Question: On January 1, 2018, Trueblood, Inc. purchased a piece of machinery for use in operations. The total acquisition cost was $33,000. The machine has

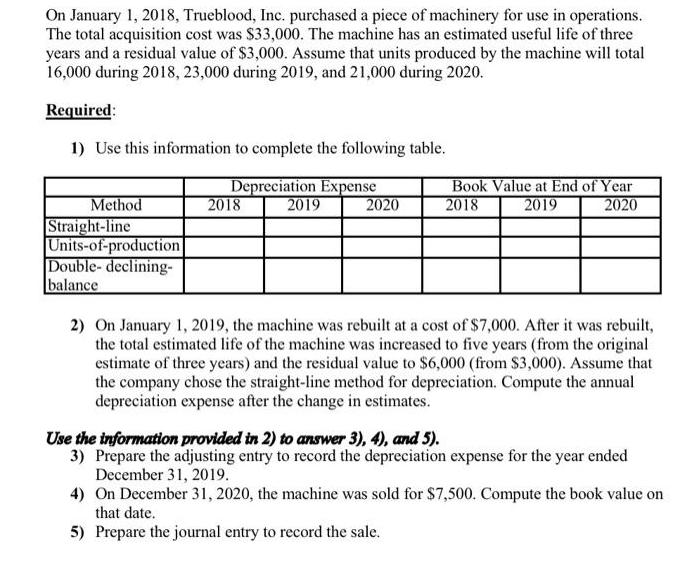

On January 1, 2018, Trueblood, Inc. purchased a piece of machinery for use in operations. The total acquisition cost was $33,000. The machine has an estimated useful life of three years and a residual value of $3,000. Assume that units produced by the machine will total 16,000 during 2018, 23,000 during 2019, and 21,000 during 2020. Required: 1) Use this information to complete the following table. Depreciation Expense 2019 Method Straight-line Units-of-production Double-declining- balance 2018 2020 Book Value at End of Year 2018 2019 2020 2) On January 1, 2019, the machine was rebuilt at a cost of $7,000. After it was rebuilt, the total estimated life of the machine was increased to five years (from the original estimate of three years) and the residual value to $6,000 (from $3,000). Assume that the company chose the straight-line method for depreciation. Compute the annual depreciation expense after the change in estimates. Use the information provided in 2) to answer 3), 4), and 5). 3) Prepare the adjusting entry to record the depreciation expense for the year ended December 31, 2019. 4) On December 31, 2020, the machine was sold for $7,500. Compute the book value on that date. 5) Prepare the journal entry to record the sale.

Step by Step Solution

There are 3 Steps involved in it

Based on the provided information lets calculate the depreciation for each method and complete the table accordingly We will also perform the calculations required for parts 2 to 5 The initial cost of ... View full answer

Get step-by-step solutions from verified subject matter experts