Question: 1. Use Fig. 4.1 to determine whether each of the currencies listed here is selling at a 3-month forward premium or discount against the

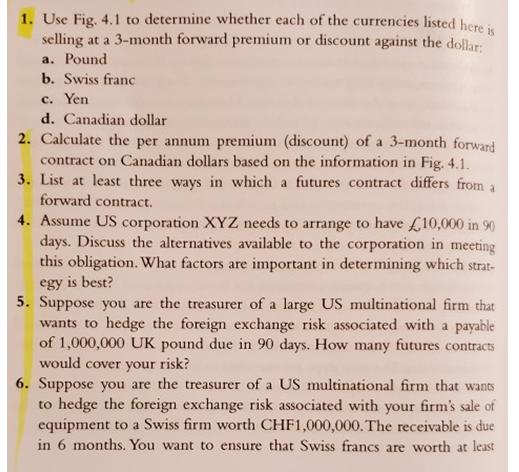

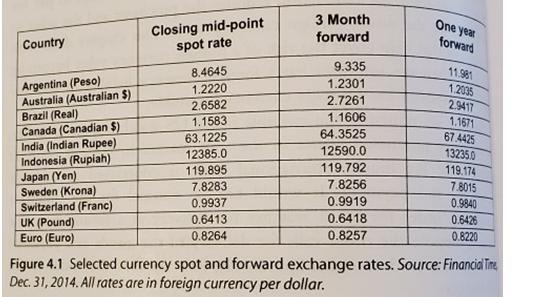

1. Use Fig. 4.1 to determine whether each of the currencies listed here is selling at a 3-month forward premium or discount against the dollar: a. Pound b. Swiss franc c. Yen d. Canadian dollar 2. Calculate the per annum premium (discount) of a 3-month forward contract on Canadian dollars based on the information in Fig. 4.1. 3. List at least three ways in which a futures contract differs from a forward contract. 4. Assume US corporation XYZ needs to arrange to have 10,000 in 90 days. Discuss the alternatives available to the corporation in meeting this obligation. What factors are important in determining which strat- egy is best? 5. Suppose you are the treasurer of a large US multinational firm that wants to hedge the foreign exchange risk associated with a payable of 1,000,000 UK pound due in 90 days. How many futures contracts would cover your risk? 6. Suppose you are the treasurer of a US multinational firm that wants to hedge the foreign exchange risk associated with your firm's sale of equipment to a Swiss firm worth CHF1,000,000. The receivable is due in 6 months. You want to ensure that Swiss francs are worth at least Forward-Looking Market Instruments 103 $0.90 when the francs are received so you want a strike price of $0.90. How many options contracts do you need to hedge this risk? Do you want a call or put on Swiss francs? What has to happen to the spot rate in 6 months for you to let the option expire? Country Argentina (Peso) Australia (Australian $) Brazil (Real) Canada (Canadian $) India (Indian Rupee) Indonesia (Rupiah) Japan (Yen) Sweden (Krona) Switzerland (Franc) UK (Pound) Euro (Euro) Closing mid-point spot rate 8.4645 1.2220 2.6582 1.1583 63.1225 12385.0 119.895 7.8283 0.9937 0.6413 0.8264 3 Month forward 9.335 1.2301 2.7261 1.1606 64.3525 12590.0 119.792 7.8256 0.9919 0.6418 0.8257 One year forward 11.981 1.2035 2.9417 1.1671 67.4425 13235.0 119.174 7.8015 0.9840 0.6426 0.8220 Figure 4.1 Selected currency spot and forward exchange rates. Source: Financial Time Dec. 31, 2014. All rates are in foreign currency per dollar.

Step by Step Solution

3.47 Rating (154 Votes )

There are 3 Steps involved in it

One thing here to note is For example 1 US dollar70 INR means with ... View full answer

Get step-by-step solutions from verified subject matter experts