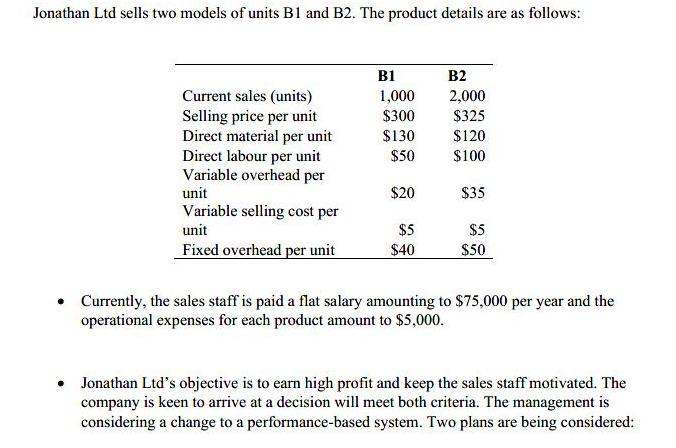

Question: Jonathan Ltd sells two models of units B1 and B2. The product details are as follows: B1 B2 Current sales (units) Selling price per

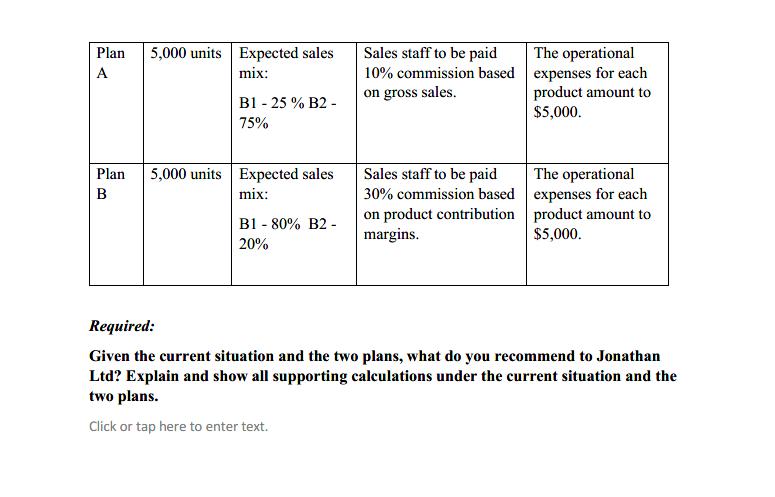

Jonathan Ltd sells two models of units B1 and B2. The product details are as follows: B1 B2 Current sales (units) Selling price per unit Direct material per unit Direct labour per unit Variable overhead per 1,000 2,000 $325 $300 $130 $120 $50 $100 unit $20 $35 Variable selling cost per $5 $40 unit $5 Fixed overhead per unit $50 Currently, the sales staff is paid a flat salary amounting to $75,000 per year and the operational expenses for each product amount to $5,000. Jonathan Ltd's objective is to earn high profit and keep the sales staff motivated. The company is keen to arrive at a decision will meet both criteria. The management is considering a change to a performance-based system. Two plans are being considered: Sales staff to be paid 10% commission based expenses for each on gross sales. Plan 5,000 units Expected sales The operational A mix: product amount to B1 - 25 % B2 - $5,000. 75% 5,000 units Expected sales Sales staff to be paid 30% commission based expenses for each on product contribution product amount to margins. Plan The operational mix: B1 - 80% B2 - $5,000. 20% Required: Given the current situation and the two plans, what do you recommend to Jonathan Ltd? Explain and show all supporting calculations under the current situation and the two plans. Click or tap here to enter text.

Step by Step Solution

3.51 Rating (154 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts