Question: accounting multiple choice questions help Question 11 (1 point) The accounting entry for a sales invoice is debit Accounts Receivable, credit Sales. debit Sales, credit

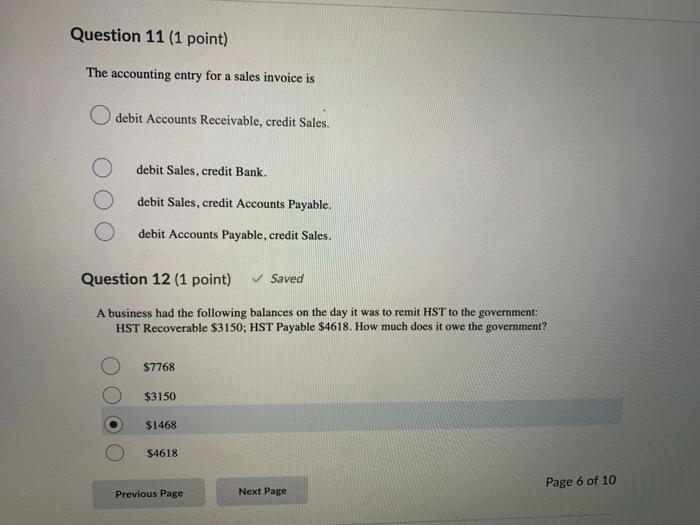

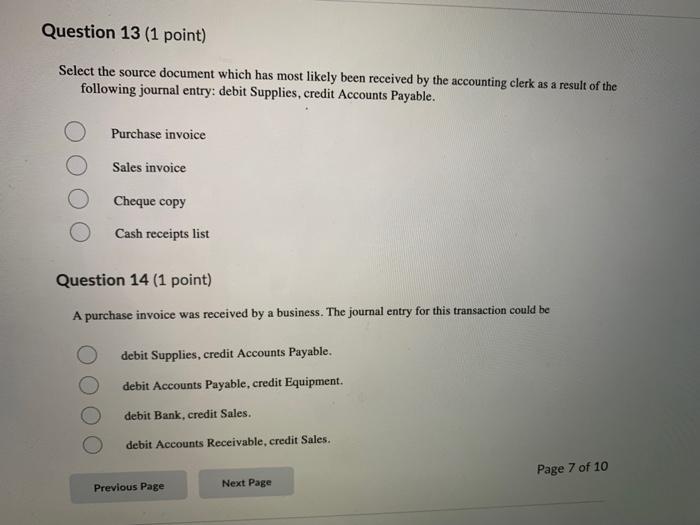

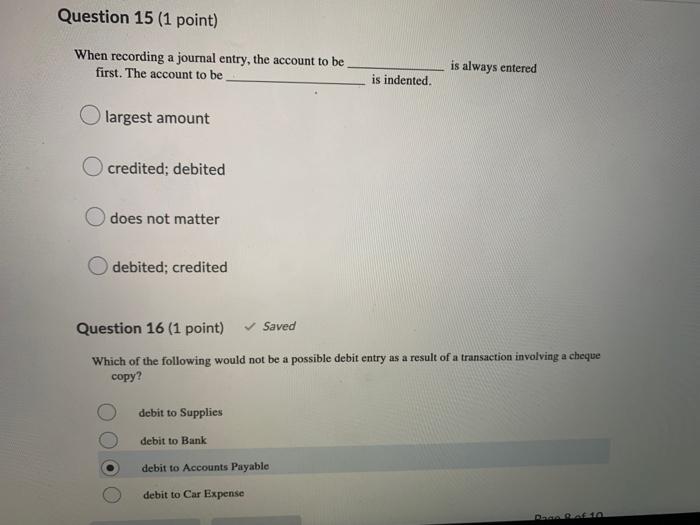

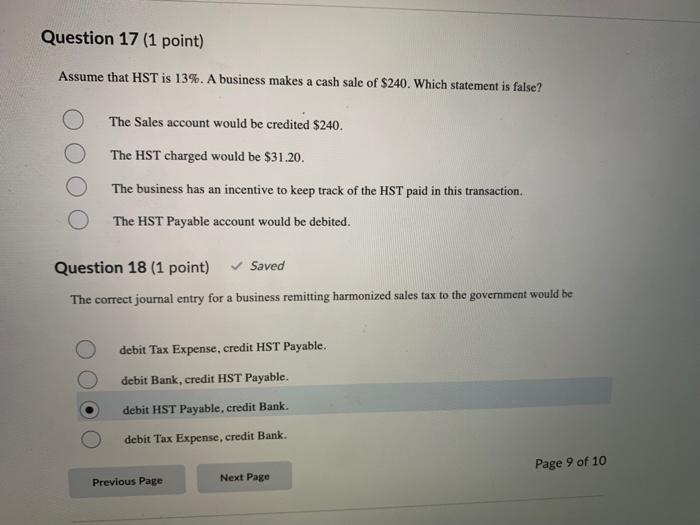

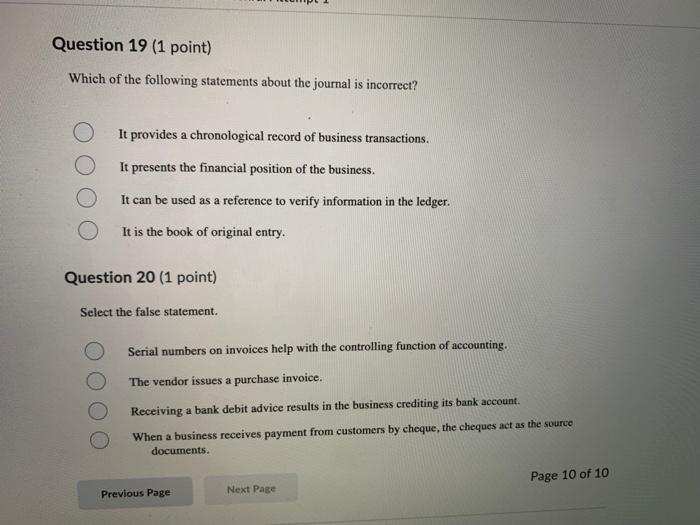

Question 11 (1 point) The accounting entry for a sales invoice is debit Accounts Receivable, credit Sales. debit Sales, credit Bank. debit Sales, credit Accounts Payable. debit Accounts Payable, credit Sales. Question 12 (1 point) Saved A business had the following balances on the day it was to remit HST to the government: HST Recoverable $3150; HST Payable $4618. How much does it owe the government? $7768 $3150 $1468 $4618 Previous Page Next Page Page 6 of 10 Question 13 (1 point) Select the source document which has most likely been received by the accounting clerk as a result of the following journal entry: debit Supplies, credit Accounts Payable. O Purchase invoice Sales invoice Cheque copy Cash receipts list Question 14 (1 point) A purchase invoice was received by a business. The journal entry for this transaction could be debit Supplies, credit Accounts Payable. debit Accounts Payable, credit Equipment. debit Bank, credit Sales. debit Accounts Receivable, credit Sales. Next Page Previous Page Page 7 of 10 Question 15 (1 point) When recording a journal entry, the account to be. first. The account to be is always entered is indented. largest amount O credited; debited does not matter debited; credited Question 16 (1 point) Saved Which of the following would not be a possible debit entry as a result of a transaction involving a cheque copy? debit to Supplies debit to Bank debit to Accounts Payable debit to Car Expense Page 8 of 10 Question 17 (1 point) Assume that HST is 13%. A business makes a cash sale of $240. Which statement is false? The Sales account would be credited $240. The HST charged would be $31.20. The business has an incentive to keep track of the HST paid in this transaction. The HST Payable account would be debited. Question 18 (1 point) Saved The correct journal entry for a business remitting harmonized sales tax to the government would be debit Tax Expense, credit HST Payable. debit Bank, credit HST Payable. debit HST Payable, credit Bank. debit Tax Expense, credit Bank. Page 9 of 10 Next Page Previous Page Question 19 (1 point) Which of the following statements about the journal is incorrect? It provides a chronological record of business transactions. It presents the financial position of the business. It can be used as a reference to verify information in the ledger. It is the book of original entry. Serial numbers on invoices help with the controlling function of accounting. The vendor issues a purchase invoice. Receiving a bank debit advice results in the business crediting its bank account. When a business receives payment from customers by cheque, the cheques act as the source documents. Page 10 of 10 Previous Page Next Page Question 20 (1 point) Select the false statement

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts