $ 5,000 $ 4,000 $ 3,000 $ 2,000 1 $15,000 $ 8,000 2 3 4 6. 7 8 9. 10 Required: 1. Determine the payback period of the investment. 2. Would the payback period be affected if the cash inflow in the last year were several times as large? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Determine the payback period of the investment. Payback period years

Step by Step Solution

3.35 Rating (161 Votes )

There are 3 Steps involved in it

1 The payback period is determined as follows Year Investment Cash Inflow Unrecovered Investment 1 ... View full answer

Get step-by-step solutions from verified subject matter experts