Question: accounting multiple choice question help Question 1 (1 point) Saved Accounting work was done for a client with 30 days given for payment. Accounts Receivable

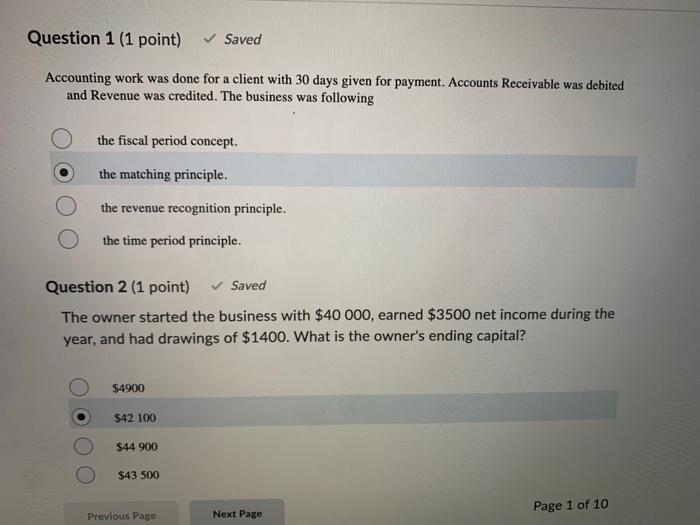

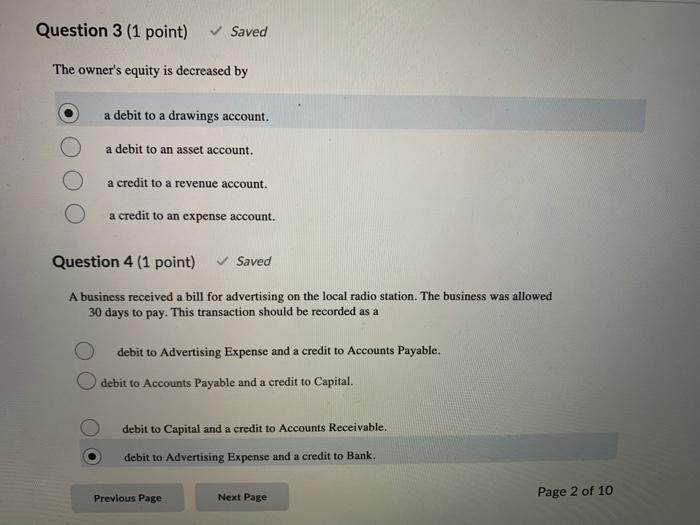

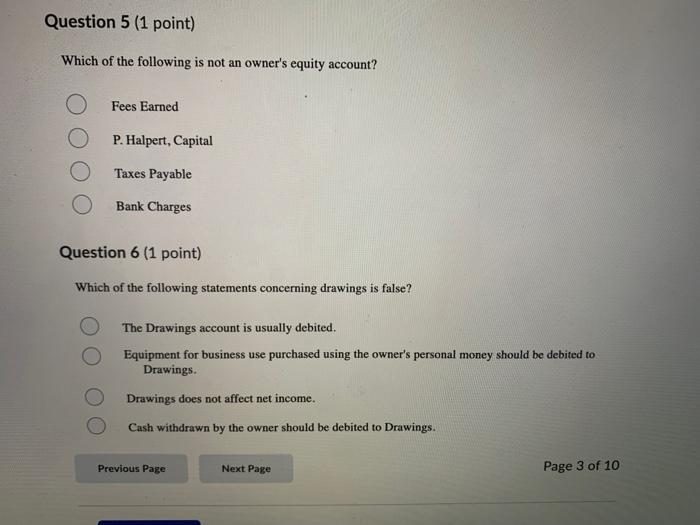

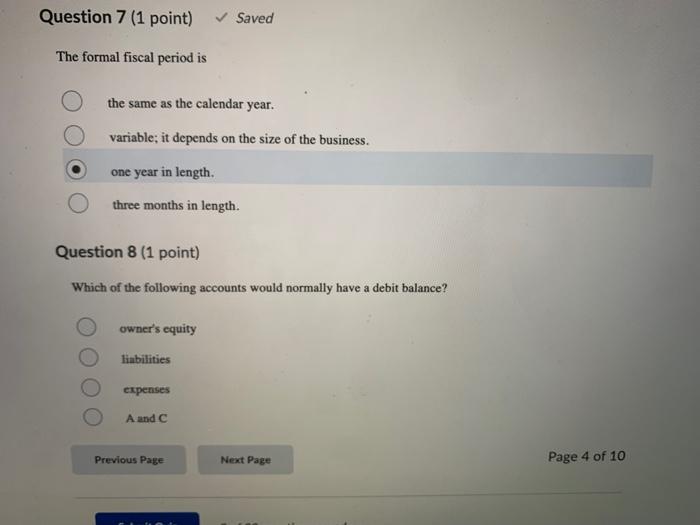

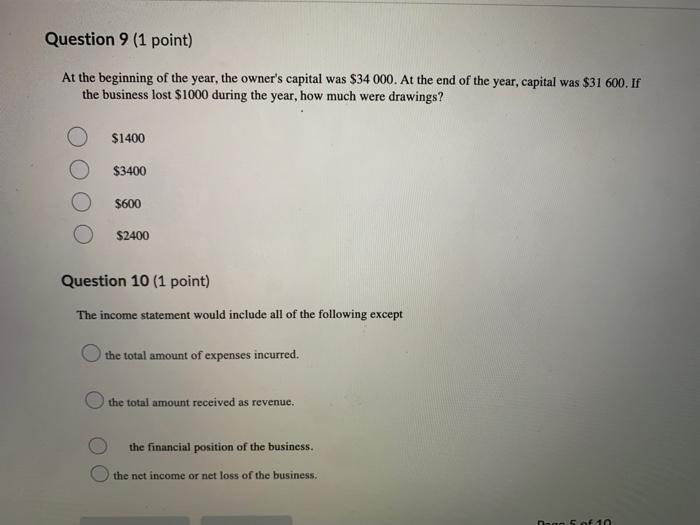

Question 1 (1 point) Saved Accounting work was done for a client with 30 days given for payment. Accounts Receivable was debited and Revenue was credited. The business was following the fiscal period concept. the matching principle. the revenue recognition principle. the time period principle. Question 2 (1 point) Saved The owner started the business with $40 000, earned $3500 net income during the year, and had drawings of $1400. What is the owner's ending capital? $4900 $42 100 $44 900 $43 500 Page 1 of 10 Previous Page Next Page Question 3 (1 point) Saved The owner's equity is decreased by a debit to a drawings account. a debit to an asset account. a credit to a revenue account. a credit to an expense account. Question 4 (1 point) Saved A business received a bill for advertising on the local radio station. The business was allowed 30 days to pay. This transaction should be recorded as a debit to Advertising Expense and a credit to Accounts Payable. debit to Accounts Payable and a credit to Capital. debit to Capital and a credit to Accounts Receivable. debit to Advertising Expense and a credit to Bank. Next Page Previous Page Page 2 of 10 Question 5 (1 point) Which of the following is not an owner's equity account? Fees Earned P. Halpert, Capital Taxes Payable Bank Charges Question 6 (1 point) Which of the following statements concerning drawings is false? The Drawings account is usually debited. Equipment for business use purchased using the owner's personal money should be debited to Drawings. Drawings does not affect net income. Cash withdrawn by the owner should be debited to Drawings. Page 3 of 10 Previous Page Next Page Question 7 (1 point) The formal fiscal period is Saved the same as the calendar year. variable; it depends on the size of the business. one year in length. three months in length. Question 8 (1 point) Which of the following accounts would normally have a debit balance? owner's equity liabilities expenses A and C Previous Page Next Page Page 4 of 10 Question 9 (1 point) At the beginning of the year, the owner's capital was $34 000. At the end of the year, capital was $31 600. If the business lost $1000 during the year, how much were drawings? $1400 $3400 $600 $2400 Question 10 (1 point) The income statement would include all of the following except the total amount of expenses incurred. the total amount received as revenue. the financial position of the business. the net income or net loss of the business. Dogo 5 of 10

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts