Question: Accounting Please solve Asap SHOW YOUR WORK FOR EACH PROBLEM PROBLEM 1 - Make or Buy: Rivertown Corporation uses a part called a nerfette in

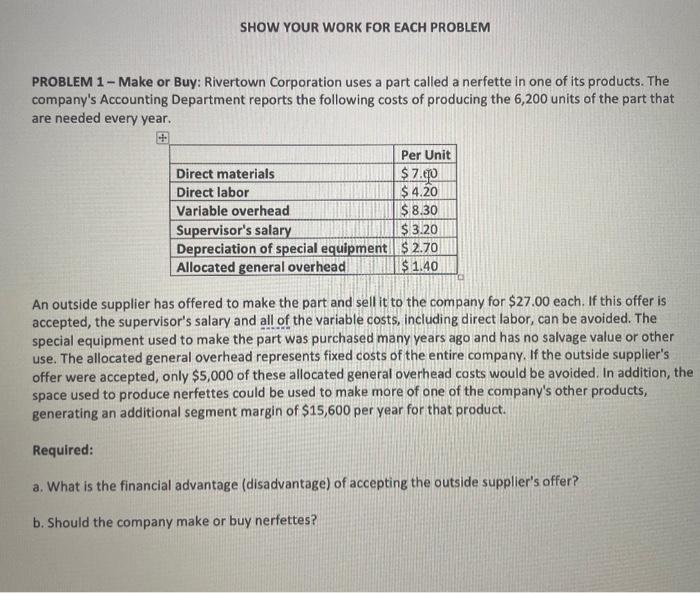

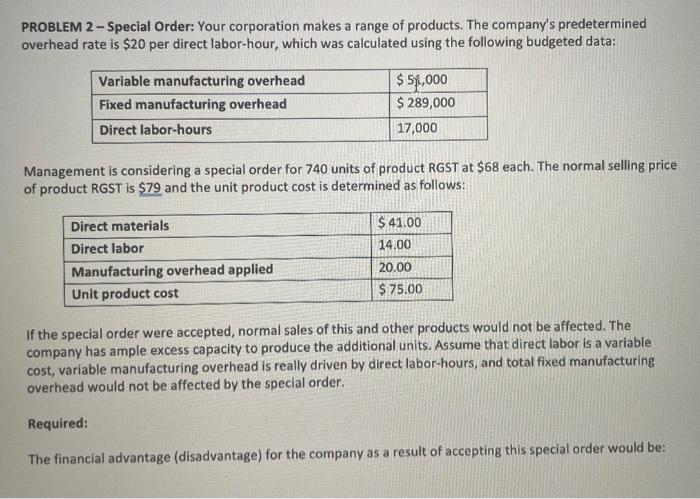

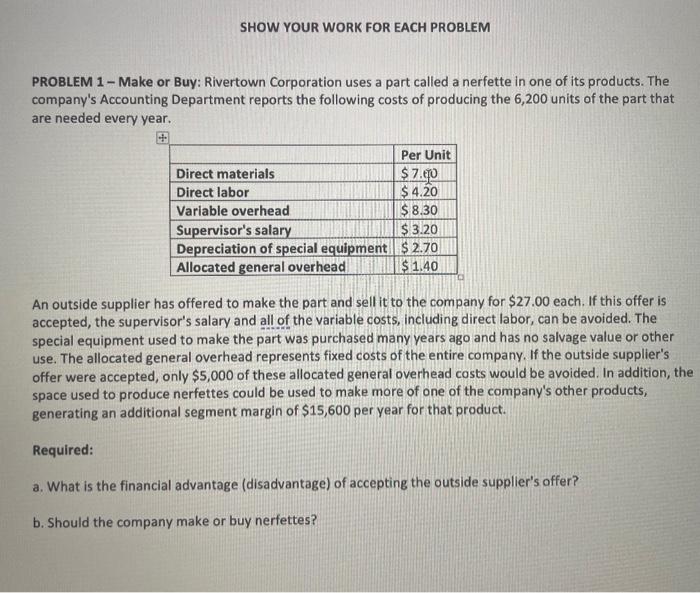

SHOW YOUR WORK FOR EACH PROBLEM PROBLEM 1 - Make or Buy: Rivertown Corporation uses a part called a nerfette in one of its products. The company's Accounting Department reports the following costs of producing the 6,200 units of the part that are needed every year. An outside supplier has offered to make the part and sell it to the company for $27.00each. If this offer is accepted, the supervisor's salary and all of the variable costs, including direct labor, can be avoided. The special equipment used to make the part was purchased many years ago and has no salvage value or other use. The allocated general overhead represents fixed costs of the entire company. If the outside supplier's offer were accepted, only $5,000 of these allocated general overhead costs would be avoided. In addition, the space used to produce nerfettes could be used to make more of one of the company's other products, generating an additional segment margin of $15,600 per year for that product. Required: a. What is the financial advantage (disadvantage) of accepting the outside supplier's offer? b. Should the company make or buy nerfettes? PROBLEM 2 - Special Order: Your corporation makes a range of products. The company's predetermined overhead rate is $20 per direct labor-hour, which was calculated using the following budgeted data: Management is considering a special order for 740 units of product RGST at $68 each. The normal selling price of product RGST is $79 and the unit product cost is determined as follows: If the special order were accepted, normal sales of this and other products would not be affected. The company has ample excess capacity to produce the additional units. Assume that direct labor is a variable cost, variable manufacturing overhead is really driven by direct labor-hours, and total fixed manufacturing overhead would not be affected by the special order. Required: The financial advantage (disadvantage) for the company as a result of accepting this special order would be: SHOW YOUR WORK FOR EACH PROBLEM PROBLEM 1 - Make or Buy: Rivertown Corporation uses a part called a nerfette in one of its products. The company's Accounting Department reports the following costs of producing the 6,200 units of the part that are needed every year. An outside supplier has offered to make the part and sell it to the company for $27.00each. If this offer is accepted, the supervisor's salary and all of the variable costs, including direct labor, can be avoided. The special equipment used to make the part was purchased many years ago and has no salvage value or other use. The allocated general overhead represents fixed costs of the entire company. If the outside supplier's offer were accepted, only $5,000 of these allocated general overhead costs would be avoided. In addition, the space used to produce nerfettes could be used to make more of one of the company's other products, generating an additional segment margin of $15,600 per year for that product. Required: a. What is the financial advantage (disadvantage) of accepting the outside supplier's offer? b. Should the company make or buy nerfettes

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts