Question: accounting HW Help! Problem 5-3A Computing merchandising amounts and formatting Income statements LO C2, P4 Valley Company's adjusted trial balance on August 31, 2017, its

accounting HW Help!

accounting HW Help!

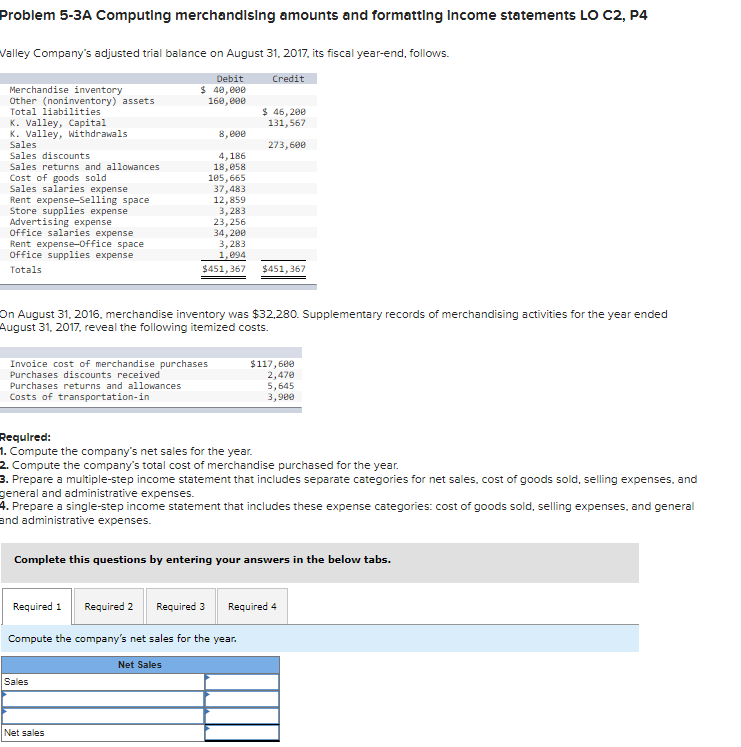

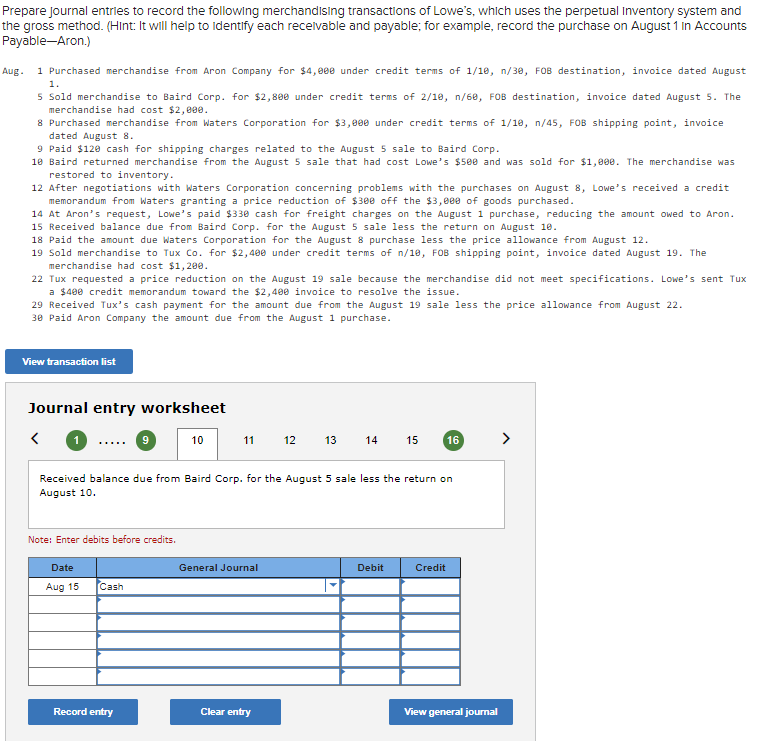

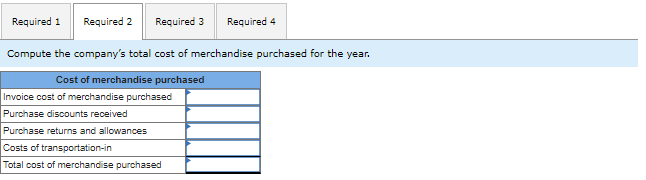

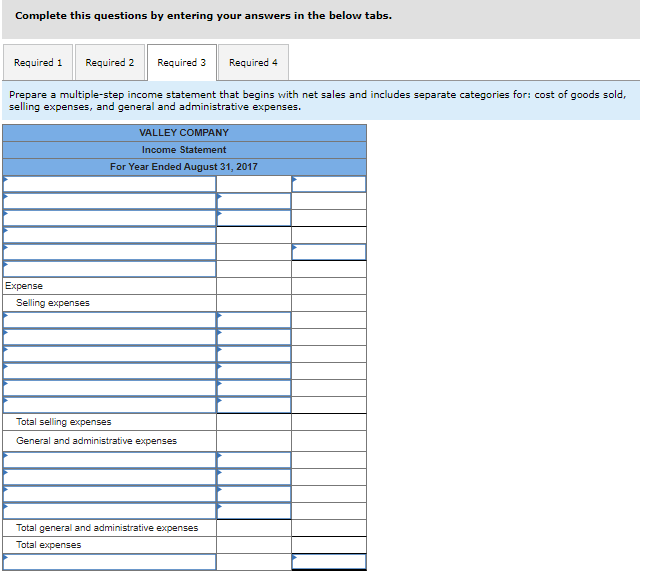

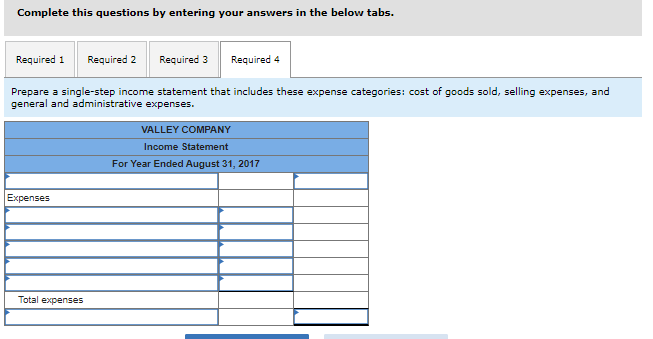

Problem 5-3A Computing merchandising amounts and formatting Income statements LO C2, P4 Valley Company's adjusted trial balance on August 31, 2017, its fiscal year-end, follows. Credit Debit $ 40, eee 160, ee $ 46,200 131,567 8,000 273,600 Merchandise inventory Other (noninventory) assets Total liabilities K. Valley, Capital K. Valley, Withdrawals Sales Sales discounts Sales returns and allowances Cost of goods sold Sales salaries expense Rent expense-Selling space Store supplies expense Advertising expense Office salaries expense Rent expense-Office space Office supplies expense Totals 4,186 18,058 105,665 37,483 12,859 3,283 23, 256 34,200 3,283 1,094 $451, 367 $451,367 On August 31, 2016. merchandise inventory was $32.280. Supplementary records of merchandising activities for the year ended August 31, 2017 reveal the following itemized costs. Invoice cost of merchandise purchases Purchases discounts received Purchases returns and allowances Costs of transportation-in $117,600 2,470 5,645 3,980 Required: 1. Compute the company's net sales for the year. 2. Compute the company's total cost of merchandise purchased for the year. 3. Prepare a multiple-step income statement that includes separate categories for net sales, cost of goods sold, selling expenses, and general and administrative expenses. 4. Prepare a single-step income statement that includes these expense categories: cost of goods sold, selling expenses, and general and administrative expenses. Complete this questions by entering your answers in the below tabs. Required 1 Required 2 Required 3 Required 4 Compute the company's net sales for the year. Net Sales Sales Net sales Prepare Journal entries to record the following merchandising transactions of Lowe's, which uses the perpetual Inventory system and the gross method. (Hint: It will help to identify each receivable and payable; for example, record the purchase on August 1 in Accounts Payable-Aron.) Aug. 1 Purchased merchandise from Aron Company for $4,00e under credit terms of 1/10, n/30, FOB destination, invoice dated August 1. 5 Sold merchandise to Baird Corp. for $2,800 under credit terms of 2/10, n/60, FOB destination, invoice dated August 5. The merchandise had cost $2,000. 8 Purchased merchandise from Waters Corporation for $3,000 under credit terms of 1/10, n/45, FOB shipping point, invoice dated August 8. 9 Paid $120 cash for shipping charges related to the August 5 sale to Baird Corp. 10 Baird returned merchandise from the August 5 sale that had cost Lowe's $500 and was sold for $1,8ee. The merchandise was restored to inventory. 12 After negotiations with waters Corporation concerning problems with the purchases on August 8, Lowe's received a credit memorandum from Waters granting a price reduction of $300 off the $3,000 of goods purchased. 14 At Aron's request, Lowe's paid $330 cash for freight charges on the August 1 purchase, reducing the amount owed to Aron. 15 Received balance due from Baird Corp. for the August 5 sale less the return on August 10. 18 Paid the amount due Waters Corporation for the August 8 purchase less the price allowance from August 12. 19 Sold merchandise to Tux Co. for $2,400 under credit terms of n/18, FOB shipping point, invoice dated August 19. The merchandise had cost $1,200. 22 Tux requested a price reduction on the August 19 sale because the merchandise did not meet specifications. Lowe's sent Tux a $400 credit memorandum toward the $2,400 invoice to resolve the issue. 29 Received Tux's cash payment for the amount due from the August 19 sale less the price allowance from August 22. 30 Paid Aron Company the amount due from the August 1 purchase. View transaction list Journal entry worksheet 9 10 11 12 13 14 15 16 Received balance due from Baird Corp. for the August 5 sale less the return on August 10. Note: Enter debits before credits Date General Journal Debit Credit Aug 15 Cash Record entry Clear entry View general journal Required 1 Required 2 Required 3 Required 4 Compute the company's total cost of merchandise purchased for the year. Cost of merchandise purchased Invoice cost of merchandise purchased Purchase discounts received Purchase returns and allowances Costs of transportation-in Total cost of merchandise purchased Complete this questions by entering your answers in the below tabs. Required 1 Required 2 Required 3 Required 4 Prepare a multiple-step income statement that begins with net sales and includes separate categories for: cost of goods sold, selling expenses, and general and administrative expenses. VALLEY COMPANY Income Statement For Year Ended August 31, 2017 Expense Selling expenses Total selling expenses General and administrative expenses Total general and administrative expenses Total expenses Complete this questions by entering your answers in the below tabs. Required 1 Required 2 Required 3 Required 4 Prepare a single-step income statement that includes these expense categories: cost of goods sold, selling expenses, and general and administrative expenses. VALLEY COMPANY Income Statement For Year Ended August 31, 2017 Expenses Total expenses

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts