You are given the opportunity to invest in a project today that yields 25% per year...

Fantastic news! We've Found the answer you've been seeking!

Question:

Transcribed Image Text:

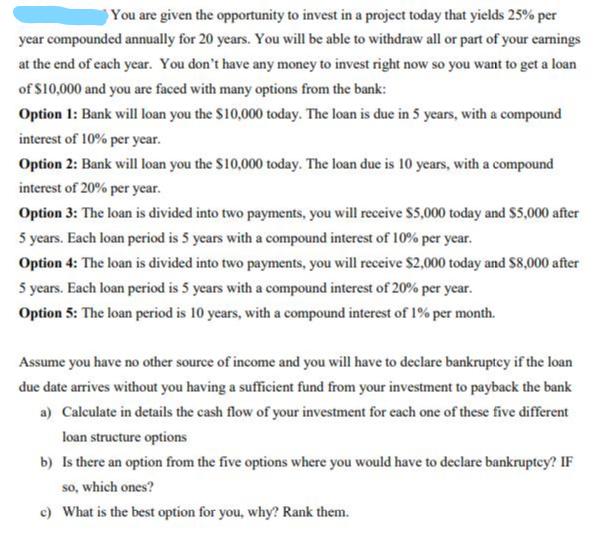

You are given the opportunity to invest in a project today that yields 25% per year compounded annually for 20 years. You will be able to withdraw all or part of your eamings at the end of each year. You don't have any money to invest right now so you want to get a loan of $10,000 and you are faced with many options from the bank: Option 1: Bank will loan you the S10,000 today. The loan is due in 5 years, with a compound interest of 10% per year. Option 2: Bank will loan you the S10,000 today. The loan due is 10 years, with a compound interest of 20% per year. Option 3: The loan is divided into two payments, you will receive $5,000 today and S5,000 after 5 years. Each loan period is 5 years with a compound interest of 10% per year. Option 4: The loan is divided into two payments, you will receive $2,000 today and S8,000 after 5 years. Each loan period is 5 years with a compound interest of 20% per year. Option 5: The loan period is 10 years, with a compound interest of 1% per month. Assume you have no other source of income and you will have to declare bankruptey if the loan due date arrives without you having a sufficient fund from your investment to payback the bank a) Calculate in details the cash flow of your investment for each one of these five different loan structure options b) Is there an option from the five options where you would have to declare bankruptey? IF so, which ones? e) What is the best option for you, why? Rank them. You are given the opportunity to invest in a project today that yields 25% per year compounded annually for 20 years. You will be able to withdraw all or part of your eamings at the end of each year. You don't have any money to invest right now so you want to get a loan of $10,000 and you are faced with many options from the bank: Option 1: Bank will loan you the S10,000 today. The loan is due in 5 years, with a compound interest of 10% per year. Option 2: Bank will loan you the S10,000 today. The loan due is 10 years, with a compound interest of 20% per year. Option 3: The loan is divided into two payments, you will receive $5,000 today and S5,000 after 5 years. Each loan period is 5 years with a compound interest of 10% per year. Option 4: The loan is divided into two payments, you will receive $2,000 today and S8,000 after 5 years. Each loan period is 5 years with a compound interest of 20% per year. Option 5: The loan period is 10 years, with a compound interest of 1% per month. Assume you have no other source of income and you will have to declare bankruptey if the loan due date arrives without you having a sufficient fund from your investment to payback the bank a) Calculate in details the cash flow of your investment for each one of these five different loan structure options b) Is there an option from the five options where you would have to declare bankruptey? IF so, which ones? e) What is the best option for you, why? Rank them.

Expert Answer:

Answer rating: 100% (QA)

PART A Cash Flow from Investment made in Security Amount Invested 10000 Yield 25 annually Time 20 ye... View the full answer

Related Book For

Managerial economics applications strategy and tactics

ISBN: 978-1439079232

12th Edition

Authors: James r. mcguigan, R. Charles Moyer, frederick h. deb harris

Posted Date:

Students also viewed these accounting questions

-

A firm has the opportunity to invest in a project having an initial outlay of $20,000. Net cash inflows (before depreciation and taxes) are expected to be $5,000 per year for five years. The firm...

-

A firm has the opportunity to invest in a project having an initial outlay of $20,000. Net cash inflows (before depreciation and taxes) are expected to be $5,000 per year for five years. The firm has...

-

You have the opportunity to invest in a new technology that will cost $2,000,000 (now, at time zero). The machine will generate cash flows of $1,000,000 at the end of years 1-5 and require...

-

According to Dr. Grant, creatives are people who ________. A. Are procrastinators B. Act on multiple ideas C. Plan out each detail D. Are highly confident with no doubts about their success

-

In Problem, use the given information to determine the number of elements in each of the four disjoint subsets in the following Venn diagram. n(A)= 70, n(B)=90, n(AU B)=120, n(U)= 200 UV

-

Consider the catalytic reaction process shown in the figure below. The control volume has two catalytic zones: a porous catalyst (catalyst I) that fills the control volume, and a nonporous catalyst...

-

An investigator is considering two blocking schemes for a $2^{4}$ design with 4 blocks. The two schemes are listed below. Scheme 1: $B_{1}=134, B_{2}=234$ Scheme 2: $B_{1}=12, B_{2}=13, B_{3}=1234$...

-

A plate-fin heat exchanger is used to condense a saturated refrigerant vapor in an air-conditioning system. The vapor has a saturation temperature of 45?C and a condensation rate of 0.015 kg/s is...

-

3. Prepare Income Statement, Statement of Owner's Equity and the Balance Sheet for the year 2023 from the following Trial Balance: Canadian Sounds Trial Balance Dec 31, 2023 Accounts Dr Cr Cash...

-

The trial balance of Pacilio Security Services Inc. as of January 1, 2017, had the following normal balances: Cash ................. 78 , 972 P e t t y C a s h . . . . . . . . . . . . . . . . 100 A c...

-

Examine the principles of functional programming paradigms in the context of building reactive systems and event-driven architectures, discussing the use of concepts like pure functions,...

-

Rose Limited operates a small chain of retail shops that sell high-quality teas and coffees. Approximately half of sales are on credit. Abbreviated and unaudited financial statements are given below....

-

Refer to Figure 17.2. Assume the price of virgin materials is p 2 . Identify the level of total materials on the graph, the level of recyclable materials and virgin materials used via curve S 1 ....

-

Threads Limited manufactures nuts and bolts, which are sold to industrial users. The abbreviated financial statements for 2009 and 2010 are as follows: Dividends were paid on ordinary shares of...

-

Explain how the same dollar emission charge satisfies the equimarginal principle while the same percent emissions reduction (equiproportional) results in higher societal costs.

-

Terry bought a house for 65,000 on 1 October 2000 and occupied the house as his principal private residence. He lived in the house until 1 October 2006 when he went to stay with relatives in...

-

Tempest Corporation expects an EBIT of $55,000 every year forever. The company currently has no debt, and its cost of equity is 14 percent. The tax rate is 22 percent. a. What is the current value of...

-

According during to the IRS, individuals filing federal income tax returns prior to March 31 received an average refund of $1,088 in 2018. Consider the population of "last-minute" filers who mail...

-

Fast Second and Speedo are trying to decide what to bid for a license in a cellular phone auction where the possible values of the new license are $10 million, $20 million, $30 million, $40 million,...

-

Lobo Lighting Corporation currently employs 100 unskilled laborers, 80 factory technicians, 30 skilled machinists, and 40 skilled electricians. Lobo feels that the marginal product of the last...

-

Using Figure contrast the annual rate of oil extraction of the United States and of Saudi Arabia in 2002 and 2008. Explain why one countrys output increased by 33 percent and the others wasflat....

-

Fill in the blanks to make the following statements correct. a. On a graph with Y on the vertical axis and X on the horizontal axis, the slope of a straight line is calculated as ___________. b. In...

-

The following diagram describes the hypothetical demand and supply for canned tuna in Canada in 2019. a. Suppose the price of a can of tuna is $4.00. What is the quantity demanded? What is the...

-

Fill in the blanks to make the following statements correct. a. The term quantity supplied refers to ___________ sales by producers, whereas quantity exchanged refers to ___________ sales by...

Study smarter with the SolutionInn App