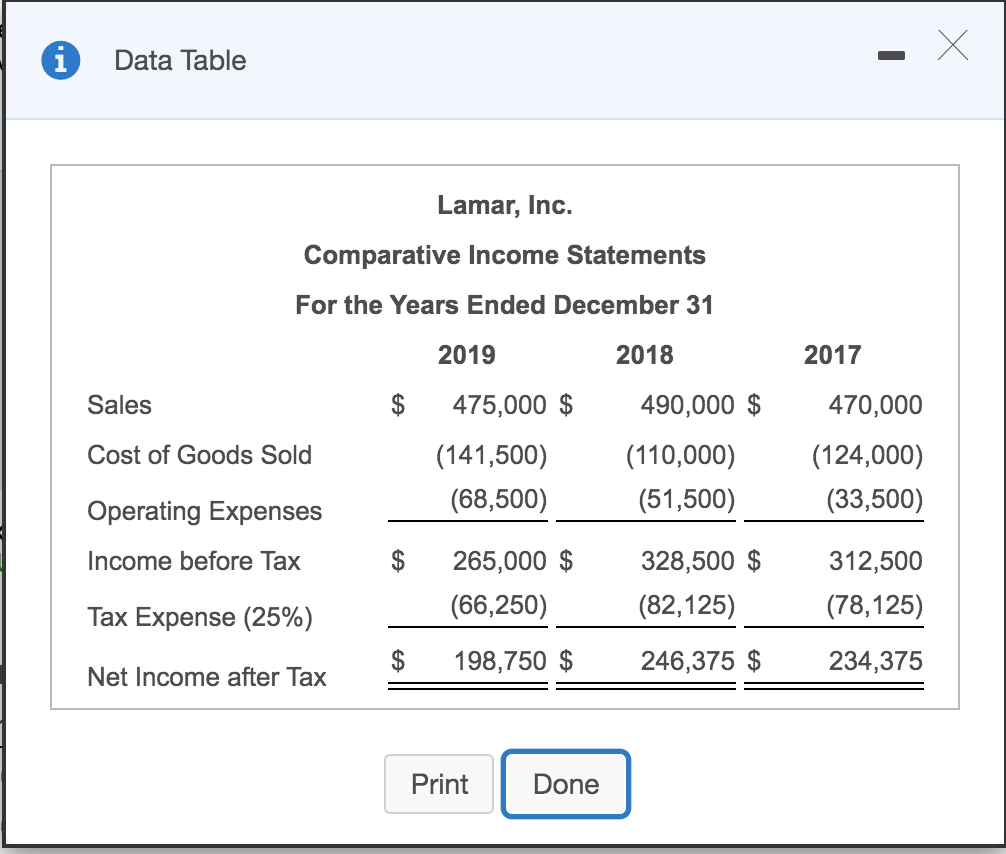

Question: Accounting help please! i Data Table Lamar, Inc. Comparative Income Statements For the Years Ended December 31 2019 2018 2017 Sales $ 475,000 $ 490,000

Accounting help please!

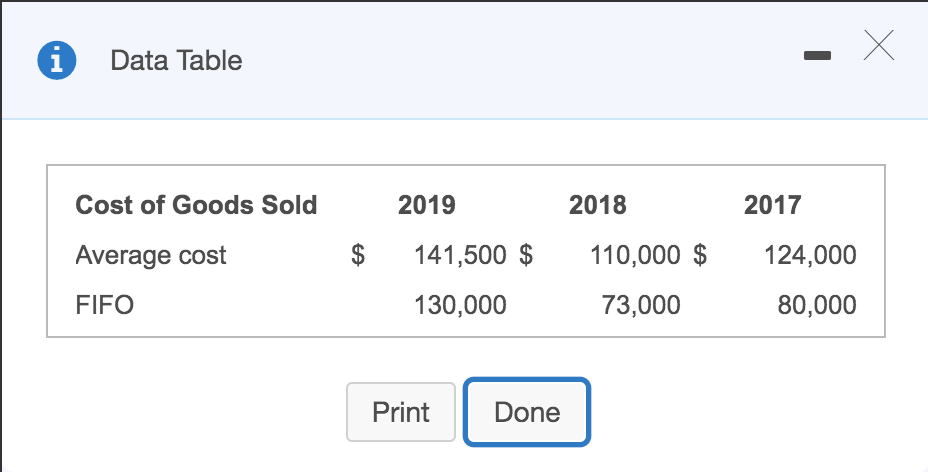

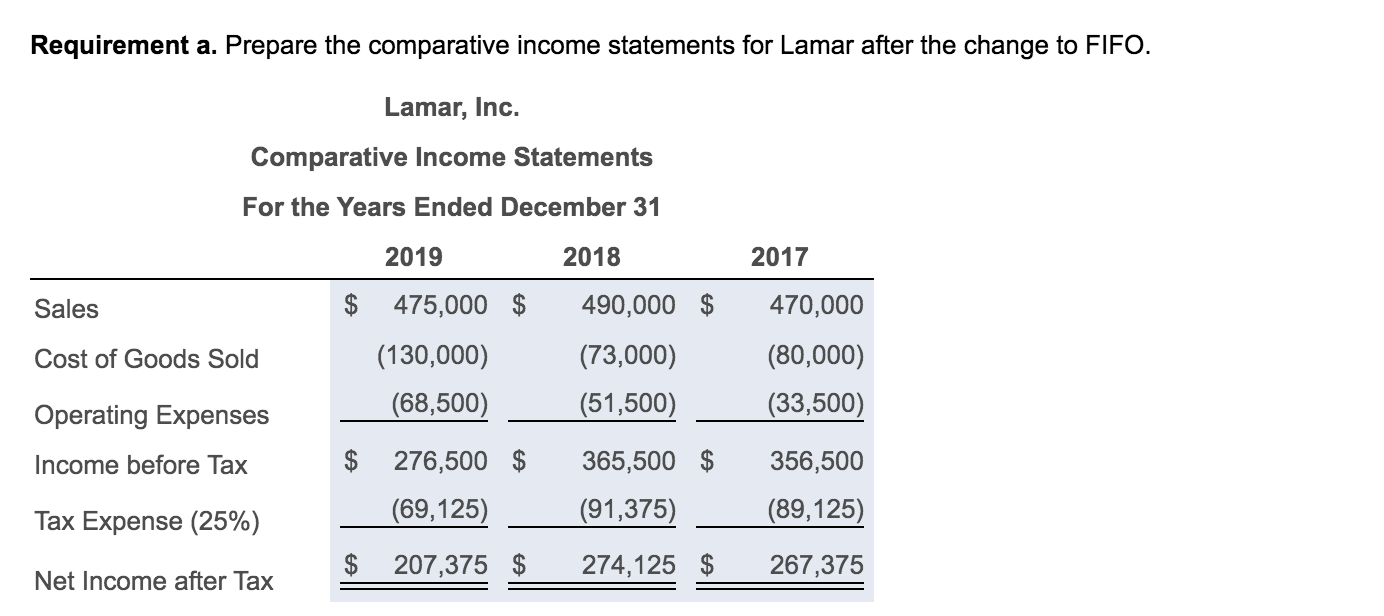

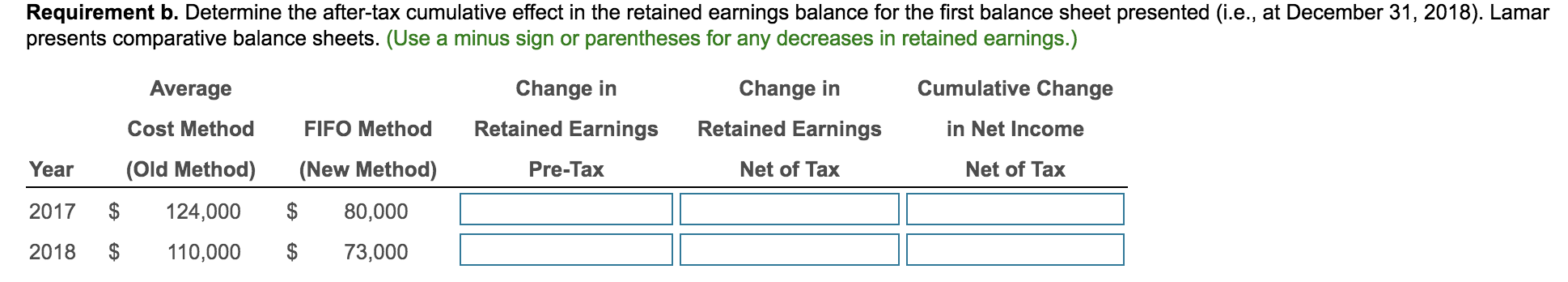

i Data Table Lamar, Inc. Comparative Income Statements For the Years Ended December 31 2019 2018 2017 Sales $ 475,000 $ 490,000 $ Cost of Goods Sold (141,500) (68,500) (110,000) (51,500) 470,000 (124,000) (33,500) Operating Expenses Income before Tax $ 265,000 $ (66,250) 328,500 $ (82,125) 312,500 (78,125) Tax Expense (25%) $ 198,750 $ 246,375 $ 234,375 Net Income after Tax Print Done 1 Data Table Cost of Goods Sold 2019 2018 2017 Average cost $ 141,500 $ 110,000 $ 124,000 FIFO 130,000 73,000 80,000 Print Done Requirement a. Prepare the comparative income statements for Lamar after the change to FIFO. Lamar, Inc. Comparative Income Statements For the Years Ended December 31 2019 2018 2017 Sales 490,000 $ Cost of Goods Sold 475,000 $ (130,000) (68,500) (73,000) (51,500) 470,000 (80,000) (33,500) Operating Expenses Income before Tax 365,500 $ 356,500 Tax Expense (25%) $ 276,500 $ (69,125) $ 207,375 $ (91,375) (89,125) 274,125 $ 267,375 Net Income after Tax Requirement b. Determine the after-tax cumulative effect in the retained earnings balance for the first balance sheet presented (i.e., at December 31, 2018). Lamar presents comparative balance sheets. (Use a minus sign or parentheses for any decreases in retained earnings.) Average Change in Cumulative Change Cost Method FIFO Method Change in Retained Earnings Pre-Tax Retained Earnings in Net Income Year (Old Method) (New Method) Net of Tax Net of Tax 2017 $ 124,000 $ 80,000 2018 $ 110,000 73,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts