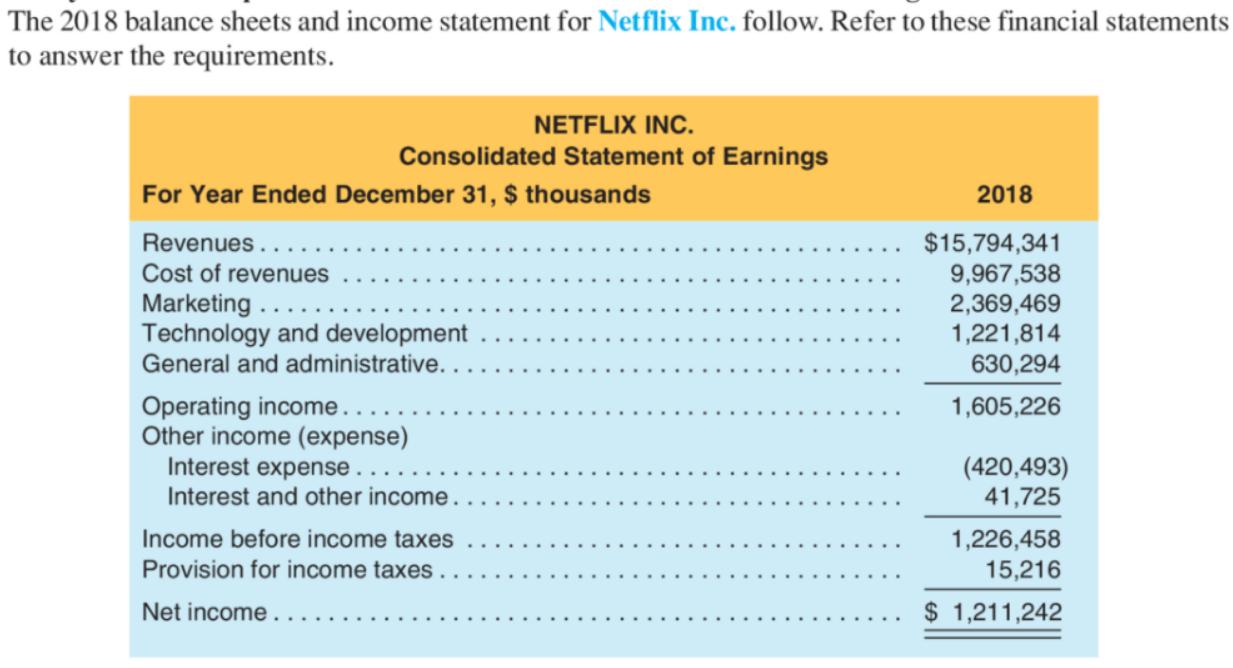

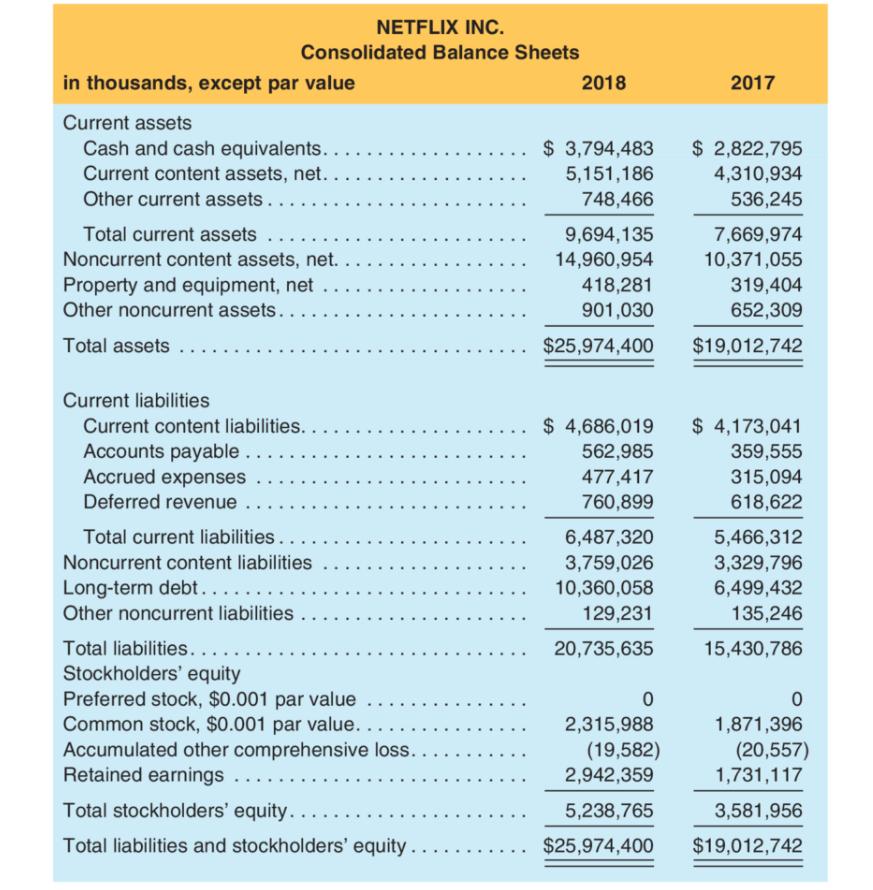

The 2018 balance sheets and income statement for Netflix Inc. follow. Refer to these financial statements...

Fantastic news! We've Found the answer you've been seeking!

Question:

Transcribed Image Text:

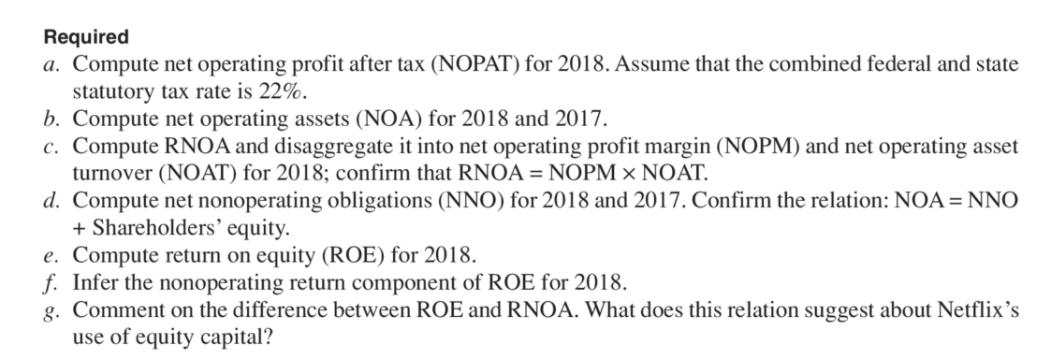

The 2018 balance sheets and income statement for Netflix Inc. follow. Refer to these financial statements to answer the requirements. NETFLIX INC. Consolidated Statement of Earnings For Year Ended December 31, $ thousands Revenues.. Cost of revenues Marketing. Technology and development General and administrative.. Operating income.. Other income (expense) Interest expense. Interest and other income. Income before income taxes Provision for income taxes. Net income...…….. 2018 $15,794,341 9,967,538 2,369,469 1,221,814 630,294 1,605,226 (420,493) 41,725 1,226,458 15,216 $ 1,211,242 in thousands, except par value Current assets Cash and cash equivalents.. Current content assets, net.. Other current assets... NETFLIX INC. Consolidated Balance Sheets ...... Total current assets Noncurrent content assets, net.. Property and equipment, net Other noncurrent assets.. Total assets ... .. ... Total current liabilities..... Noncurrent content liabilities Long-term debt.... Other noncurrent liabilities. Total liabilities..... ... Current liabilities Current content liabilities. . . . . Accounts payable. Accrued expenses Deferred revenue .. .... ... Stockholders equity Preferred stock, $0.001 par value Common stock, $0.001 par value... Accumulated other comprehensive loss. Retained earnings .. Total stockholders equity. . . . . Total liabilities and stockholders equity.... 2018 $ 3,794,483 5,151,186 748,466 9,694,135 14,960,954 418,281 901,030 $25,974,400 $ 4,686,019 562,985 477,417 760,899 6,487,320 3,759,026 10,360,058 129,231 20,735,635 0 2,315,988 (19,582) 2,942,359 5,238,765 $25,974,400 2017 $2,822,795 4,310,934 536,245 7,669,974 10,371,055 319,404 652,309 $19,012,742 $4,173,041 359,555 315,094 618,622 5,466,312 3,329,796 6,499,432 135,246 15,430,786 0 1,871,396 (20,557) 1,731,117 3,581,956 $19,012,742 Required a. Compute net operating profit after tax (NOPAT) for 2018. Assume that the combined federal and state statutory tax rate is 22%. b. Compute net operating assets (NOA) for 2018 and 2017. c. Compute RNOA and disaggregate it into net operating profit margin (NOPM) and net operating asset turnover (NOAT) for 2018; confirm that RNOA = NOPM > NOAT. d. Compute net nonoperating obligations (NNO) for 2018 and 2017. Confirm the relation: NOA = NNO + Shareholders equity. e. Compute return on equity (ROE) for 2018. f. Infer the nonoperating return component of ROE for 2018. g. Comment on the difference between ROE and RNOA. What does this relation suggest about Netflix s use of equity capital? The 2018 balance sheets and income statement for Netflix Inc. follow. Refer to these financial statements to answer the requirements. NETFLIX INC. Consolidated Statement of Earnings For Year Ended December 31, $ thousands Revenues.. Cost of revenues Marketing. Technology and development General and administrative.. Operating income.. Other income (expense) Interest expense. Interest and other income. Income before income taxes Provision for income taxes. Net income...…….. 2018 $15,794,341 9,967,538 2,369,469 1,221,814 630,294 1,605,226 (420,493) 41,725 1,226,458 15,216 $ 1,211,242 in thousands, except par value Current assets Cash and cash equivalents.. Current content assets, net.. Other current assets... NETFLIX INC. Consolidated Balance Sheets ...... Total current assets Noncurrent content assets, net.. Property and equipment, net Other noncurrent assets.. Total assets ... .. ... Total current liabilities..... Noncurrent content liabilities Long-term debt.... Other noncurrent liabilities. Total liabilities..... ... Current liabilities Current content liabilities. . . . . Accounts payable. Accrued expenses Deferred revenue .. .... ... Stockholders equity Preferred stock, $0.001 par value Common stock, $0.001 par value... Accumulated other comprehensive loss. Retained earnings .. Total stockholders equity. . . . . Total liabilities and stockholders equity.... 2018 $ 3,794,483 5,151,186 748,466 9,694,135 14,960,954 418,281 901,030 $25,974,400 $ 4,686,019 562,985 477,417 760,899 6,487,320 3,759,026 10,360,058 129,231 20,735,635 0 2,315,988 (19,582) 2,942,359 5,238,765 $25,974,400 2017 $2,822,795 4,310,934 536,245 7,669,974 10,371,055 319,404 652,309 $19,012,742 $4,173,041 359,555 315,094 618,622 5,466,312 3,329,796 6,499,432 135,246 15,430,786 0 1,871,396 (20,557) 1,731,117 3,581,956 $19,012,742 Required a. Compute net operating profit after tax (NOPAT) for 2018. Assume that the combined federal and state statutory tax rate is 22%. b. Compute net operating assets (NOA) for 2018 and 2017. c. Compute RNOA and disaggregate it into net operating profit margin (NOPM) and net operating asset turnover (NOAT) for 2018; confirm that RNOA = NOPM > NOAT. d. Compute net nonoperating obligations (NNO) for 2018 and 2017. Confirm the relation: NOA = NNO + Shareholders equity. e. Compute return on equity (ROE) for 2018. f. Infer the nonoperating return component of ROE for 2018. g. Comment on the difference between ROE and RNOA. What does this relation suggest about Netflix s use of equity capital?

Expert Answer:

Related Book For

Cornerstones of Financial and Managerial Accounting

ISBN: 978-1111879044

2nd edition

Authors: Rich, Jeff Jones, Dan Heitger, Maryanne Mowen, Don Hansen

Posted Date:

Students also viewed these finance questions

-

Income statements and balance sheets follow for Snap-On Incorporated. Refer to these financial statements to answer the following questions. a. Compute net operating profit after tax (NOPAT) for 2016...

-

Analysis and Interpretation of Profitability Balance sheets and income statements for Costco Wholesale Corporation follow. Costco Wholesale Corporation Consolidated Statements of Earnings For Fiscal...

-

Analysis and Interpretation of Cash Flow Statements Your analysis should also include a review of Myer Ltds operating, investing, and financing cash flows over the prior three years (2017,2018,2019)....

-

Determine the force in member GC of the truss and state if this member is in tension or compression. Units Used: kip = 103 lb Given: F1 = 1000 lb F2 = 1000 lb F3 = 1000 lb F4 = 1000 lb a = 10 ft =...

-

Why is it incorrect for couples who postpone childbearing until age 35 or later to conclude that medical advances can overcome fertility problems?

-

What do you know about existence and uniqueness of solutions of linear second-order ODEs?

-

Consider two plates at temperatures of \(600 \mathrm{~K}\) and \(500 \mathrm{~K}\) with emissivities of 0.8 and 0.4 , respectively. The plates are separated by a gray gas that has an absorption...

-

Below is a brief description of a design-&-build power plant project. The top (i.e. northern) half of the plant plot contains the evaporation pond and tanks for storage of fuel. The...

-

Gold Inc invests $10,000 today in a mutual fund. Gold anticipates leaving this fund alone for 12 years. $ The fund is increased each year-end by specified compound interest rates as follows: years 1...

-

Explain some of the different aspects of the customer experience that could be managed to improve customer satisfaction if you were the marketing manager for: (a) An airport branch of a rental car...

-

The population of a city in the Northeast is given by p(t) = 130(1+12e-0.02t)-1 thousand people where t is the number of years since 2010. The number of garbage trucks needed by the city can be...

-

A mineshaft has an ore elevator hung from a single braided cable of diameter 2.5 cm. Youngs modulus of the cable is 10 10 10 N/m 2 . When the cable is fully extended, the end of the cable is 800 m...

-

Logan is conducting an economic evaluation under inflation using the then-current approach. If the inflation rate is \(j\) and the real time value of money rate is \(d\), which of the following is...

-

An 85 kg man stands in a very strong wind moving at 14 m/s at torso height. As you know, he will need to lean in to the wind, and we can model the situation to see why. Assume that the man has a mass...

-

Global steel prices have a year-over-year inflationary rate increase of 12.4 percent. Tube Fab purchased $700,000 of a particular carbon steel during the year just ended right now, and they intend to...

-

If you free the cork in a highly pressurized champagne bottle, the resulting launch of the cork will, in principle, cause the bottle to recoil. A filled champagne bottle has a mass of 1.8 kg. The...

-

Deszca et al . ( 2 0 2 0 ) suggest that the strategy and structure of organizations will continue to be closely tied. How might this interconnection influence the approach of change agents in...

-

A bubble-point liquid feed is to be distilled as shown in Figure. Use the Edmister group method to estimate the mole-fraction compositions of the distillate and bottoms. Assume initial overhead and...

-

Identify each of the following categories of accounts as temporary or permanent: assets, liabilities, equity, revenues, expenses, dividends. How is the distinction between temporary and permanent...

-

Multiple Choice Questions 1. Which of the following ratios is used to measure a firms efficiency? a. Net Income Equity b. Net Sales Average Total Assets c. Assets Equity d. Net Income Sales 2....

-

Multiple Choice Questions 1. A factor that causes or leads to a change in a cost or activity is a(n) a. Slope. b. Intercept. c. Driver. d. Variable term. e. Cost object. 2. Which of the following...

-

A \(0.010-\mathrm{kg}\) bullet is fired from a \(5.0-\mathrm{kg}\) gun with a muzzle velocity of \(250 \mathrm{~m} / \mathrm{s}\). (a) While the bullet is traveling in the barrel, what is the ratio...

-

A \(1500-\mathrm{kg}\) car going at \(6.32 \mathrm{~m} / \mathrm{s}\) collides with a \(3000-\mathrm{kg}\) truck at rest. If the collision is totally inelastic and takes place over an interval of...

-

On a low-friction track, a \(0.66-\mathrm{kg}\) cart initially going at \(1.85 \mathrm{~m} / \mathrm{s}\) to the right collides with a cart of unknown inertia initially going at \(2.17 \mathrm{~m} /...

Study smarter with the SolutionInn App