Question: Accounting for Inventory Transactions with Purchase Commitments The following data is from Sonic Inc. Nov. 1, Year 1: Sonic Inc. entered into a purchase

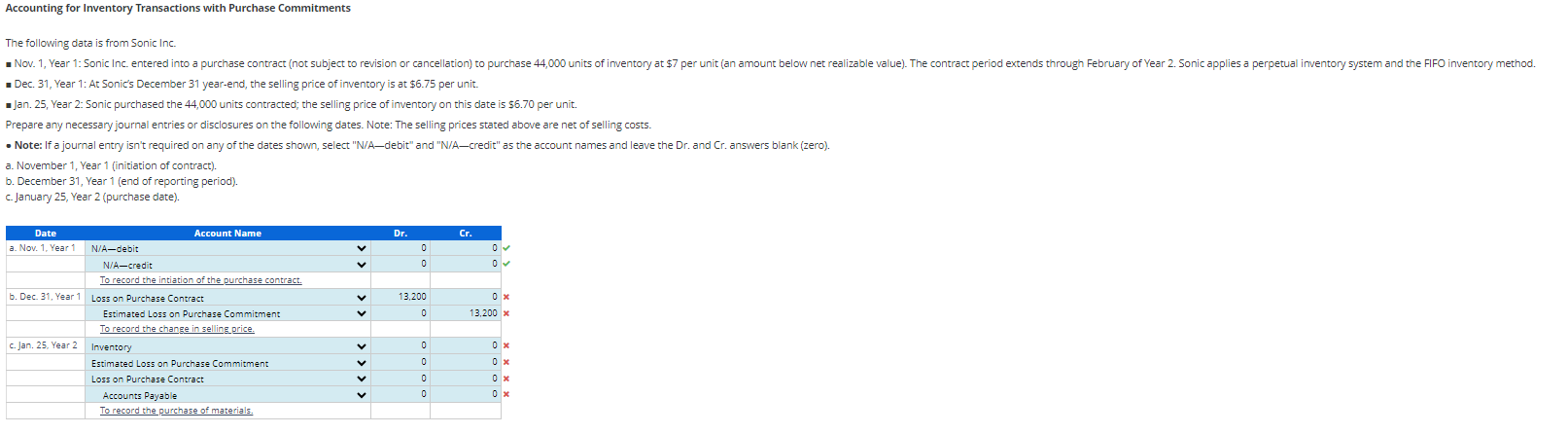

Accounting for Inventory Transactions with Purchase Commitments The following data is from Sonic Inc. Nov. 1, Year 1: Sonic Inc. entered into a purchase contract (not subject to revision or cancellation) to purchase 44,000 units of inventory at $7 per unit (an amount below net realizable value). The contract period extends through February of Year 2. Sonic applies a perpetual inventory system and the FIFO inventory method. Dec. 31, Year 1: At Sonic's December 31 year-end, the selling price of inventory is at $6.75 per unit. Jan. 25, Year 2: Sonic purchased the 44,000 units contracted; the selling price of inventory on this date is $6.70 per unit. Prepare any necessary journal entries or disclosures on the following dates. Note: The selling prices stated above are net of selling costs. Note: If a journal entry isn't required on any of the dates shown, select "N/Adebit" and "N/A-credit" as the account names and leave the Dr. and Cr. answers blank (zero). a. November 1, Year 1 (initiation of contract). b. December 31, Year 1 (end of reporting period). c. January 25, Year 2 (purchase date). Date a. Nov. 1, Year 1 N/A-debit Account Name N/A-credit To record the intiation of the purchase contract. b. Dec. 31, Year 1 Loss on Purchase Contract c. Jan. 25, Year 2 Estimated Loss on Purchase Commitment To record the change in selling price. Inventory Estimated Loss on Purchase Commitment Loss on Purchase Contract Accounts Payable To record the purchase of materials. > > > > Dr. Cr. 0 13,200 0 x 0 13,200 x 0 0x 0 0 0x

Step by Step Solution

There are 3 Steps involved in it

Answer The analysis of your breakdown is correct for most parts However theres a key point to consid... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (2 attachments)

66426f3c6aae0_980589.pdf

180 KBs PDF File

66426f3c6aae0_980589.docx

120 KBs Word File