Question: Accounting for Inventory Transactions with Purchase Commitments During 2020, Moss Company signed a contract with a supplier to purchase 30,000 subassemblies at $30 each during

Accounting for Inventory Transactions with Purchase Commitments

During 2020, Moss Company signed a contract with a supplier to purchase 30,000 subassemblies at $30 each during 2021. The company uses the FIFO method to account for inventory. Assume Moss Company uses a periodic inventory system.

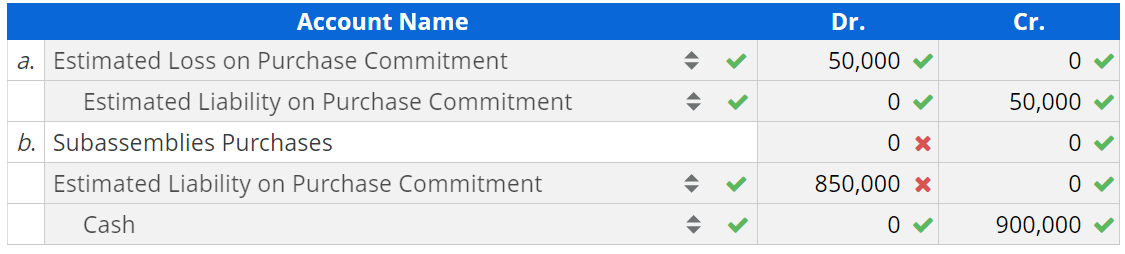

a. The cost of subassemblies had declined and the estimated net realizable value is $850,000 on December 31, 2020. Prepare any year-end entry required for this cost decline.

b. The subassemblies are received in 2021 when the net realizable value is estimated at $850,000. The contract was paid in full. Prepare the required purchase entry in 2021.

Account Name Dr. Cr. a. Estimated Loss on Purchase Commitment 50,000 0 > 0 50,000 0 x 0 Estimated Liability on Purchase Commitment b. Subassemblies Purchases Estimated Liability on Purchase Commitment Cash 0 850,000 x 0 900,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts