The Fashion Rack has a monthly accounting period. All transactions are recorded in a general journal....

Fantastic news! We've Found the answer you've been seeking!

Question:

Transcribed Image Text:

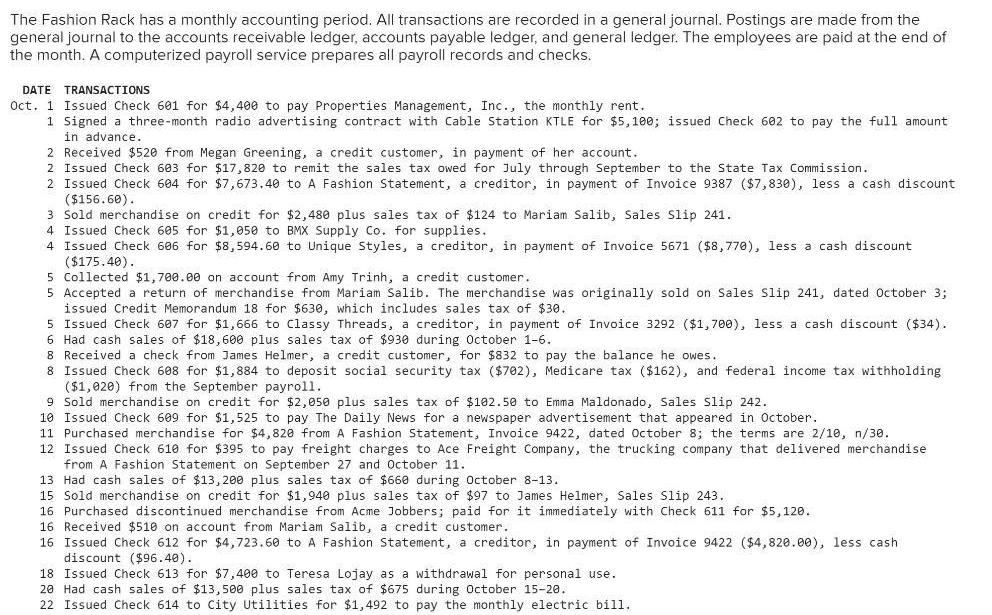

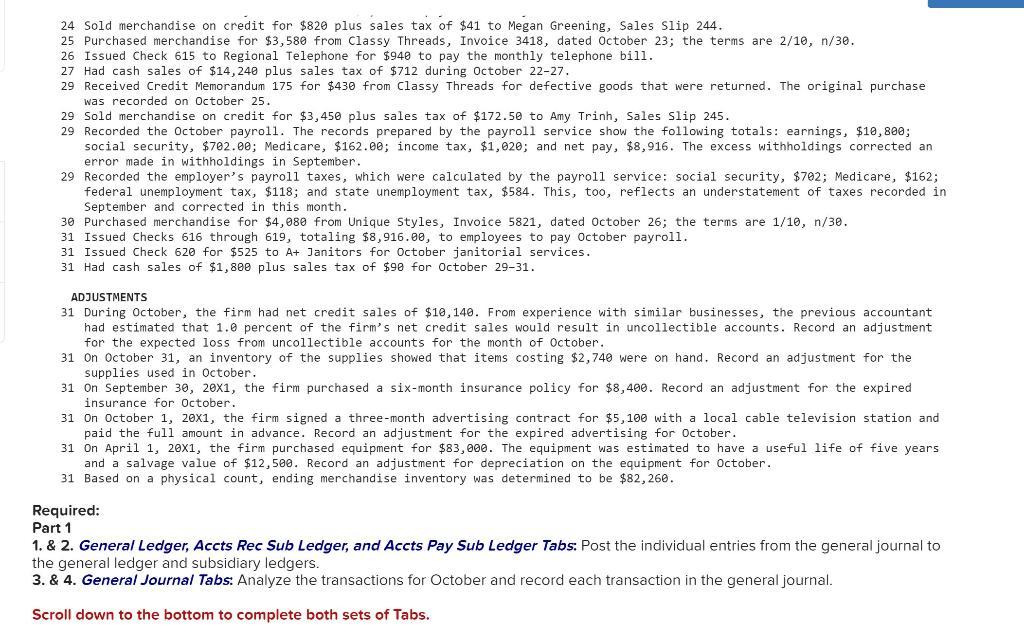

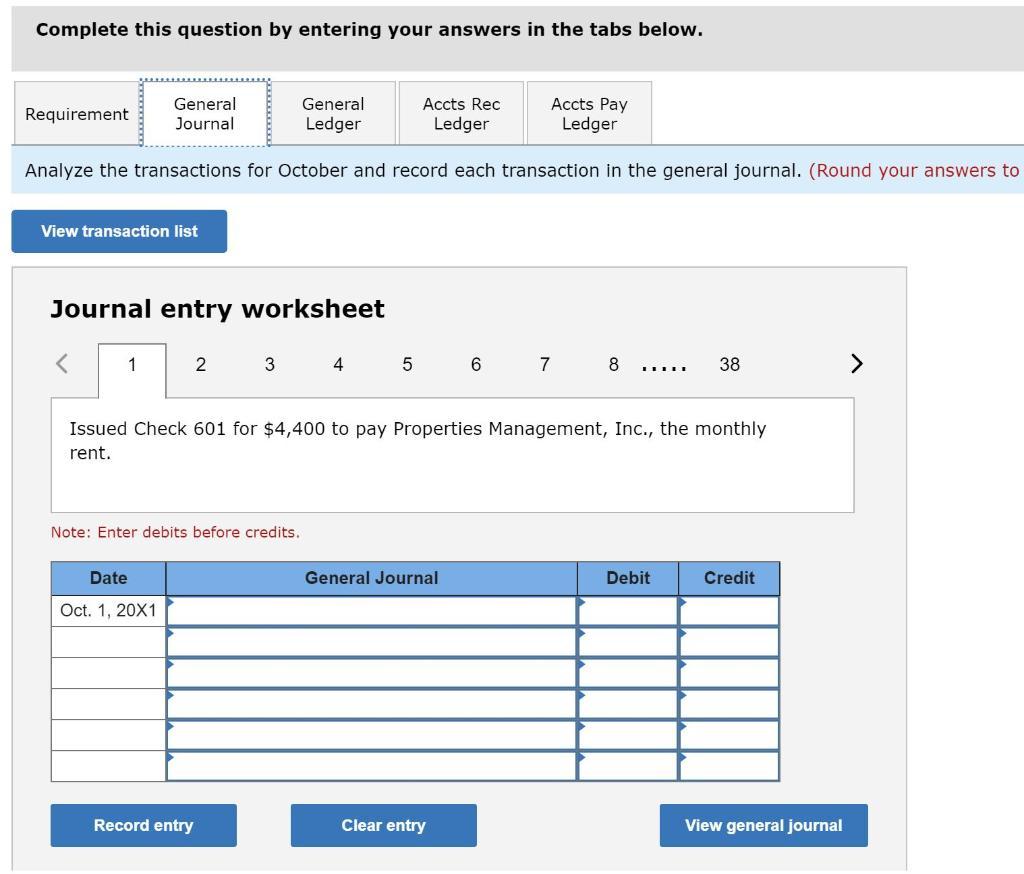

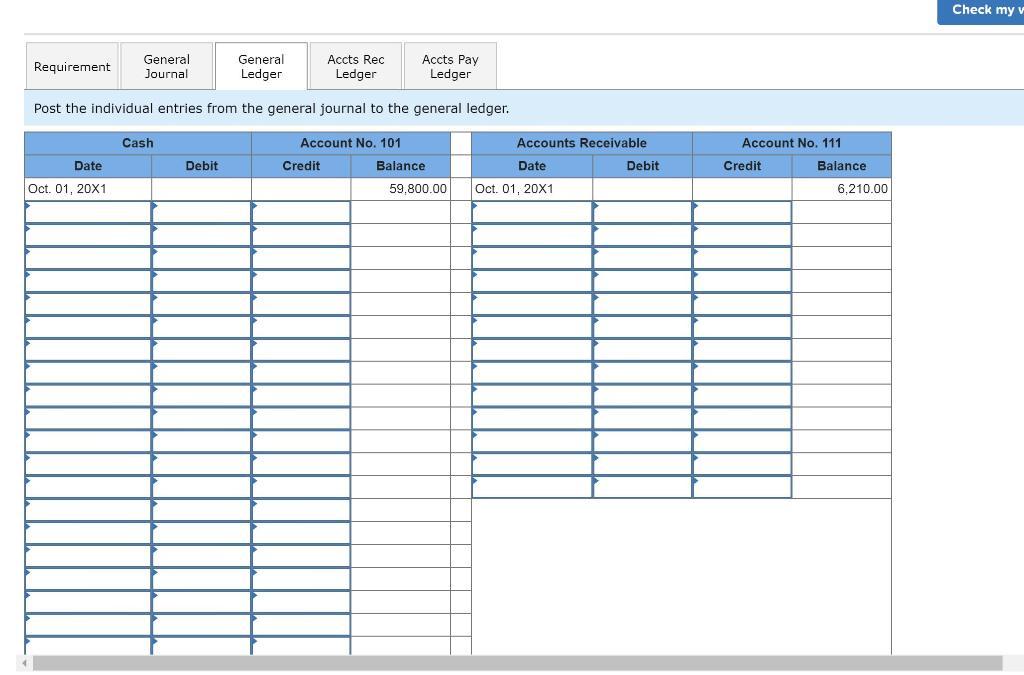

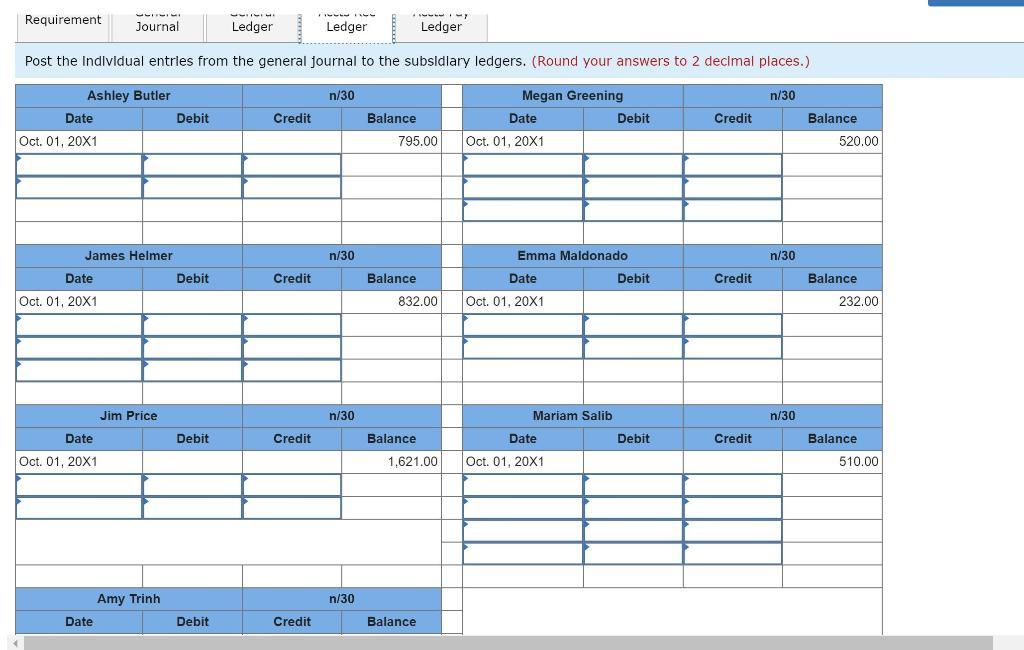

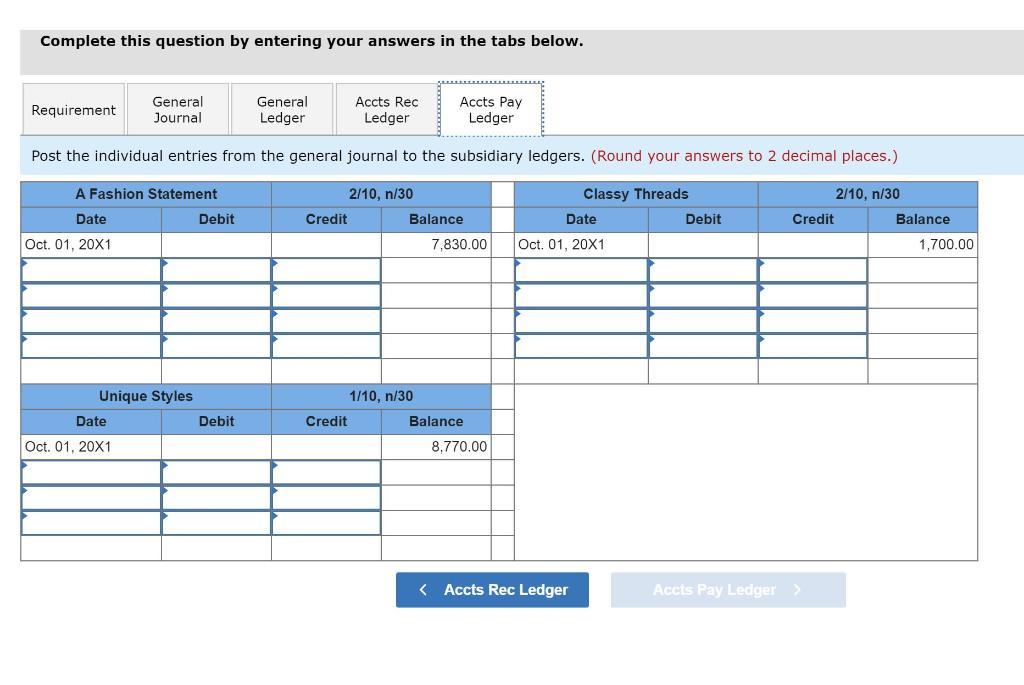

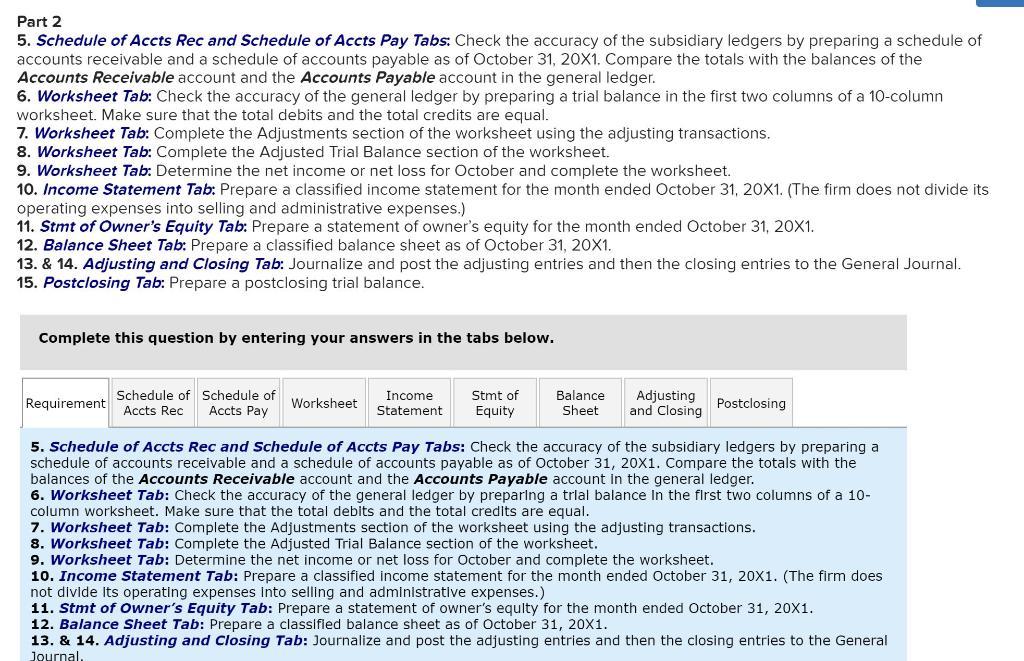

The Fashion Rack has a monthly accounting period. All transactions are recorded in a general journal. Postings are made from the general journal to the accounts receivable ledger, accounts payable ledger, and general ledger. The employees are paid at the end of the month. A computerized payroll service prepares all payroll records and checks. DATE TRANSACTIONS Oct. 1 Issued Check 601 for $4,400 to pay Properties Management, Inc., the monthly rent. 1 Signed a three-month radio advertising contract with Cable Station KTLE for $5,100; issued Check 602 to pay the full amount in advance. 2 Received $520 from Megan Greening, a credit customer, in payment of her account. 2 Issued Check 603 for $17,820 to remit the sales tax owed for July through September to the State Tax Commission. 2 Issued Check 604 for $7,673.40 to A Fashion Statement, a creditor, in payment of Invoice 9387 ($7,830), less a cash discount ($156.60). 3 Sold merchandise on credit for $2,480 plus sales tax of $124 to Mariam Salib, Sales Slip 241. 4 Issued Check 605 for $1,050 to BMX Supply Co. for supplies. 4 Issued Check 606 for $8,594.60 to Unique Styles, a creditor, in payment of Invoice 5671 ($8,770), less a cash discount ($175.40). 0. 5 Collected $1,700.00 on account from Amy Trinh, a credit customer. 5 Accepted a return of merchandise from Mariam Salib. The merchandise was originally sold on Sales Slip 241, dated October 3; issued Credit Memorandum 18 for $630, which includes sales tax of $30. T 5 Issued Check 607 for $1,666 to Classy Threads, a creditor, in payment of Invoice 3292 ($1,700), less a cash discount ($34). 6 Had cash sales of $18,600 plus sales tax of $930 during October 1-6. 8 Received a check from James Helmer, a credit customer, for $832 to pay the balance he owes. 8 Issued Check 608 for $1,884 to deposit social security tax ($702), Medicare tax ($162), and federal income tax withholding ($1,020) from the September payroll. 9 Sold merchandise credit for $2,050 plus sales tax of $102.50 to Emma Maldonado, Sales Slip 242. 10 Issued Check 609 for $1,525 pay The Daily News for a newspaper advertisement that appeared in October. 11 Purchased merchandise for $4,820 from A Fashion Statement, Invoice 9422, dated October 8; the terms are 2/10, n/30. 12 Issued Check 610 for $395 to pay freight charges to Ace Freight Company, the trucking company that delivered merchandise. from A Fashion Statement on September 27 and October 11. 13 Had cash sales of $13,200 plus sales tax of $660 during October 8-13. 15 Sold merchandise on credit for $1,940 plus sales tax of $97 to James Helmer, Sales Slip 243. S 16 Purchased discontinued merchandise from Acme Jobbers; paid for it immediately with Check 611 for $5,120. 16 Received $510 on account from Mariam Salib, a credit customer. 16 Issued Check 612 for $4,723.60 to A Fashion Statement, creditor, in payment of Invoice 9422 ($4,820.00), less cash discount ($96.40). 18 Issued Check 613 for $7,400 to Teresa Lojay as a withdrawal for personal use. 20 Had cash sales of $13,500 plus sales tax of $675 during October 15-20. 22 Issued Check 614 to City Utilities for $1,492 to pay the monthly electric bill. 24 Sold merchandise on credit for $820 plus sales tax of $41 to Megan Greening, Sales Slip 244. 25 Purchased merchandise for $3,580 from Classy Threads, Invoice 3418, dated October 23; the terms are 2/10, n/30. 26 Issued Check 615 to Regional Telephone for $940 to pay the monthly telephone bill. 27 Had cash sales of $14,240 plus sales tax of $712 during October 22-27. 29 Received Credit Memorandum 175 for $430 from Classy Threads for defective goods that were returned. The original purchase was recorded on October 25. 29 Sold merchandise on credit for $3,450 plus sales tax of $172.50 to Amy Trinh, Sales Slip 245. 29 Recorded the October payroll. The records prepared by the payroll service show the following totals: earnings, $10,800; social security, $702.00; Medicare, $162.00; income tax, $1,020; and net pay, $8,916. The excess withholdings corrected an error made in withholdings in September. 29 Recorded the employer's payroll taxes, which were calculated by the payroll service: social security, $702; Medicare, $162; federal unemployment tax, $118; and state unemployment tax, $584. This, too, reflects an understatement of taxes recorded in September and corrected in this month. 30 Purchased merchandise for $4,080 from Unique Styles, Invoice 5821, dated October 26; the terms are 1/10, n/30. 31 Issued Checks 616 through 619, totaling $8,916.00, to employees to pay October payroll. 31 Issued Check 620 for $525 to A+ Janitors for October janitorial services. 31 Had cash sales of $1,800 plus sales tax of $90 for October 29-31. ADJUSTMENTS 31 During October, the firm had net credit sales of $10,140. From experience with similar businesses, the previous accountant had estimated that 1.0 percent of the firm's net credit sales would result in uncollectible accounts. Record an adjustment for the expected loss from uncollectible accounts for the month of October. 31 On October 31, an inventory of the supplies showed that items costing $2,740 were on hand. Record an adjustment for the supplies used in October. 31 On September 30, 20x1, the firm purchased a six-month insurance policy for $8,400. Record an adjustment for the expired insurance for October. 31 On October 1, 20x1, the firm signed a three-month advertising contract for $5,100 with a local cable television station and paid the full amount in advance. Record an adjustment for the expired advertising for October. 31 On April 20x1, the firm purchased equipment for $83,000. The equipment was estimated to have a useful life of five years and a salvage value of $12,500. Record an adjustment for depreciation on the equipment for October. 31 Based on a physical count, ending merchandise inventory was determined to be $82,260. Required: Part 1 1. & 2. General Ledger, Accts Rec Sub Ledger, and Accts Pay Sub Ledger Tabs: Post the individual entries from the general journal to the general ledger and subsidiary ledgers. 3. & 4. General Journal Tabs: Analyze the transactions for October and record each transaction in the general journal. Scroll down to the bottom to complete both sets of Tabs. Complete this question by entering your answers in the tabs below. General Requirement General Ledger Accts Rec Ledger Accts Pay Ledger Journal Analyze the transactions for October and record each transaction in the general journal. (Round your answers to View transaction list Journal entry worksheet 1 2 3 4 5 6 7 8 38 > ⠀⠀E Issued Check 601 for $4,400 to pay Properties Management, Inc., the monthly rent. Note: Enter debits before credits. Date General Journal Debit Credit Oct. 1, 20X1 Clear entry View general journal Record entry General General Requirement Journal Accts Rec Ledger Accts Pay Ledger Ledger Post the individual entries from the general journal to the general ledger. Cash Account No. 101 Date Debit Balance Oct. 01, 20X1 Oct. 01, 20X1 Credit 59,800.00 Accounts Receivable Date Debit Account No. 111 Credit Balance 6,210.00 Check my w SEDILI ww - - - - - - Requirement Journal Ledger Ledger Ledger Post the Individual entries from the general journal to the subsidiary ledgers. (Round your answers to 2 decimal places.) Ashley Butler n/30 Megan Greening n/30 Date Debit Credit Date Debit Credit Balance 795.00 Oct. 01, 20X1 Oct. 01, 20X1 Credit Balance Credit Credit Credit James Helmer Date Oct. 01, 20X1 Date Oct. 01, 20X1 Date Jim Price Amy Trinh Debit Debit Debit Credit n/30 n/30 n/30 832.00 Balance 1,621.00 Balance Emma Maldonado Date Oct. 01, 20X1 Mariam Salib Date Oct. 01, 20X1 Debit Debit n/30 n/30 Balance 520.00 Balance 232.00 Balance 510.00 Complete this question by entering your answers in the tabs below. General Requirement General Journal Accts Rec Ledger Accts Pay Ledger Ledger Post the individual entries from the general journal to the subsidiary ledgers. (Round your answers to 2 decimal places.) A Fashion Statement 2/10, n/30 2/10, n/30 Classy Threads Date Date Credit Debit Credit Balance 7,830.00 Oct. 01, 20X1 Oct. 01, 20X1 Accts Pay Ledger > Unique Styles Date Oct. 01, 20X1 Debit Debit Credit 1/10, n/30 Balance 8,770.00 < Accts Rec Ledger Balance 1,700.00 Part 2 5. Schedule of Accts Rec and Schedule of Accts Pay Tabs: Check the accuracy of the subsidiary ledgers by preparing a schedule of accounts receivable and a schedule of accounts payable as October 31, 20X1. Compare the totals with the balances of the Accounts Receivable account and the Accounts Payable account in the general ledger. 6. Worksheet Tab: Check the accuracy of the general ledger by preparing a trial balance in the first two columns of a 10-column worksheet. Make sure that the total debits and the total credits are equal. 7. Worksheet Tab: Complete the Adjustments section of the worksheet using the adjusting transactions. 8. Worksheet Tab: Complete the Adjusted Trial Balance section of the worksheet. 9. Worksheet Tab: Determine the net income or net loss for October and complete the worksheet. 10. Income Statement Tab: Prepare a classified income statement for the month ended October 31, 20X1. (The firm does not divide its operating expenses into selling and administrative expenses.) 11. Stmt of Owner's Equity Tab: Prepare a statement of owner's equity for the month ended October 31, 20X1. 12. Balance Sheet Tab: Prepare a classified balance sheet as of October 31, 20X1. 13. & 14. Adjusting and Closing Tab: Journalize and post the adjusting entries and then the closing entries to the General Journal. 15. Postclosing Tab: Prepare a postclosing trial balance. Complete this question by entering your answers in the tabs below. Requirement Schedule of Schedule of Accts Rec Accts Pay Worksheet Income Statement Stmt of Equity Balance Sheet Adjusting and Closing Postclosing 5. Schedule of Accts Rec and Schedule of Accts Pay Tabs: Check the accuracy of the subsidiary ledgers by preparing a schedule of accounts receivable and a schedule of accounts payable as October 31, 20X1. Compare the totals with the balances of the Accounts Receivable account and the Accounts Payable account in the general ledger. 6. Worksheet Tab: Check the accuracy of the general ledger by preparing a trial balance in the first two columns of a 10- column worksheet. Make sure that the total debits and the total credits are equal. 7 Worksheet Tah lote the Ad iction of the 7. Worksheet Tab: Complete the Adjustments section of the worksheet using the adjusting transactions. of wor 8. Worksheet Tab: Complete the Adjusted Trial Balance section of the worksheet. haja. Tab: Determ 9. Worksheet Tab: Determine the net income or net loss for October and complete the worksheet. 10. Income Statement Tab: Prepare classified income statement for the month ended October 31, 20X1. (The firm does not divide its operating expenses into selling and administrative expenses.) 11. Stmt of Owner's Equity Tab: Prepare a statement of owner's equity for the month ended October 31, 20X1. 12. Balance Sheet Tab: Prepare a classified balance sheet as of October 31, 20X1. 13. & 14. Adjusting and Closing Tab: Journalize and post the adjusting entries and then the closing entries to the General Journal. The Fashion Rack has a monthly accounting period. All transactions are recorded in a general journal. Postings are made from the general journal to the accounts receivable ledger, accounts payable ledger, and general ledger. The employees are paid at the end of the month. A computerized payroll service prepares all payroll records and checks. DATE TRANSACTIONS Oct. 1 Issued Check 601 for $4,400 to pay Properties Management, Inc., the monthly rent. 1 Signed a three-month radio advertising contract with Cable Station KTLE for $5,100; issued Check 602 to pay the full amount in advance. 2 Received $520 from Megan Greening, a credit customer, in payment of her account. 2 Issued Check 603 for $17,820 to remit the sales tax owed for July through September to the State Tax Commission. 2 Issued Check 604 for $7,673.40 to A Fashion Statement, a creditor, in payment of Invoice 9387 ($7,830), less a cash discount ($156.60). 3 Sold merchandise on credit for $2,480 plus sales tax of $124 to Mariam Salib, Sales Slip 241. 4 Issued Check 605 for $1,050 to BMX Supply Co. for supplies. 4 Issued Check 606 for $8,594.60 to Unique Styles, a creditor, in payment of Invoice 5671 ($8,770), less a cash discount ($175.40). 0. 5 Collected $1,700.00 on account from Amy Trinh, a credit customer. 5 Accepted a return of merchandise from Mariam Salib. The merchandise was originally sold on Sales Slip 241, dated October 3; issued Credit Memorandum 18 for $630, which includes sales tax of $30. T 5 Issued Check 607 for $1,666 to Classy Threads, a creditor, in payment of Invoice 3292 ($1,700), less a cash discount ($34). 6 Had cash sales of $18,600 plus sales tax of $930 during October 1-6. 8 Received a check from James Helmer, a credit customer, for $832 to pay the balance he owes. 8 Issued Check 608 for $1,884 to deposit social security tax ($702), Medicare tax ($162), and federal income tax withholding ($1,020) from the September payroll. 9 Sold merchandise credit for $2,050 plus sales tax of $102.50 to Emma Maldonado, Sales Slip 242. 10 Issued Check 609 for $1,525 pay The Daily News for a newspaper advertisement that appeared in October. 11 Purchased merchandise for $4,820 from A Fashion Statement, Invoice 9422, dated October 8; the terms are 2/10, n/30. 12 Issued Check 610 for $395 to pay freight charges to Ace Freight Company, the trucking company that delivered merchandise. from A Fashion Statement on September 27 and October 11. 13 Had cash sales of $13,200 plus sales tax of $660 during October 8-13. 15 Sold merchandise on credit for $1,940 plus sales tax of $97 to James Helmer, Sales Slip 243. S 16 Purchased discontinued merchandise from Acme Jobbers; paid for it immediately with Check 611 for $5,120. 16 Received $510 on account from Mariam Salib, a credit customer. 16 Issued Check 612 for $4,723.60 to A Fashion Statement, creditor, in payment of Invoice 9422 ($4,820.00), less cash discount ($96.40). 18 Issued Check 613 for $7,400 to Teresa Lojay as a withdrawal for personal use. 20 Had cash sales of $13,500 plus sales tax of $675 during October 15-20. 22 Issued Check 614 to City Utilities for $1,492 to pay the monthly electric bill. 24 Sold merchandise on credit for $820 plus sales tax of $41 to Megan Greening, Sales Slip 244. 25 Purchased merchandise for $3,580 from Classy Threads, Invoice 3418, dated October 23; the terms are 2/10, n/30. 26 Issued Check 615 to Regional Telephone for $940 to pay the monthly telephone bill. 27 Had cash sales of $14,240 plus sales tax of $712 during October 22-27. 29 Received Credit Memorandum 175 for $430 from Classy Threads for defective goods that were returned. The original purchase was recorded on October 25. 29 Sold merchandise on credit for $3,450 plus sales tax of $172.50 to Amy Trinh, Sales Slip 245. 29 Recorded the October payroll. The records prepared by the payroll service show the following totals: earnings, $10,800; social security, $702.00; Medicare, $162.00; income tax, $1,020; and net pay, $8,916. The excess withholdings corrected an error made in withholdings in September. 29 Recorded the employer's payroll taxes, which were calculated by the payroll service: social security, $702; Medicare, $162; federal unemployment tax, $118; and state unemployment tax, $584. This, too, reflects an understatement of taxes recorded in September and corrected in this month. 30 Purchased merchandise for $4,080 from Unique Styles, Invoice 5821, dated October 26; the terms are 1/10, n/30. 31 Issued Checks 616 through 619, totaling $8,916.00, to employees to pay October payroll. 31 Issued Check 620 for $525 to A+ Janitors for October janitorial services. 31 Had cash sales of $1,800 plus sales tax of $90 for October 29-31. ADJUSTMENTS 31 During October, the firm had net credit sales of $10,140. From experience with similar businesses, the previous accountant had estimated that 1.0 percent of the firm's net credit sales would result in uncollectible accounts. Record an adjustment for the expected loss from uncollectible accounts for the month of October. 31 On October 31, an inventory of the supplies showed that items costing $2,740 were on hand. Record an adjustment for the supplies used in October. 31 On September 30, 20x1, the firm purchased a six-month insurance policy for $8,400. Record an adjustment for the expired insurance for October. 31 On October 1, 20x1, the firm signed a three-month advertising contract for $5,100 with a local cable television station and paid the full amount in advance. Record an adjustment for the expired advertising for October. 31 On April 20x1, the firm purchased equipment for $83,000. The equipment was estimated to have a useful life of five years and a salvage value of $12,500. Record an adjustment for depreciation on the equipment for October. 31 Based on a physical count, ending merchandise inventory was determined to be $82,260. Required: Part 1 1. & 2. General Ledger, Accts Rec Sub Ledger, and Accts Pay Sub Ledger Tabs: Post the individual entries from the general journal to the general ledger and subsidiary ledgers. 3. & 4. General Journal Tabs: Analyze the transactions for October and record each transaction in the general journal. Scroll down to the bottom to complete both sets of Tabs. Complete this question by entering your answers in the tabs below. General Requirement General Ledger Accts Rec Ledger Accts Pay Ledger Journal Analyze the transactions for October and record each transaction in the general journal. (Round your answers to View transaction list Journal entry worksheet 1 2 3 4 5 6 7 8 38 > ⠀⠀E Issued Check 601 for $4,400 to pay Properties Management, Inc., the monthly rent. Note: Enter debits before credits. Date General Journal Debit Credit Oct. 1, 20X1 Clear entry View general journal Record entry General General Requirement Journal Accts Rec Ledger Accts Pay Ledger Ledger Post the individual entries from the general journal to the general ledger. Cash Account No. 101 Date Debit Balance Oct. 01, 20X1 Oct. 01, 20X1 Credit 59,800.00 Accounts Receivable Date Debit Account No. 111 Credit Balance 6,210.00 Check my w SEDILI ww - - - - - - Requirement Journal Ledger Ledger Ledger Post the Individual entries from the general journal to the subsidiary ledgers. (Round your answers to 2 decimal places.) Ashley Butler n/30 Megan Greening n/30 Date Debit Credit Date Debit Credit Balance 795.00 Oct. 01, 20X1 Oct. 01, 20X1 Credit Balance Credit Credit Credit James Helmer Date Oct. 01, 20X1 Date Oct. 01, 20X1 Date Jim Price Amy Trinh Debit Debit Debit Credit n/30 n/30 n/30 832.00 Balance 1,621.00 Balance Emma Maldonado Date Oct. 01, 20X1 Mariam Salib Date Oct. 01, 20X1 Debit Debit n/30 n/30 Balance 520.00 Balance 232.00 Balance 510.00 Complete this question by entering your answers in the tabs below. General Requirement General Journal Accts Rec Ledger Accts Pay Ledger Ledger Post the individual entries from the general journal to the subsidiary ledgers. (Round your answers to 2 decimal places.) A Fashion Statement 2/10, n/30 2/10, n/30 Classy Threads Date Date Credit Debit Credit Balance 7,830.00 Oct. 01, 20X1 Oct. 01, 20X1 Accts Pay Ledger > Unique Styles Date Oct. 01, 20X1 Debit Debit Credit 1/10, n/30 Balance 8,770.00 < Accts Rec Ledger Balance 1,700.00 Part 2 5. Schedule of Accts Rec and Schedule of Accts Pay Tabs: Check the accuracy of the subsidiary ledgers by preparing a schedule of accounts receivable and a schedule of accounts payable as October 31, 20X1. Compare the totals with the balances of the Accounts Receivable account and the Accounts Payable account in the general ledger. 6. Worksheet Tab: Check the accuracy of the general ledger by preparing a trial balance in the first two columns of a 10-column worksheet. Make sure that the total debits and the total credits are equal. 7. Worksheet Tab: Complete the Adjustments section of the worksheet using the adjusting transactions. 8. Worksheet Tab: Complete the Adjusted Trial Balance section of the worksheet. 9. Worksheet Tab: Determine the net income or net loss for October and complete the worksheet. 10. Income Statement Tab: Prepare a classified income statement for the month ended October 31, 20X1. (The firm does not divide its operating expenses into selling and administrative expenses.) 11. Stmt of Owner's Equity Tab: Prepare a statement of owner's equity for the month ended October 31, 20X1. 12. Balance Sheet Tab: Prepare a classified balance sheet as of October 31, 20X1. 13. & 14. Adjusting and Closing Tab: Journalize and post the adjusting entries and then the closing entries to the General Journal. 15. Postclosing Tab: Prepare a postclosing trial balance. Complete this question by entering your answers in the tabs below. Requirement Schedule of Schedule of Accts Rec Accts Pay Worksheet Income Statement Stmt of Equity Balance Sheet Adjusting and Closing Postclosing 5. Schedule of Accts Rec and Schedule of Accts Pay Tabs: Check the accuracy of the subsidiary ledgers by preparing a schedule of accounts receivable and a schedule of accounts payable as October 31, 20X1. Compare the totals with the balances of the Accounts Receivable account and the Accounts Payable account in the general ledger. 6. Worksheet Tab: Check the accuracy of the general ledger by preparing a trial balance in the first two columns of a 10- column worksheet. Make sure that the total debits and the total credits are equal. 7 Worksheet Tah lote the Ad iction of the 7. Worksheet Tab: Complete the Adjustments section of the worksheet using the adjusting transactions. of wor 8. Worksheet Tab: Complete the Adjusted Trial Balance section of the worksheet. haja. Tab: Determ 9. Worksheet Tab: Determine the net income or net loss for October and complete the worksheet. 10. Income Statement Tab: Prepare classified income statement for the month ended October 31, 20X1. (The firm does not divide its operating expenses into selling and administrative expenses.) 11. Stmt of Owner's Equity Tab: Prepare a statement of owner's equity for the month ended October 31, 20X1. 12. Balance Sheet Tab: Prepare a classified balance sheet as of October 31, 20X1. 13. & 14. Adjusting and Closing Tab: Journalize and post the adjusting entries and then the closing entries to the General Journal.

Expert Answer:

Answer rating: 100% (QA)

102 Date Account title explanation 103 01Oct Rent expense 104 Cash 105 106 01Oct Prepaid Advertising ... View the full answer

Related Book For

College Accounting A Contemporary Approach

ISBN: 978-0077639730

3rd edition

Authors: David Haddock, John Price, Michael Farina

Posted Date:

Students also viewed these accounting questions

-

The Fashion Rack has a monthly accounting period. The firms chart of accounts is shown below and on the next page. The journals used to record transactions are the sales journal, purchases journal,...

-

On March 17, Dolomite Sales sold merchandise on credit for $5,800 (cost of sales $5,000). Assuming 7% PST and 5% GST, record the entries on March 17. Assume a perpetual inventory system.

-

On March 17, Dolomite Sales sold merchandise on credit for $5,800 (cost of sales $5,000). Assuming 7% PST and 5% GST, record the entry on March 17. Assume a periodic inventory system.

-

The following are comparative financial statements of the Cohen Company for 2006, 2007, and 2008: Additional information: Credit sales were 65% of net sales in 2007 and 60% in 2008. At the beginning...

-

EarthLink, Inc., is a nationwide Internet Service Provider (ISP). EarthLink provides a variety of services to its customers, including narrowband access, broadband or high-speed access, and Web...

-

In Exercises 3742, the following circle graph, which was created using with data from the website www.healthline.com, shows the percentages of Americans with the various blood types. If one American...

-

E 14-5 AcquisitionExcess allocation and amortization effect On January 1, 2016, Krab Co. Ltd. of Thailand acquires an 80 percent interest in Shin Co. Inc., a Japanese firm, for 150bn Thai baht on...

-

The Baily Hill Bicycle Shop sells mountain bikes and offers a maintenance program to its customers. The manager has found the average repair bill during the maintenance programs first year to be...

-

The overhead allocated to each cost object is calculated by multiplying the plantwide overhead rate by the _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ . A . ) number of units B . ) number of hours C . )...

-

Please write a short (limit 1000 words) essay on the United Nations Human Rights Council's 2017 report on the financialization of housing (relevant links below). You may either agree or disagree with...

-

Sales Mox and Break Even Sales Dragon Sports Inc. manufactures and sells two products, baseball bats and baseball gloves. The fixed costs are $580,000, and the sales mix is 20% bats and 80% gloves....

-

3. Given the continuous beam shown below, which span or spans should be loaded with a uniform distributed load to produce a maximum moment at support B? (5 points) SPAN 1 SPAN 2 SPAN 3 A B D 20 ft...

-

Complete the following writing assignment: Analyze the attached 10_pages. Write_about them, summarize what you read, and connect it to personal experiences. CHAPTER 8 Anxiety Disorders DAVID P....

-

As a manager of an airline company you want to learn the average weight of luggages checked in on a flight. From a sample of 1 6 luggages, you find the average to be 2 6 kg and the standard deviation...

-

What is the Manufacturing Cycle Efficiency? 11. Use High-Low to find the fixed and variable costs. Machine Month Costs Hours 12345678 $1,730,890 15,820 $1,753,860 13,980 $1,562,890 11,550 4...

-

Jimmy Padilla purchased a gravel pit in the current year for $944,232 and estimates that there will be a residual value in the land of $36,404 once resource extraction is complete. He estimates that...

-

Assume that a company purchases land for $1,000,000, paying $400,000 cash and borrowing the remainder with a long-term notes payable. How should this transaction be reported on a statement of cash...

-

What are three disadvantages of using the direct write-off method?

-

What is the fundamental accounting equation?

-

A state charges a basic SUTA tax rate of 5.4 percent. Because of an excellent experience rating, an employer in the state has to pay only 1.0 percent of the taxable payroll as state tax. What is the...

-

What is the purpose of the Medicare tax?

-

Develop a plan to establish a strong credit history. lo1

-

E 12-1 1. What is a characteristic of a forward contract? a Traded on an exchange b Negotiated with a counterparty c Covers a stream of future payments d Must be settled daily

-

E 12-4 Accounting for foreign currencydenominated purchases Zip purchased merchandise from Tas of Japan on November 1, 2016, for 10,000,000 yen, payable on December 1, 2016. The spot rate for yen on...

Study smarter with the SolutionInn App