Question: Accounting Principles Homework Problems Chapter 16 1. Mickelson Inc. provides financing and capital to the assisted living industry. The following selected transactions relate to bonds

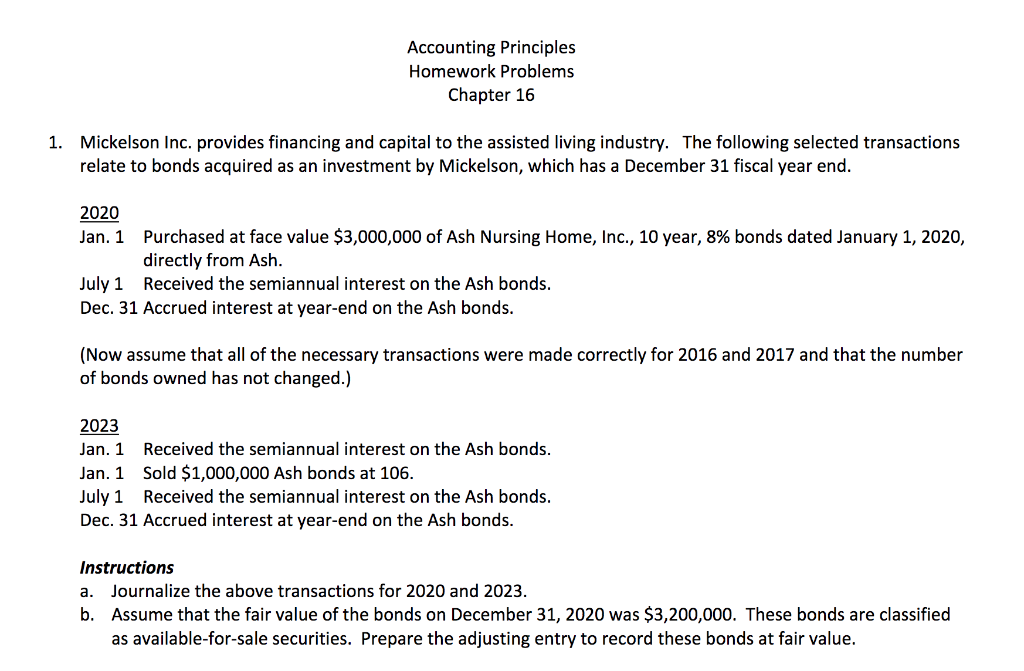

Accounting Principles Homework Problems Chapter 16 1. Mickelson Inc. provides financing and capital to the assisted living industry. The following selected transactions relate to bonds acquired as an investment by Mickelson, which has a December 31 fiscal year end. 2020 Jan. 1 Purchased at face value $3,000,000 of Ash Nursing Home, Inc., 10 year, 8% bonds dated January 1, 2020, directly from Ash. July 1 Received the semiannual interest on the Ash bonds. Dec. 31 Accrued interest at year-end on the Ash bonds. (Now assume that all of the necessary transactions were made correctly for 2016 and 2017 and that the number of bonds owned has not changed.) 2023 Jan. 1 Received the semiannual interest on the Ash bonds. Jan. 1 Sold $1,000,000 Ash bonds at 106. July 1 Received the semiannual interest on the Ash bonds. Dec. 31 Accrued interest at year-end on the Ash bonds. Instructions a. Journalize the above transactions for 2020 and 2023. b. Assume that the fair value of the bonds on December 31, 2020 was $3,200,000. These bonds are classified as available-for-sale securities. Prepare the adjusting entry to record these bonds at fair value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts