Question: Accounting for Special Institutions - Assignment Create a contracting company in your name and suggest a 3-year contract considering the following: 1. The contract (i.e.

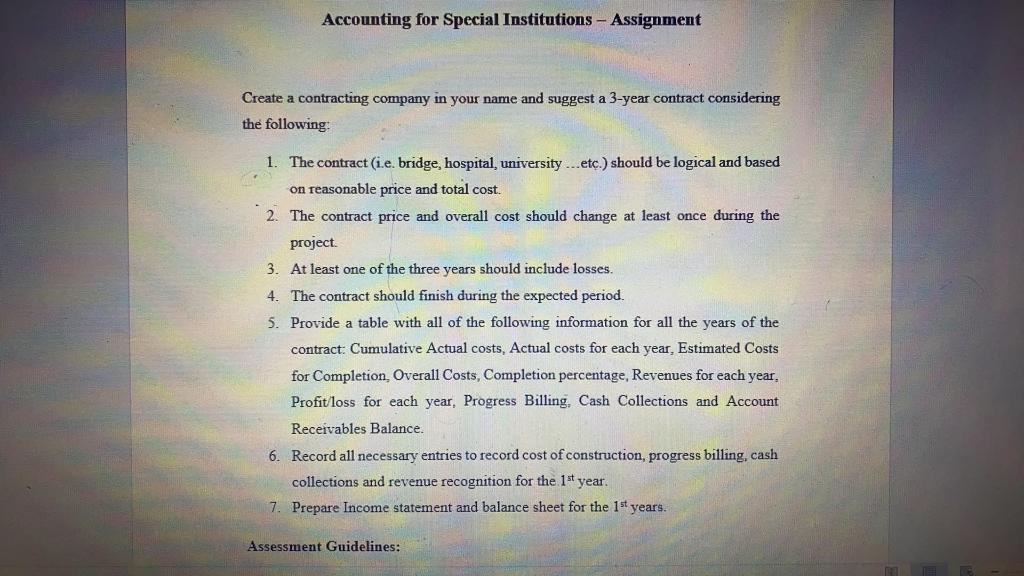

Accounting for Special Institutions - Assignment Create a contracting company in your name and suggest a 3-year contract considering the following: 1. The contract (i.e. bridge, hospital, university ...etc.) should be logical and based on reasonable price and total cost. 2. The contract price and overall cost should change at least once during the project 3. At least one of the three years should include losses. 4. The contract should finish during the expected period. 5. Provide a table with all of the following information for all the years of the contract: Cumulative Actual costs, Actual costs for each year. Estimated Costs for Completion. Overall Costs, Completion percentage, Revenues for each year, Profit/loss for each year, Progress Billing Cash Collections and Account Receivables Balance. 6. Record all necessary entries to record cost of construction, progress billing, cash collections and revenue recognition for the 1st year. 7. Prepare Income statement and balance sheet for the 1st years. Assessment Guidelines: Accounting for Special Institutions - Assignment Create a contracting company in your name and suggest a 3-year contract considering the following: 1. The contract (i.e. bridge, hospital, university ...etc.) should be logical and based on reasonable price and total cost. 2. The contract price and overall cost should change at least once during the project 3. At least one of the three years should include losses. 4. The contract should finish during the expected period. 5. Provide a table with all of the following information for all the years of the contract: Cumulative Actual costs, Actual costs for each year. Estimated Costs for Completion. Overall Costs, Completion percentage, Revenues for each year, Profit/loss for each year, Progress Billing Cash Collections and Account Receivables Balance. 6. Record all necessary entries to record cost of construction, progress billing, cash collections and revenue recognition for the 1st year. 7. Prepare Income statement and balance sheet for the 1st years. Assessment Guidelines

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts