Question: ACcounting Part 2: You must use a computer. Solve each of the following problems using Excel (show the supporting calculations), print and attach your response.

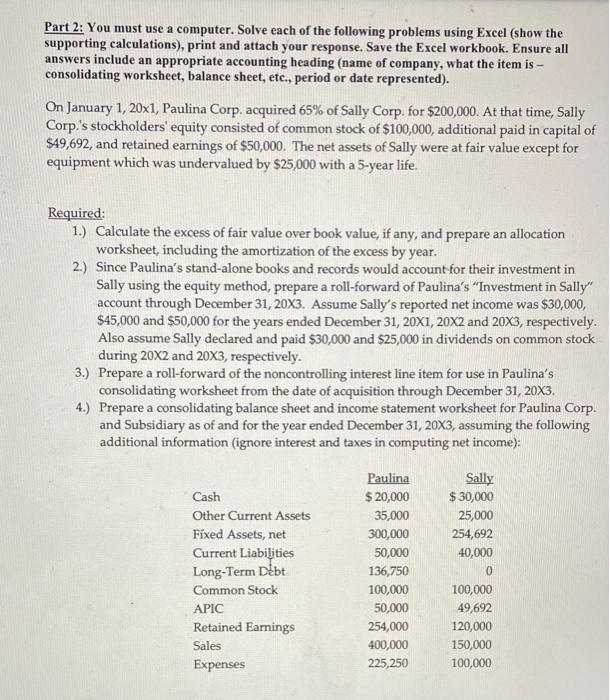

Part 2: You must use a computer. Solve each of the following problems using Excel (show the supporting calculations), print and attach your response. Save the Excel workbook. Ensure all answers include an appropriate accounting heading (name of company, what the item is - consolidating worksheet, balance sheet, etc., period or date represented). On January 1, 20x1, Paulina Corp. acquired 65% of Sally Corp. for $200,000. At that time, Sally Corp.'s stockholders' equity consisted of common stock of $100,000, additional paid in capital of $49,692, and retained earnings of $50,000. The net assets of Sally were at fair value except for equipment which was undervalued by $25,000 with a 5-year life. Required: 1.) Calculate the excess of fair value over book value, if any, and prepare an allocation worksheet, including the amortization of the excess by year. 2.) Since Paulina's stand-alone books and records would account for their investment in Sally using the equity method, prepare a roll-forward of Paulina's "Investment in Sally" account through December 31, 20X3. Assume Sally's reported net income was $30,000, $45,000 and $50,000 for the years ended December 31, 20X1, 20X2 and 20X3, respectively. Also assume Sally declared and paid $30,000 and $25,000 in dividends on common stock during 20X2 and 20X3, respectively. 3.) Prepare a roll-forward of the noncontrolling interest line item for use in Paulina's consolidating worksheet from the date of acquisition through December 31, 20X3. 4.) Prepare a consolidating balance sheet and income statement worksheet for Paulina Corp. and Subsidiary as of and for the year ended December 31, 20X3, assuming the following additional information (ignore interest and taxes in computing net income): Cash Other Current Assets Fixed Assets, net Current Liabilities Long-Term Debt Common Stock APIC Retained Earnings Sales Expenses Paulina $ 20,000 35,000 300,000 50,000 136,750 100,000 50,000 254,000 400,000 225,250 Sally $30,000 25,000 254,692 40,000 0 100,000 49,692 120,000 150,000 100,000 Part 2: You must use a computer. Solve each of the following problems using Excel (show the supporting calculations), print and attach your response. Save the Excel workbook. Ensure all answers include an appropriate accounting heading (name of company, what the item is - consolidating worksheet, balance sheet, etc., period or date represented). On January 1, 20x1, Paulina Corp. acquired 65% of Sally Corp. for $200,000. At that time, Sally Corp.'s stockholders' equity consisted of common stock of $100,000, additional paid in capital of $49,692, and retained earnings of $50,000. The net assets of Sally were at fair value except for equipment which was undervalued by $25,000 with a 5-year life. Required: 1.) Calculate the excess of fair value over book value, if any, and prepare an allocation worksheet, including the amortization of the excess by year. 2.) Since Paulina's stand-alone books and records would account for their investment in Sally using the equity method, prepare a roll-forward of Paulina's "Investment in Sally" account through December 31, 20X3. Assume Sally's reported net income was $30,000, $45,000 and $50,000 for the years ended December 31, 20X1, 20X2 and 20X3, respectively. Also assume Sally declared and paid $30,000 and $25,000 in dividends on common stock during 20X2 and 20X3, respectively. 3.) Prepare a roll-forward of the noncontrolling interest line item for use in Paulina's consolidating worksheet from the date of acquisition through December 31, 20X3. 4.) Prepare a consolidating balance sheet and income statement worksheet for Paulina Corp. and Subsidiary as of and for the year ended December 31, 20X3, assuming the following additional information (ignore interest and taxes in computing net income): Cash Other Current Assets Fixed Assets, net Current Liabilities Long-Term Debt Common Stock APIC Retained Earnings Sales Expenses Paulina $ 20,000 35,000 300,000 50,000 136,750 100,000 50,000 254,000 400,000 225,250 Sally $30,000 25,000 254,692 40,000 0 100,000 49,692 120,000 150,000 100,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts