Question: Accounting Problems: 9:21PM Mon Mar 11 . . . 1 67% Hill9:21PM Mon Mar 11 . . . 167% 9:22 PM Mon Mar 11 .

Accounting Problems:

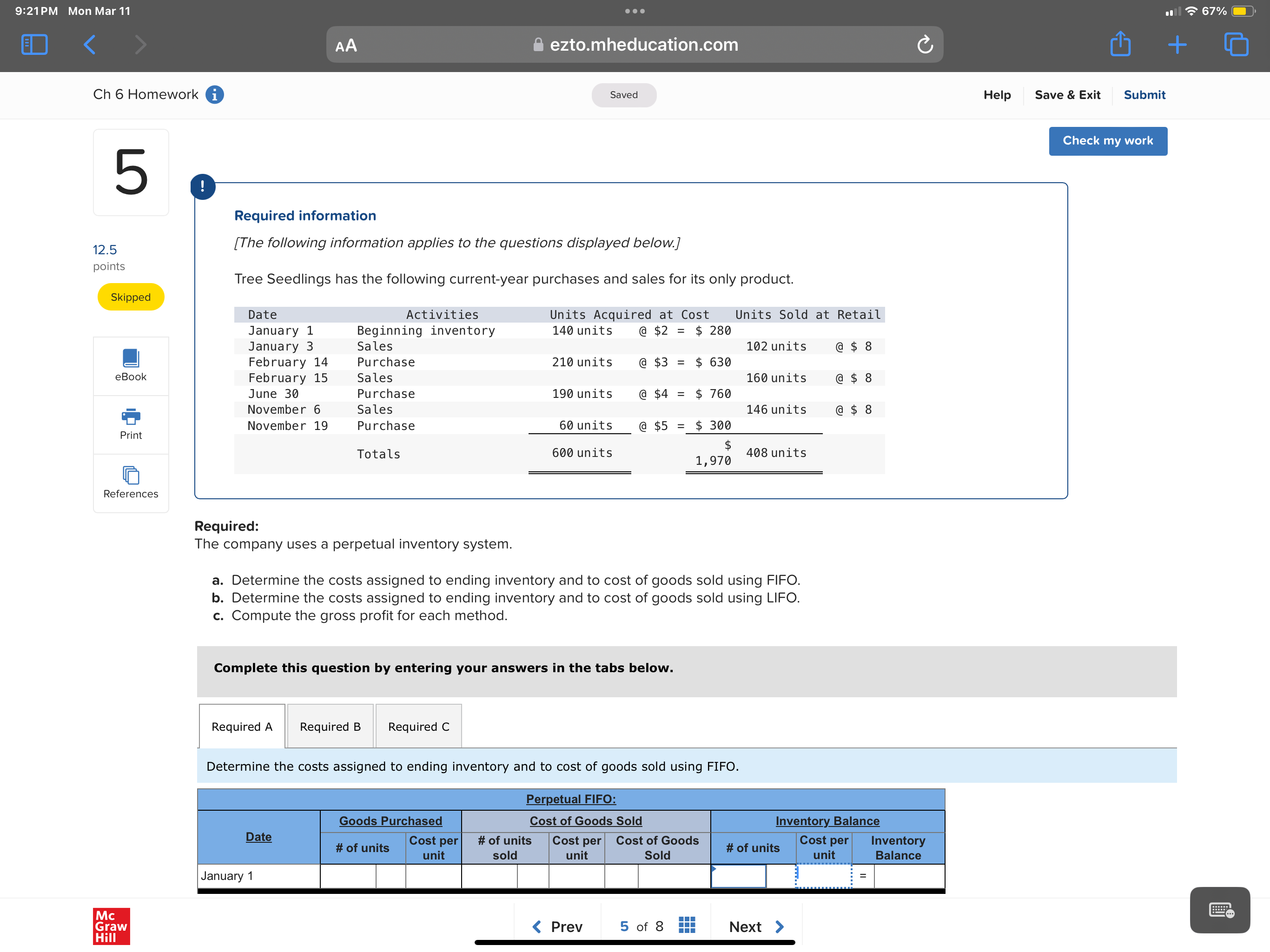

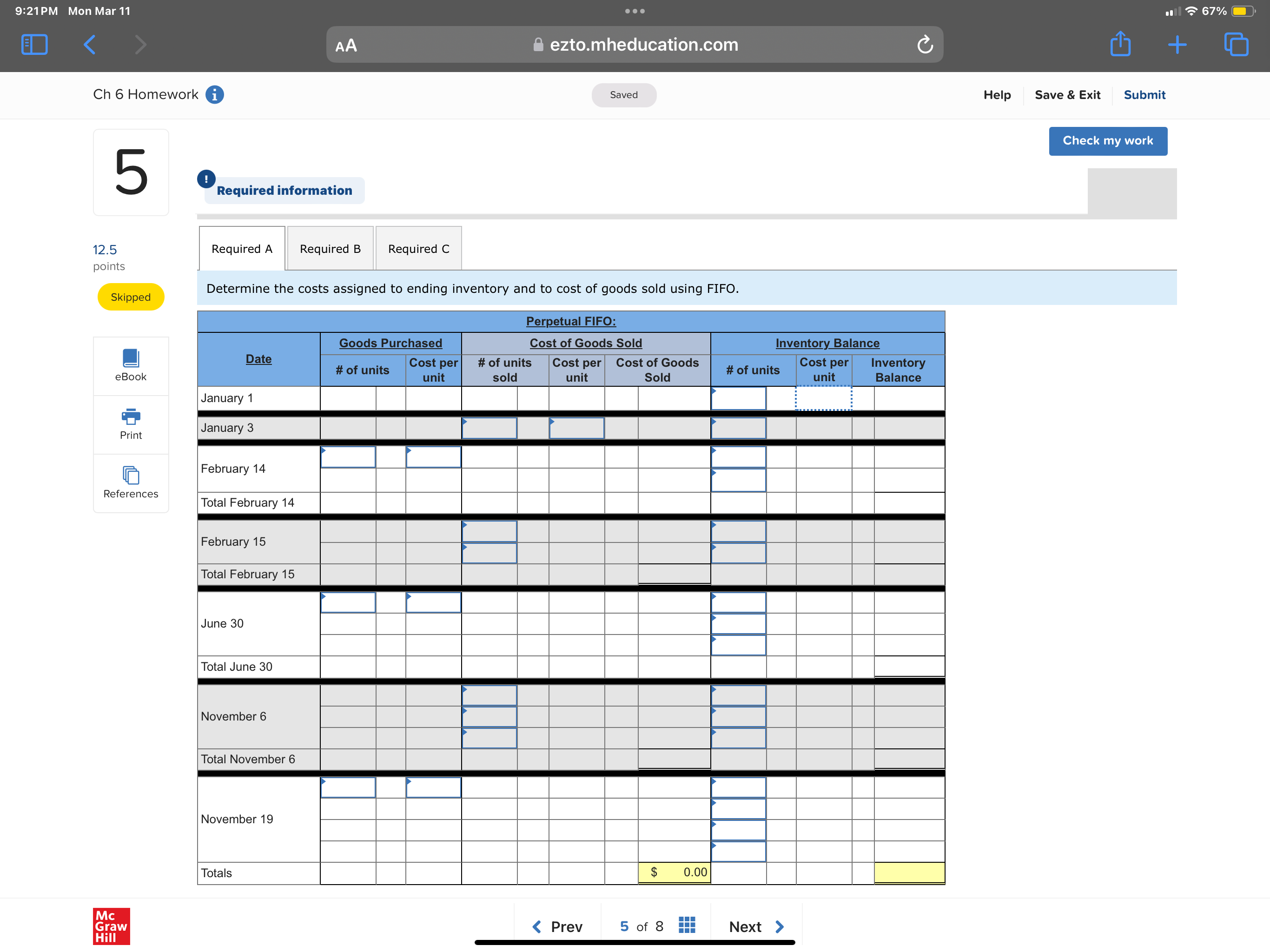

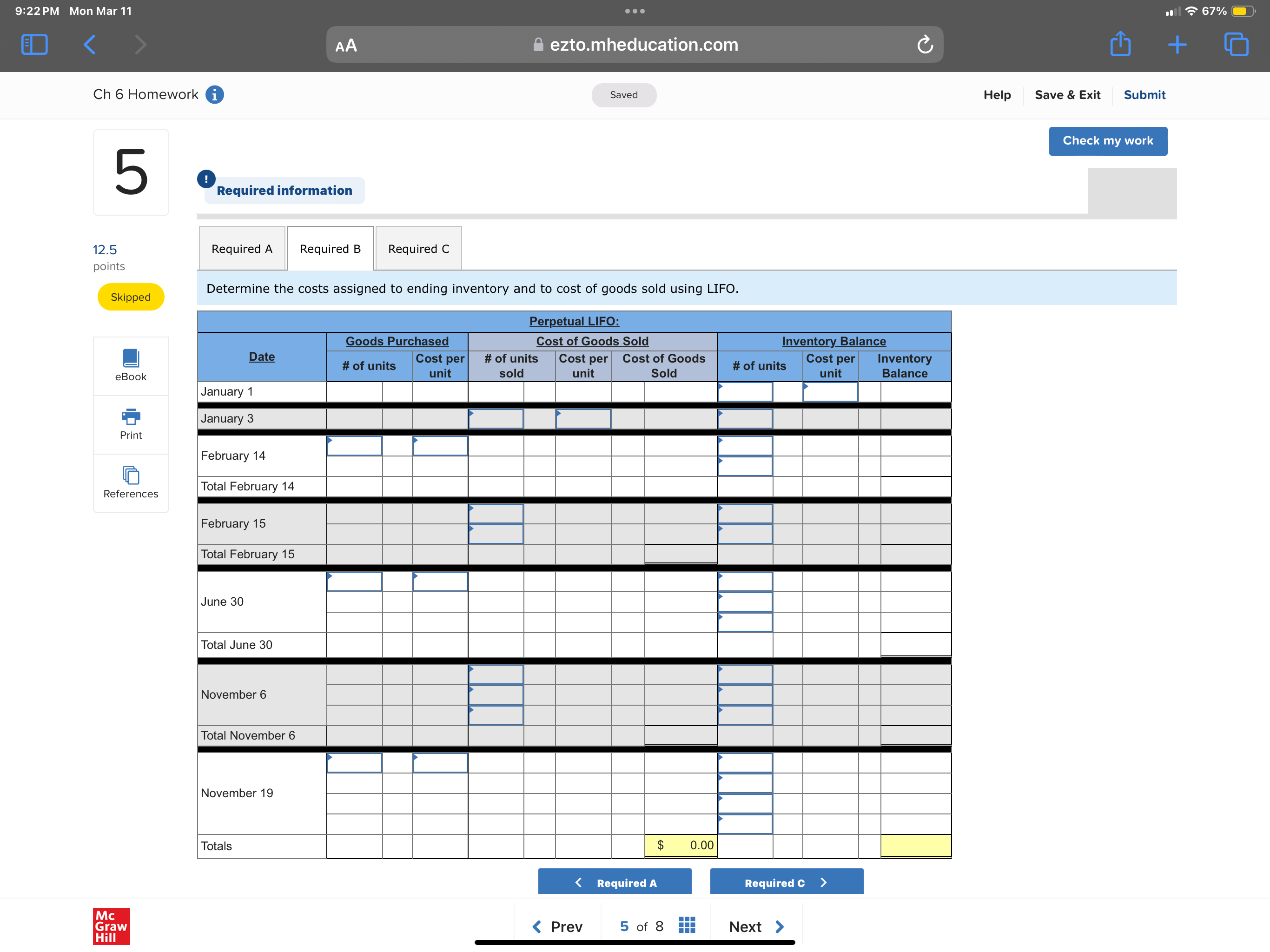

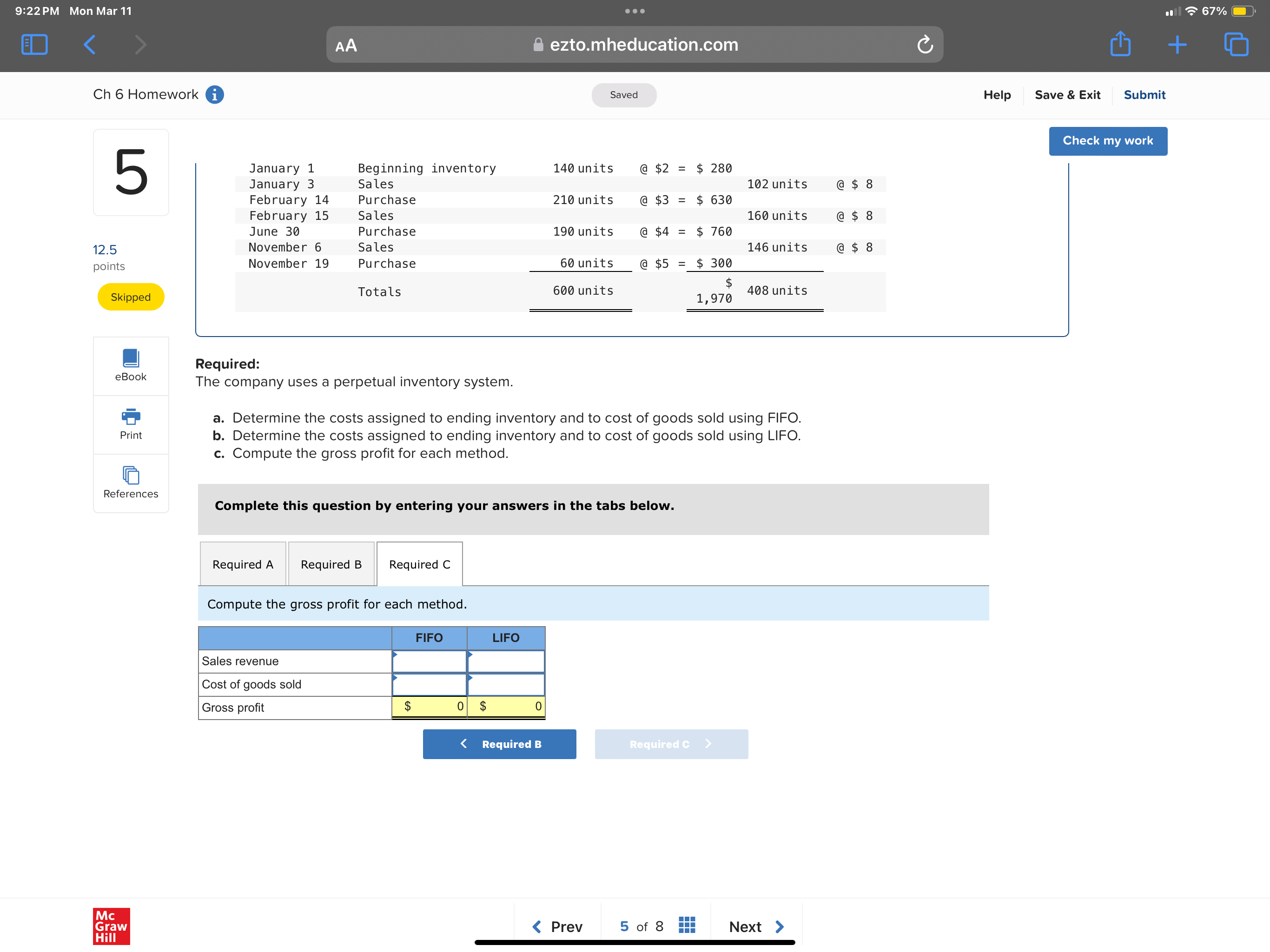

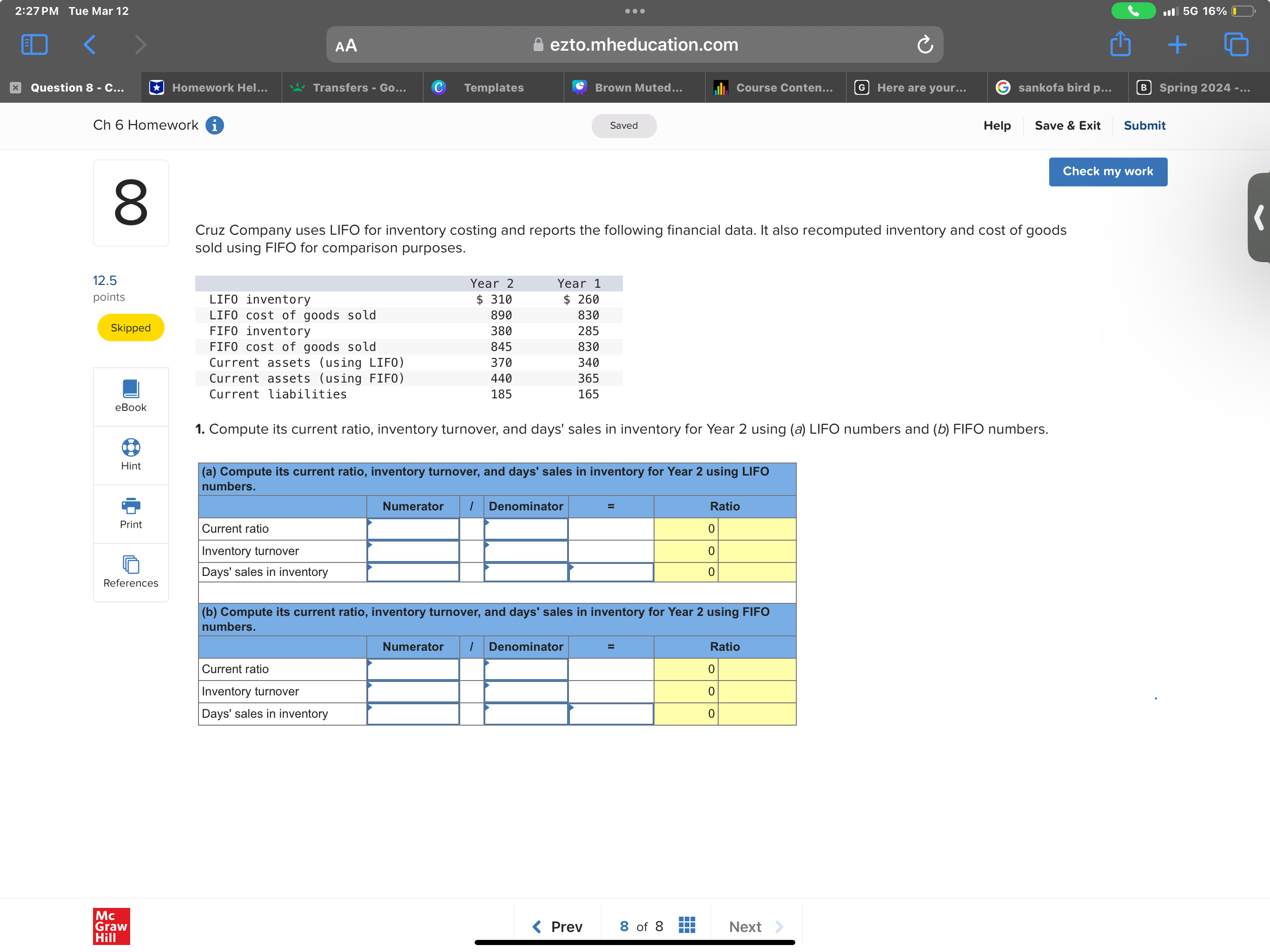

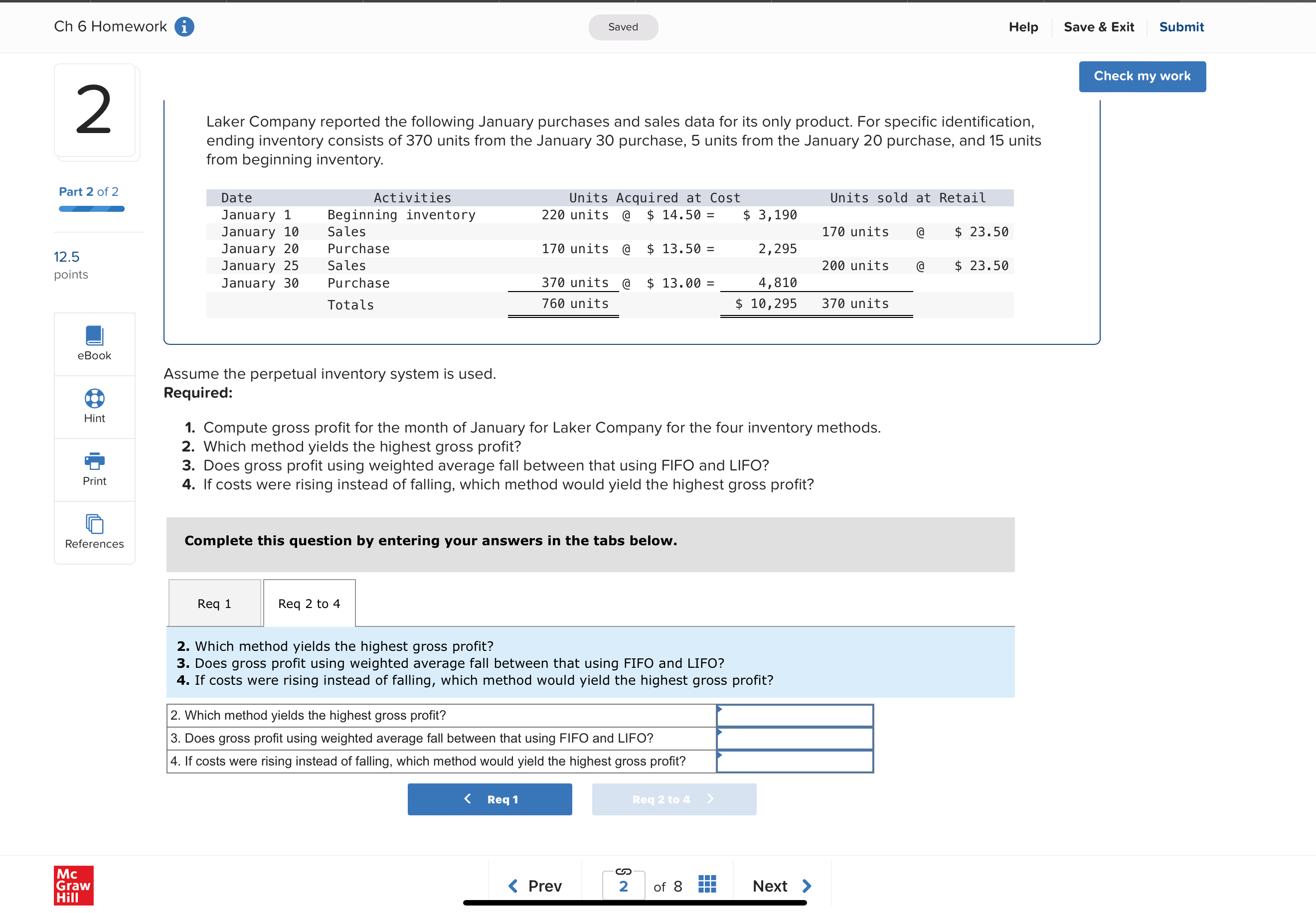

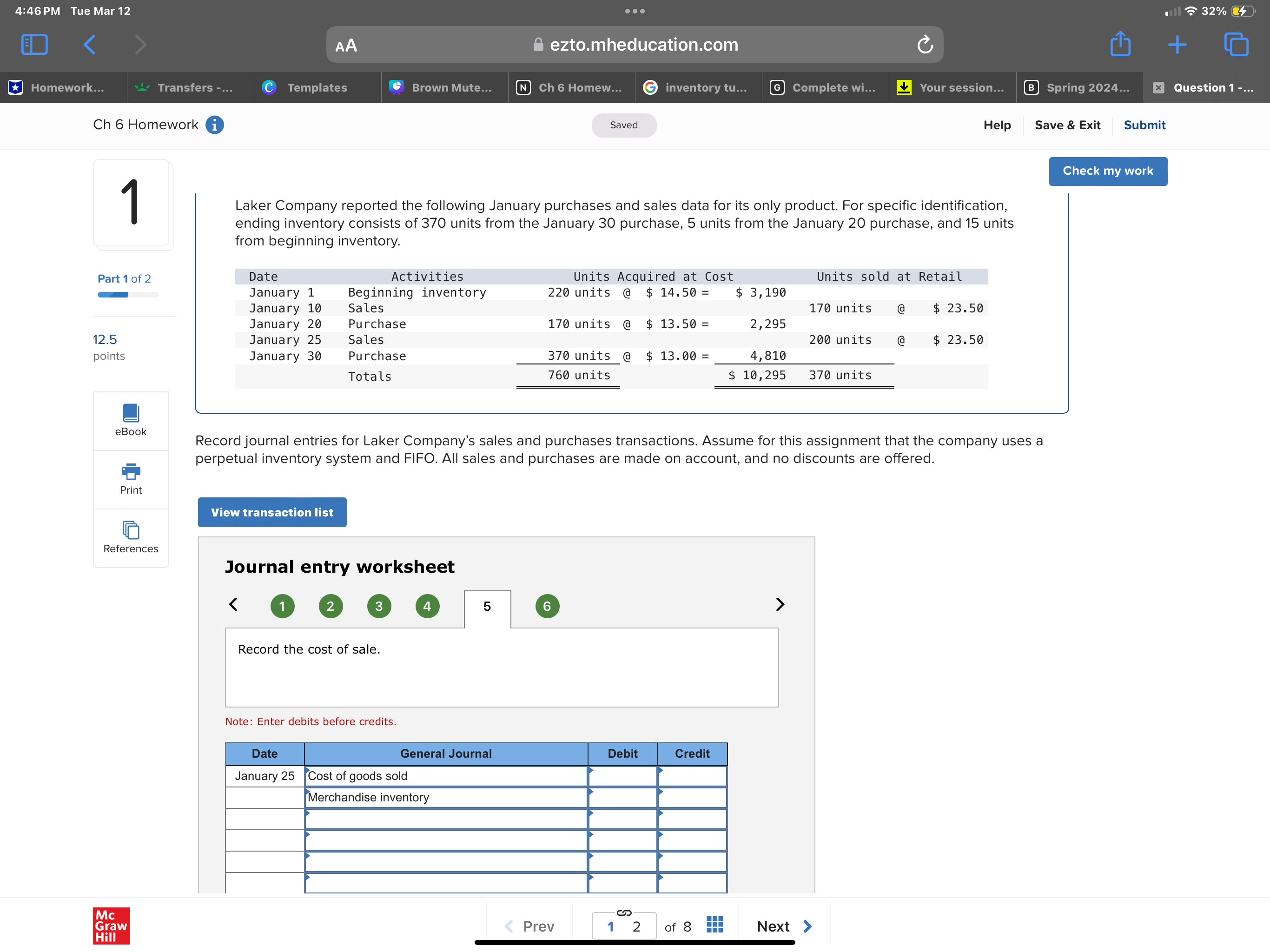

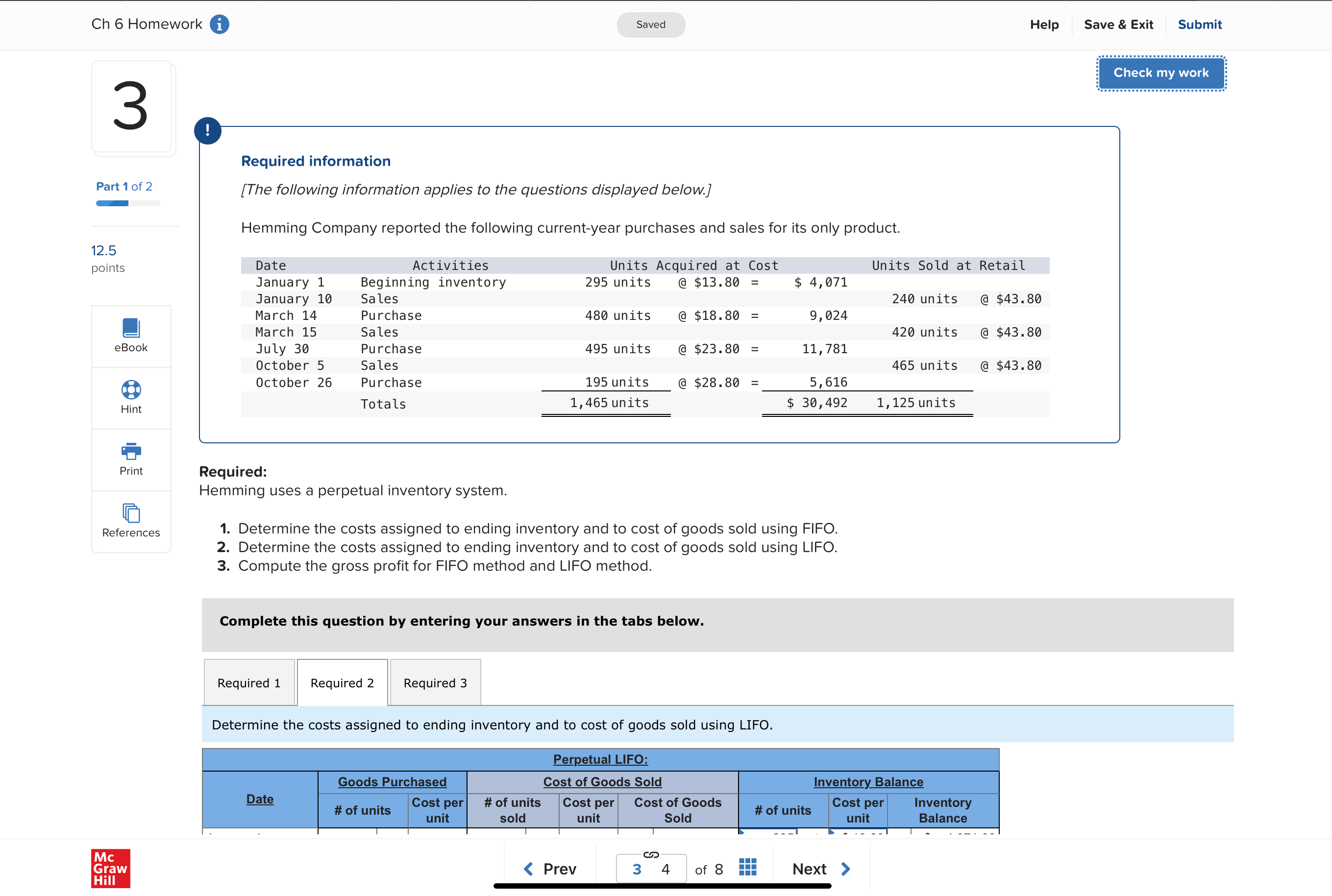

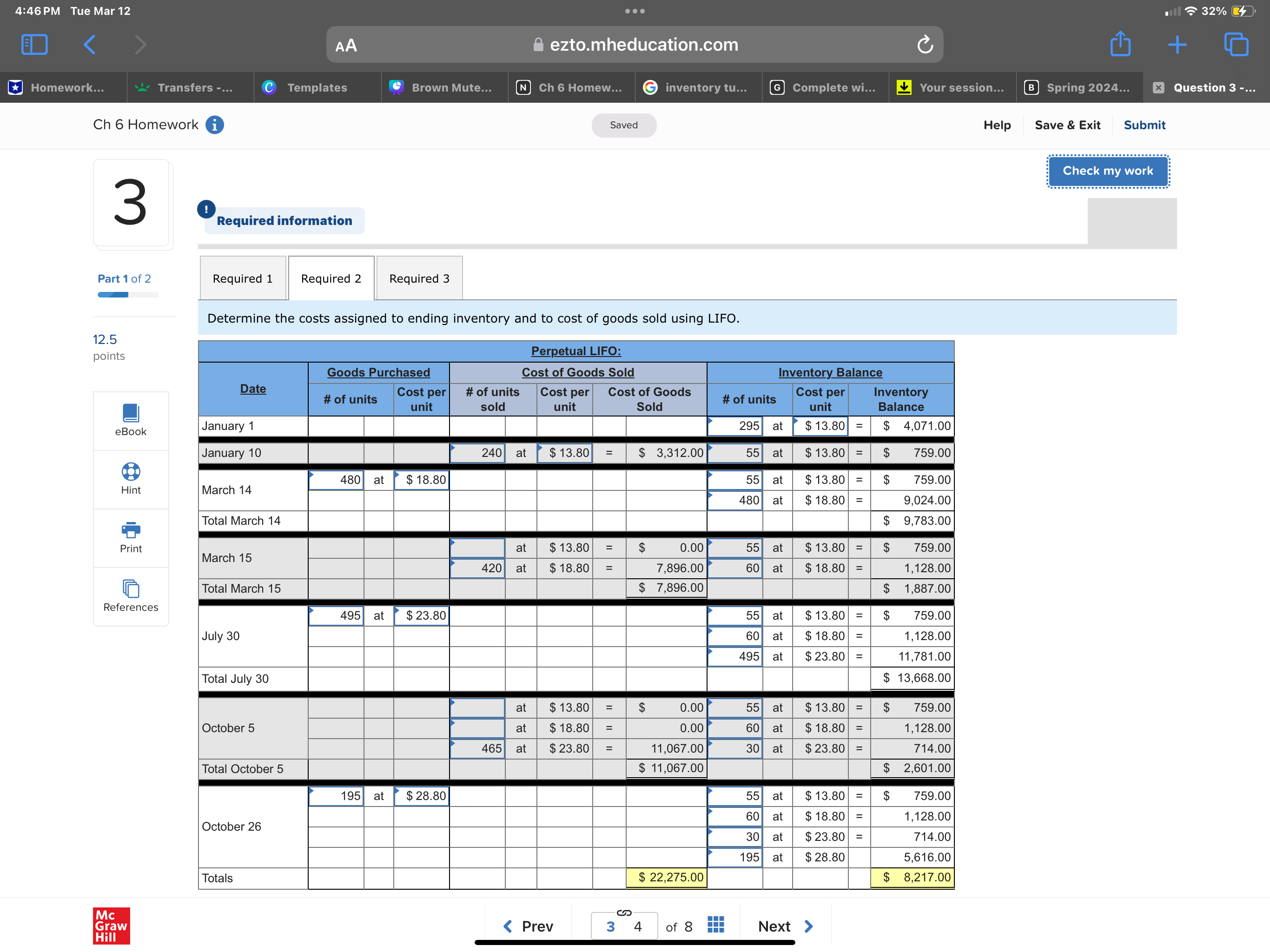

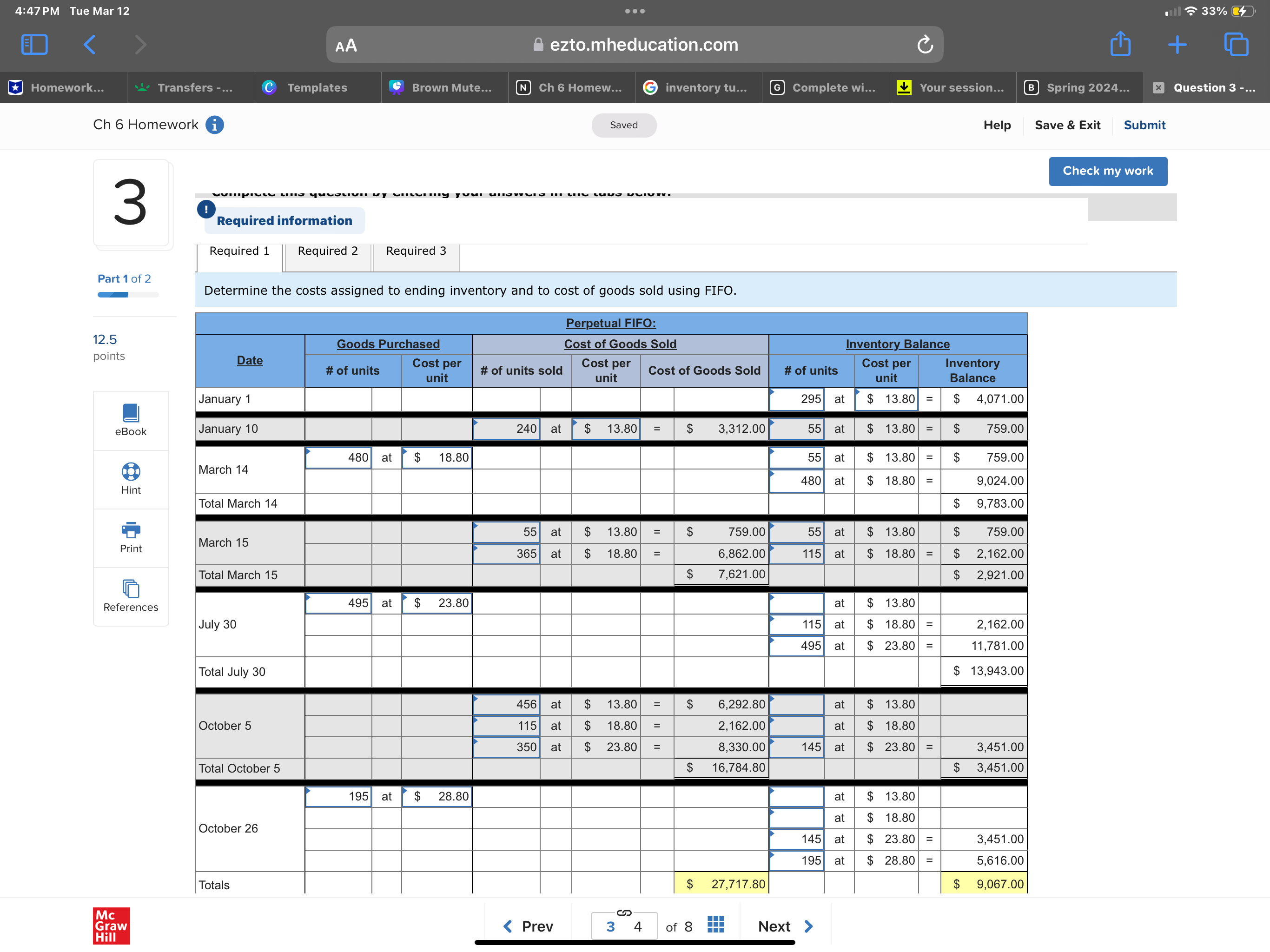

9:21PM Mon Mar 11 . . . 1 67% Hill9:21PM Mon Mar 11 . . . 167% 9:22 PM Mon Mar 11 . . . 167% Mc Graw Hill 9:22PM Mon Mar 11 @& ezto.mheducation.com Ch 6 Homework @ Saved Help Save & Exit Submit Check my work January 1 Beginning inventory 140 units @$2 = $ 280 January 3 Sales 102 units @$ 8 February 14 Purchase 210 units @ $3 = $ 630 February 15 Sales 160 units @$ 8 June 30 Purchase 190 units @ $4 = $ 760 12.5 November 6 Sales 146 units @$ 8 points November 19 Purchase 60 units @ $5 = $ 300 . $ s Skipped Totals 600 units 1,970 408 units ;l Required: eBook The company uses a perpetual inventory system. = a. Determine the costs assigned to ending inventory and to cost of goods sold using FIFO. Print b. Determine the costs assigned to ending inventory and to cost of goods sold using LIFO. c. Compute the gross profit for each method. D References Complete this question by entering your answers in the tabs below. Required A Required B Required C Compute the gross profit for each method. Sales revenue Cost of goods sold Gross profit % 4:46 PM Tue Mar 12 . . . 1 32% Ch 6 Homework 0 Saved Help Save & Exit Submit 3 e Required information Part1of2 [The following information applies to the questions displayed below.] o a Hemming Company reported the following current-year purchases and sales for its only product. 125 points Date Activities Units Acquired at Cost Units Sold at Retail January 1 Beginning inventory 295 units @ $13.80 = $ 4,071 January 10 Sales 240 units @ $43.80 March 14 Purchase 480 units @ $18.80 = 9,024 !] March 15 Sales 420 units @ $43.80 eBook July 30 Purchase 495 units @ $23.80 = 11,781 October 5 Sales 465 units @ $43.80 @ October 26 Purchase 195 units @ $28.80 = 5,616 Hint Totals 1,465 units $ 30,492 5125 nits = Print Required: Hemming uses a perpetual inventory system. D References. 1. Determine the costs assigned to ending inventory and to cost of goods sold using FIFO. 2. Determine the costs assigned to ending inventory and to cost of goods sold using LIFO. 3. Compute the gross profit for FIFO method and LIFO method. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Determine the costs assigned to ending inventory and to cost of goods sold using LIFO. 4:46 PM Tue Mar 12 . . . 1 32% 4:47 PM Tue Mar 12 . . . 1 33%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts