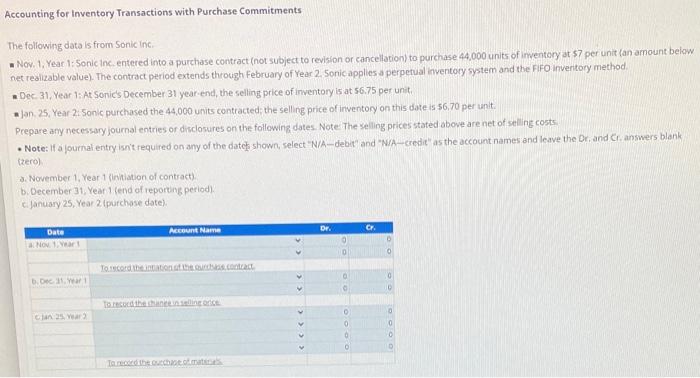

Question: Accounting for Inventory Transactions with Purchase Commitments The following data is from Sonic inic. - Nav. 1. Year 1: Sonic ink, entered into a purchase

Accounting for Inventory Transactions with Purchase Commitments The following data is from Sonic inic. - Nav. 1. Year 1: Sonic ink, entered into a purchase contract (not subject to revision or cancellation) to purchase 44,000 units of inventory at 57 per unit (an amount below net reaizable value). The contract period extends through February of Year 2. Sonic applies a perpetual inventory system and the FiFo invertory method. - Dec 31, Year 1: At Sonic's December 31 year-end, the selling price of inventory is at 56.75 per unit. - Jan. 25, Year 2: 5onic purchased the 44,000 units contracted; the selling price of inventory on this date is 56,70 per unit: Prepare any necessary journal entries of disclosures on the following dates Note The selling prices stated above are net of sellilig costs - Note: if a journal entry isn't required on any of the date shown, select "N/A-debit" and "N/A-credit" as the account names and leave the Dr, and Cr. answers blank. (zero) d. November 1, Year 1 (initiation of contract). b. December 31, Year 1 (end of reporting period). c. january 25, Year 2 (parchase date)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts