Question: r In this Weekly Assignment, you are asked to apply the free cash flow valuation model to calculate the intrinsic price of Nike. On Canvas

r

r

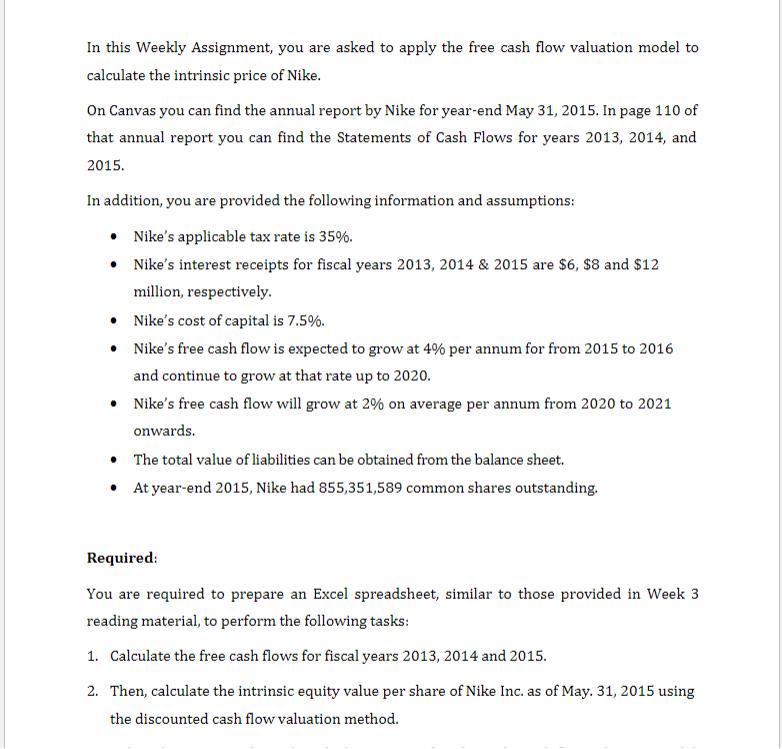

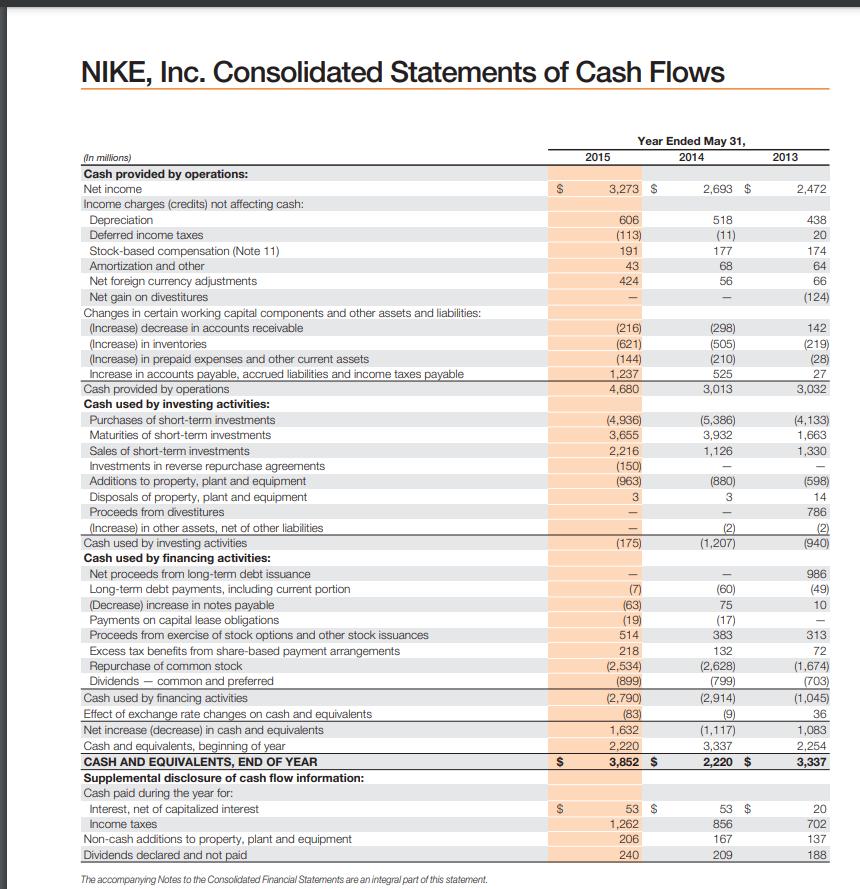

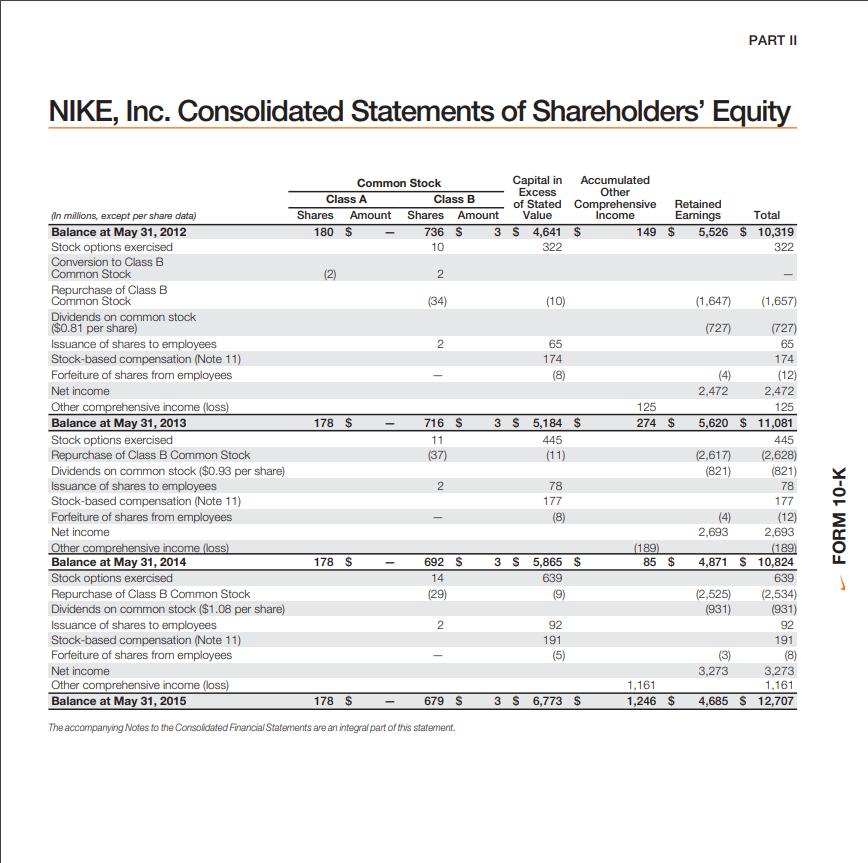

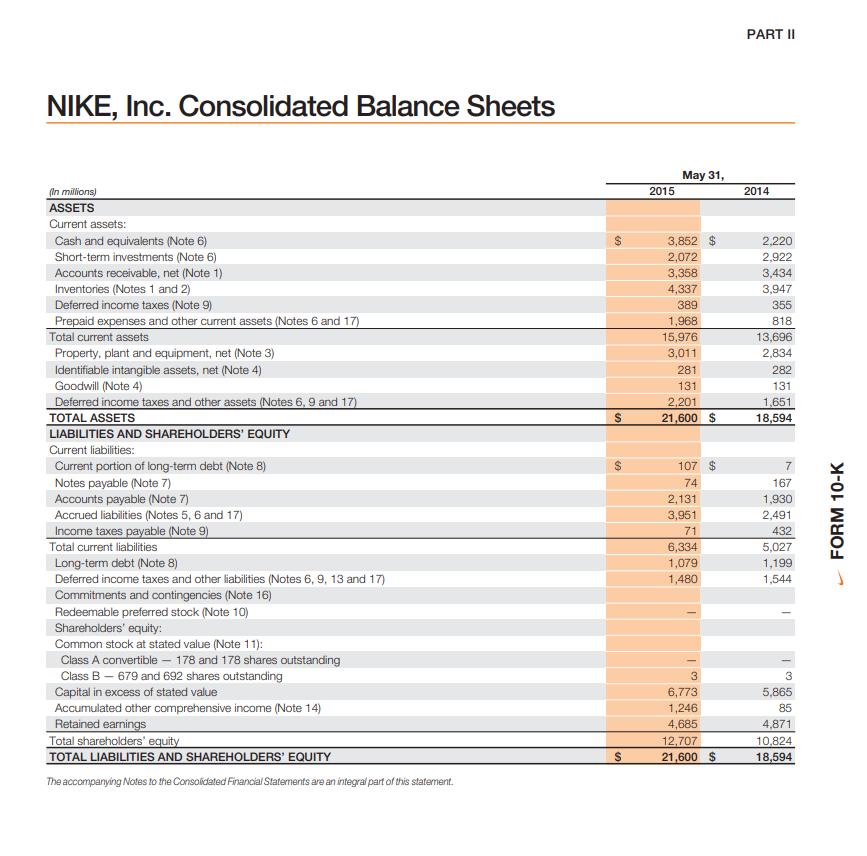

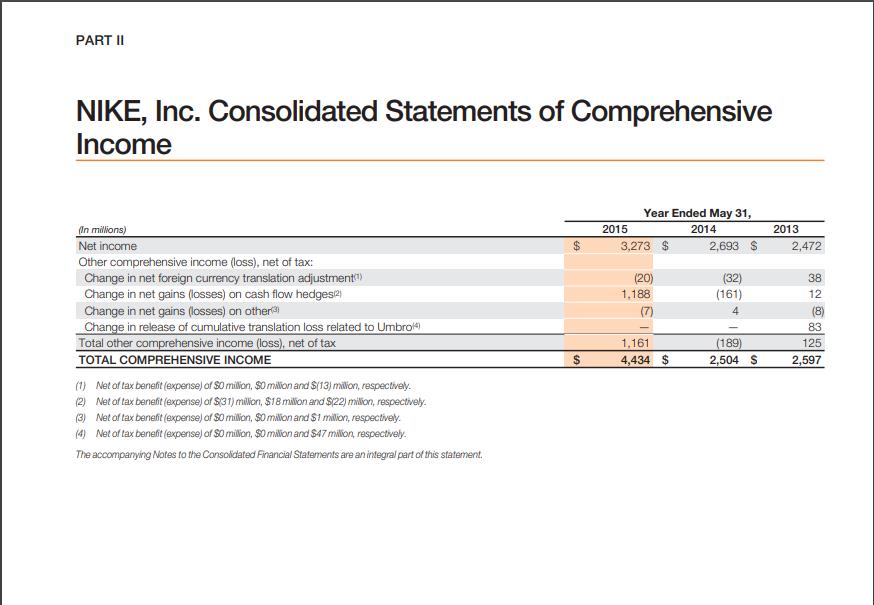

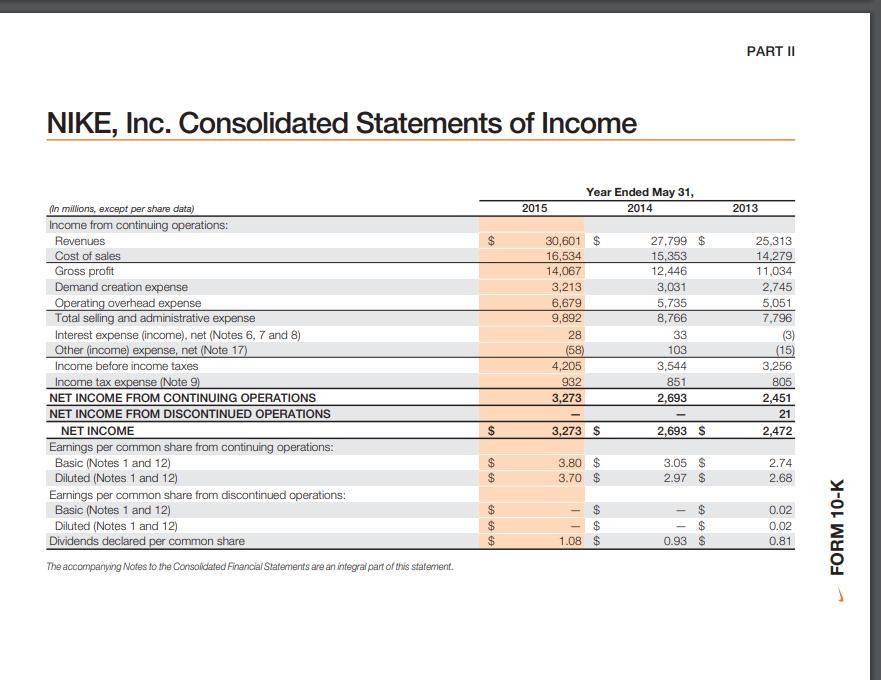

In this Weekly Assignment, you are asked to apply the free cash flow valuation model to calculate the intrinsic price of Nike. On Canvas you can find the annual report by Nike for year-end May 31, 2015. In page 110 of that annual report you can find the Statements of Cash Flows for years 2013, 2014, and 2015. In addition, you are provided the following information and assumptions: Nike's applicable tax rate is 35%. Nike's interest receipts for fiscal years 2013, 2014 & 2015 are $6, $8 and $12 million, respectively. Nike's cost of capital is 7.5%. Nike's free cash flow is expected to grow at 4% per annum for from 2015 to 2016 and continue to grow at that rate up to 2020. Nike's free cash flow will grow at 2% on average per annum from 2020 to 2021 onwards. The total value of liabilities can be obtained from the balance sheet. At year-end 2015, Nike had 855,351,589 common shares outstanding. Required: You are required to prepare an Excel spreadsheet, similar to those provided in Week 3 reading material, to perform the following tasks: 1. Calculate the free cash flows for fiscal years 2013, 2014 and 2015. 2. Then, calculate the intrinsic equity value per share of Nike Inc. as of May. 31, 2015 using the discounted cash flow valuation method.

Step by Step Solution

3.50 Rating (157 Votes )

There are 3 Steps involved in it

Free cash flow can be calculated using the cash flow statement as follows Free ca... View full answer

Get step-by-step solutions from verified subject matter experts