Question: Accounting for Inventory Transactions with Purchase Commitments During 2020, Moss Company signed a contract with a supplier to purchase 30,000 subassemblies at $30 each during

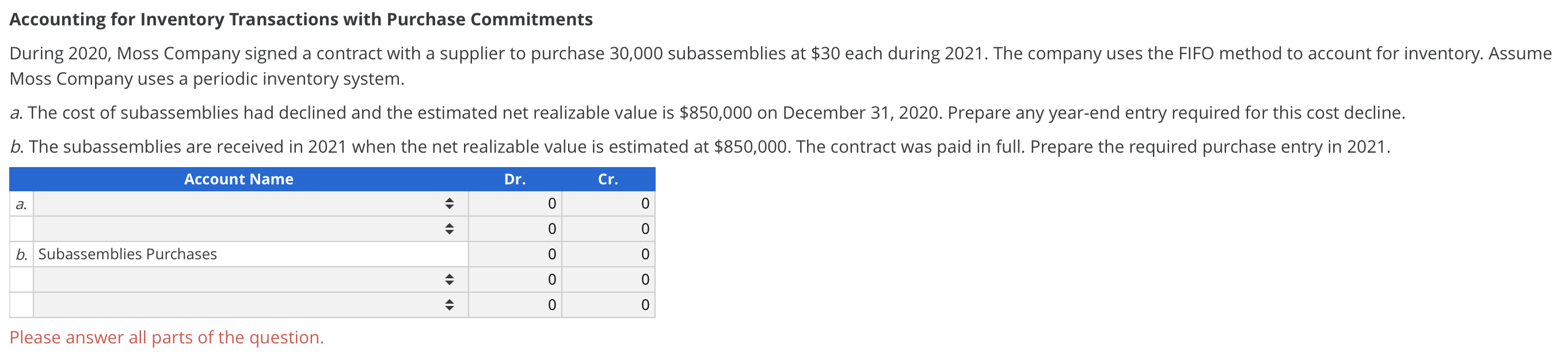

Accounting for Inventory Transactions with Purchase Commitments During 2020, Moss Company signed a contract with a supplier to purchase 30,000 subassemblies at $30 each during 2021. The company uses the FIFO method to account for inventory. Assume Moss Company uses a periodic inventory system. a. The cost of subassemblies had declined and the estimated net realizable value is $850,000 on December 31, 2020. Prepare any year-end entry required for this cost decline. b. The subassemblies are received in 2021 when the net realizable value is estimated at $850,000. The contract was paid in full. Prepare the required purchase entry in 2021. Account Name Dr. Cr. a. 0 0 A 0 0 b. Subassemblies Purchases 0 0 0 0 0 0 Please answer all parts of the

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts