Question: Accounting! Part 2: You must use a computer. Solve each of the following problems using Excel (show the supporting calculations, as appropriate), print and attach

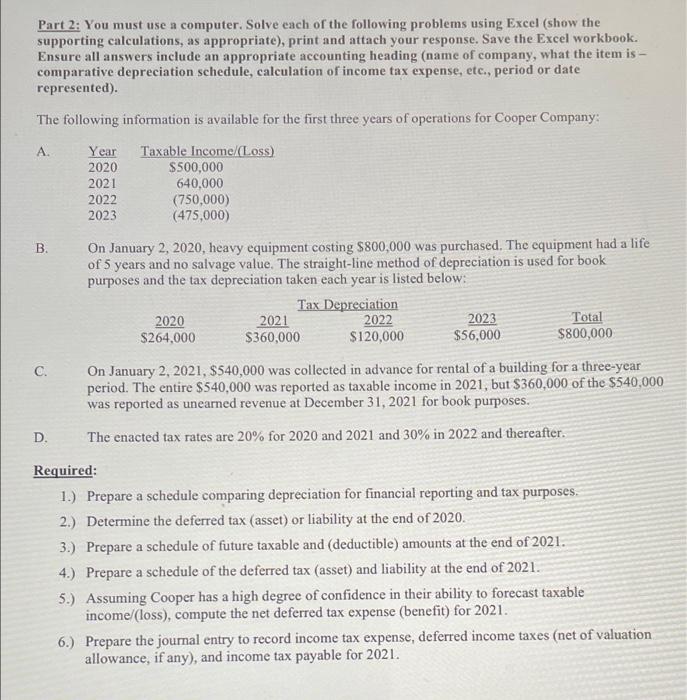

Part 2: You must use a computer. Solve each of the following problems using Excel (show the supporting calculations, as appropriate), print and attach your response. Save the Excel workbook. Ensure all answers include an appropriate accounting heading (name of company, what the item is - comparative depreciation schedule, calculation of income tax expense, etc., period or date represented). The following information is available for the first three years of operations for Cooper Company: A Year 2020 2021 2022 2023 Taxable income/(Loss) $500,000 640,000 (750,000) (475,000) B. On January 2, 2020, heavy equipment costing $800,000 was purchased. The equipment had a life of 5 years and no salvage value. The straight-line method of depreciation is used for book purposes and the tax depreciation taken each year is listed below: Tax Depreciation 2020 2021 2022 2023 Total $264,000 $360,000 $120,000 $56,000 $800,000 c. On January 2, 2021, $540,000 was collected in advance for rental of a building for a three-year period. The entire $540,000 was reported as taxable income in 2021, but $360,000 of the $540,000 was reported as unearned revenue at December 31, 2021 for book purposes. The enacted tax rates are 20% for 2020 and 2021 and 30% in 2022 and thereafter. D. Required: 1.) Prepare a schedule comparing depreciation for financial reporting and tax purposes. 2.) Determine the deferred tax (asset) or liability at the end of 2020. 3.) Prepare a schedule of future taxable and (deductible) amounts at the end of 2021. 4.) Prepare a schedule of the deferred tax (asset) and liability at the end of 2021. 5.) Assuming Cooper has a high degree of confidence in their ability to forecast taxable income (loss), compute the net deferred tax expense (benefit) for 2021. 6.) Prepare the journal entry to record income tax expense, deferred income taxes (net of valuation allowance, if any), and income tax payable for 2021

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts