Question: both tax purposes and accounting purposes, the company uses a June 30 year end. This Marcon Ltd. is Canadian company that is publicly traded

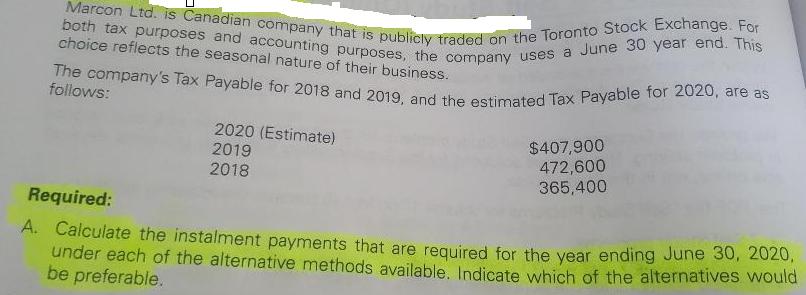

both tax purposes and accounting purposes, the company uses a June 30 year end. This Marcon Ltd. is Canadian company that is publicly traded on the Toronto Stock Exchange. For The company's Tax Payable for 2018 and 2019, and the estimated Tax Payable for 2020, are as choice reflects the seasonal nature of their business. follows: 2020 (Estimate) 2019 $407,900 472,600 365,400 2018 Required: A. Calculate the instalment payments that are required for the vear ending June 30, 2020, under each of the alternative methods available, Indicate which of the alternatives would be preferable.

Step by Step Solution

3.41 Rating (154 Votes )

There are 3 Steps involved in it

Your specific tax situation will determine which payment options are available to you Payment o... View full answer

Get step-by-step solutions from verified subject matter experts